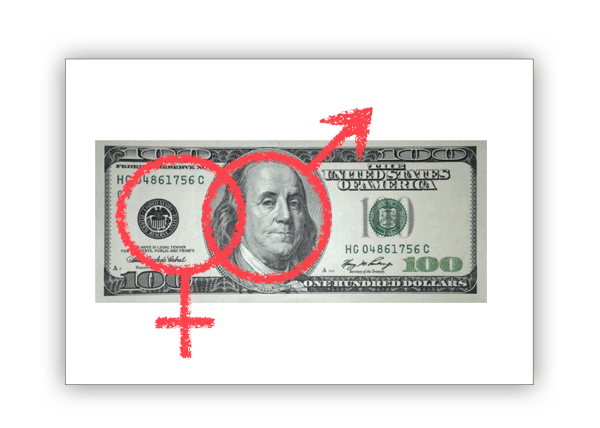

For a long time women entrepreneurs have been marginalized in traditional forms of finance, excluded from venture capital and business angel investing which is often referred to as old boys clubs. With only 12 percent of all business angels being female, it is not surprising that only 12 percent of business angels funded female entrepreneurs in 2011, according to the Center for Venture Research. People tend to fund people just like them. Men fund men and women fund women according to an article in Forbes.

Does a gender bias really exist when it comes to investment or do female entrepreneurs simply not start the kinds of businesses angels are looking to back? Whether or not, equity-based crowdfunding emerges as a promising opportunity to empower female entrepreneurship and to emancipate investment.

Does a gender bias really exist when it comes to investment or do female entrepreneurs simply not start the kinds of businesses angels are looking to back? Whether or not, equity-based crowdfunding emerges as a promising opportunity to empower female entrepreneurship and to emancipate investment.

On January 30th Seedrs, a UK-based crowdfunding platform, published updated statistics on the investment activity on the platform indicating that only 1 in 4 crowdinvestors and not more than 1 in 10 entrepreneurs are female. However, comparing these numbers with statistics published by Seedrs nine months ago an astonishing progression is revealed. While the number of female entrepreneurs has only increased marginally, the number of female investors has almost doubled.

This development suggests that equity crowdfunding is increasingly attracting to females. In our current research on crowdinvestor decision making it has become apparent that crowdinvestors women and men are actively searching to support female entrepreneurs. The data sample includes interviews with investors from Seedrs, Seedmatch and FundedByMe, platforms from three different EU countries.

As discussed recently at Silicon Valley Meets Crowdfunders Conference 2014, women entrepreneurs are in general more successful with their crowdfunding campaigns. They are trustworthy and are faster growing their business after receiving funding. Further it seems that they have an advantage at engaging with their investors. Women tend to raise smaller amounts than their male counterparts, but this could be related to risk aversion with women being more conservative in the amounts they ask for. While risk aversion is a limiting factor in the amounts asked for, it can be an advantage for the investor with women being better and more responsible paying back investors.

As discussed recently at Silicon Valley Meets Crowdfunders Conference 2014, women entrepreneurs are in general more successful with their crowdfunding campaigns. They are trustworthy and are faster growing their business after receiving funding. Further it seems that they have an advantage at engaging with their investors. Women tend to raise smaller amounts than their male counterparts, but this could be related to risk aversion with women being more conservative in the amounts they ask for. While risk aversion is a limiting factor in the amounts asked for, it can be an advantage for the investor with women being better and more responsible paying back investors.

Women are behind most purchasing decisions and are largely in charge of family spending (Belch & Willis, 2001). Being the most powerful consumer, they will become powerful investors in the crowdfunding space. They have the ability to identify product potential and thus have good chances of picking winner companies. Risk aversion, which is more common with female than male investors (Borghans et al., 2009) can be turned into strength in crowd investing which relies on conscientious decision-making. An overweight of risk taking investors weaken the mechanisms of the wisdom of the crowd, which need conscientious decision making to be effective.

Casper Arboll is based in Denmark and is a Project Manager at crowdfunding platform FundedByMe.

Balthasar Scheder is a Crowdfunding researcher at Copenhagen Business School.