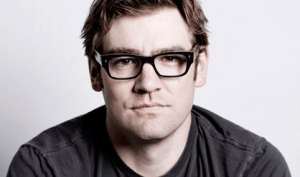

Like a lot of people, I’m excited about crowdfunding, and specifically the crowdfunding of startups now that’s it’s legal in the US.Chris Dixon

Chris Dixon is a prolific investor and has been a co-founder of multiple companies including Hunch and SiteAdvisor. He is currently an investor with Andreessen Horowitz. He also has personal investments in various companies including one you may have heard of, Kickstarter.

Chris Dixon is a prolific investor and has been a co-founder of multiple companies including Hunch and SiteAdvisor. He is currently an investor with Andreessen Horowitz. He also has personal investments in various companies including one you may have heard of, Kickstarter.

I recently became aware of an interesting post on Dixon’s blog from September of this year. In the post he explores some of the interesting factors of early-stage investing and frames these factors in the context of crowdfunding. Some revelations include:

- Oversubscription vs. Undersubscription

Most offerings for early-stage ventures end up in one of these two categories. Dixon says it is important to realize which category applies to a given offering when considering investing. - Crowd Wisdom

This is more of an allusion than an assertion, but could the crowd’s participation increase the number of successful startups? - Regulation and the cat-and-mouse game

Dixon describes the “cat and mouse game” between regulators and shady market participants. There is a direct correlation between the amount of shady activity in a market and the amount of regulation in that market. Regulation drives cost up. It’s a simple point but an important one.