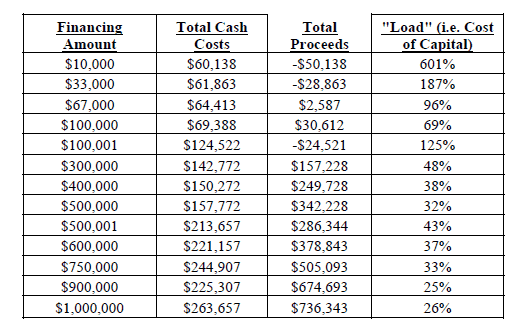

Since the proposed crowdfunding rules were released on October 23, 2013, the top concern for many in the industry has been that the costs of compliance would make crowdfunding too expensive to be useful. Our Crowdfunding Cost Model further backed up this concern, indicating that offerings under approximately $115,000 would actually result in negative cash flow over a 5 year horizon and larger offerings would result in an exorbitant cost of capital:

Since the proposed crowdfunding rules were released on October 23, 2013, the top concern for many in the industry has been that the costs of compliance would make crowdfunding too expensive to be useful. Our Crowdfunding Cost Model further backed up this concern, indicating that offerings under approximately $115,000 would actually result in negative cash flow over a 5 year horizon and larger offerings would result in an exorbitant cost of capital:

According to our analysis, the biggest cost driver is the requirement that companies file ongoing annual reports, including both narrative disclosure and financial statements every year after the offering.

To address these concerns, we’ve submitted this Comment Letter to the SEC to ask that these annual reporting requirements should be limited to only to the materials required by the JOBS Act and that exceptions to these requirements should be implemented for:

- Small offerings below $350,000,

- Where there can be no investment decision,

- For Institutional, VC or Angel led deals and

- Where all of the investors have contractually waived the right to receive ongoing reporting.

If you agree with our Comment Letter and that the costs for crowdfunding should be kept under control, click the link below to let the SEC know.

Click Here to Tell the SEC to Reduce Crowdfunding Costs

View SEC Comment Letter Submitted to SEC Below:

[scribd id=201470525 key=key-1r79472sllmh3w5jlyir mode=scroll]

(Editors Note: This article previously appeared on the SeedInvest blog and was republished with the author’s permission)

________________________

Kiran Lingam has a passion for helping young companies do big things. In his time before SeedInvest, Kiran worked at a corporate and securities attorney at the law firms of Jones Day LLP and DLA Piper LLP, where he served as outside legal counsel to venture capital and private equity funds, angel groups and over 30 technology startups. He has seen first-hand the struggles encountered by early stage entrepreneurs and believes strongly that many more startups would be successful with additional avenues for early stage capital. Since passage of the JOBS Act, Kiran has been an active speaker, writer and commentator on crowdfunding and the related legal issues. He is a Charter Member and Executive Team member of TiE (The Indus Entrepreneurs) and is an active member of a number of groups in the New York startup community. Kiran received a B.A. in Economics from Cornell University and a J.D., with honors, from the University of Georgia.

Kiran Lingam has a passion for helping young companies do big things. In his time before SeedInvest, Kiran worked at a corporate and securities attorney at the law firms of Jones Day LLP and DLA Piper LLP, where he served as outside legal counsel to venture capital and private equity funds, angel groups and over 30 technology startups. He has seen first-hand the struggles encountered by early stage entrepreneurs and believes strongly that many more startups would be successful with additional avenues for early stage capital. Since passage of the JOBS Act, Kiran has been an active speaker, writer and commentator on crowdfunding and the related legal issues. He is a Charter Member and Executive Team member of TiE (The Indus Entrepreneurs) and is an active member of a number of groups in the New York startup community. Kiran received a B.A. in Economics from Cornell University and a J.D., with honors, from the University of Georgia.