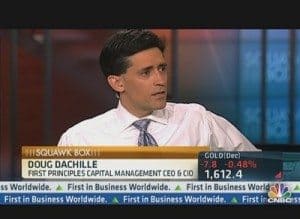

What caused the financial crisis of 2008? Many would argue that bad loans made to unworthy borrowers were at the core of the entire downturn. For First Principles Capital Management CEO and co-founder Doug Dachille, the current trajectory of the peer-to-peer lending market bears a striking resemblance to what preceded the 2008 economic crisis.

He recently took to PBS’s The Business Desk to reiterate concerns about the P2P lending space and answer to questions raised in an original piece posted in November of 2013…

What history has demonstrated is that while the name of the financial instruments responsible for financial crises always seem to change, the root causes are the same: poor credit underwriting standards, the excessive use of leverage, classic agency problems (lack of economic skin in the game) and the power of group thinking pushing the belief that this time, things will be different and financial alchemy has somehow produced real instead of fool’s gold.

If you reflect on some of the causes of the recent financial crisis, the parallels to peer-to-peer lending are striking. During the recent crisis, lenders extended credit with limited or no documentation. Loan originators and underwriters had far too little economic skin in the game. Investors relied far too much on the risk analysis coming from elsewhere in the investment decision process — mainly bond credit ratings. Diversification was just an illusion — unfortunately it is hard to diversify rampant fraud risk linked to loan originators and borrowers. Remarkably, peer-to-peer lending has all of those key ingredients.

Dachille summarizes his concerns about the P2P lending space (with a specific nod toward Lending Club) by saying that “the intermediary companies are giving investors the impression that they are conducting greater underwriting on the borrowers than they actually are.” He points out that Lending Club relies mostly on the historical loan performance of the borrowers. Elements like the borrower’s income or employment status have diminished importance in this model.

Dachille summarizes his concerns about the P2P lending space (with a specific nod toward Lending Club) by saying that “the intermediary companies are giving investors the impression that they are conducting greater underwriting on the borrowers than they actually are.” He points out that Lending Club relies mostly on the historical loan performance of the borrowers. Elements like the borrower’s income or employment status have diminished importance in this model.

Lend Academy‘s Peter Renton commented on income verification as a means of vetting borrowers specifically on Lending Club. “Default rates on loans with income that has not been verified are actually LOWER than default rates on loans with verified income (7.24% versus 7.87% according to a recent independent analysis),” he said. “Sounds counter intuitive but that is the reality. Now, I don’t know the secret sauce for determining who gets verified and who doesn’t but to say that ‘40% of the credit scores may be inaccurate’ is conjecture that is clearly not based on any actual analysis.”

As with any alternative form of investment, there is plenty of disagreement on where peer-to-peer lending is heading. It’s something we’ll be watching closely in 2014, especially with markets at historic highs and interest rates at historic lows. The yields seen on sites like Lending Club will continue to be enticing in these market conditions, at least in the short term. Whether it is a bubble remains to be seen.