Here at Crowdfund Insider we are unabashed fans of peer to peer lending. It should be easy to understand why too. As an investor you can generate risk adjusted returns far higher than you can easily generate elsewhere. With interest rates at an historic low P2P investing is a pretty compelling alternative. For borrowers, depending on your specific situation, it may be a quick and efficient way to raise capital for personal needs or for a small business. No trip to the local bank necessary.

Here at Crowdfund Insider we are unabashed fans of peer to peer lending. It should be easy to understand why too. As an investor you can generate risk adjusted returns far higher than you can easily generate elsewhere. With interest rates at an historic low P2P investing is a pretty compelling alternative. For borrowers, depending on your specific situation, it may be a quick and efficient way to raise capital for personal needs or for a small business. No trip to the local bank necessary.

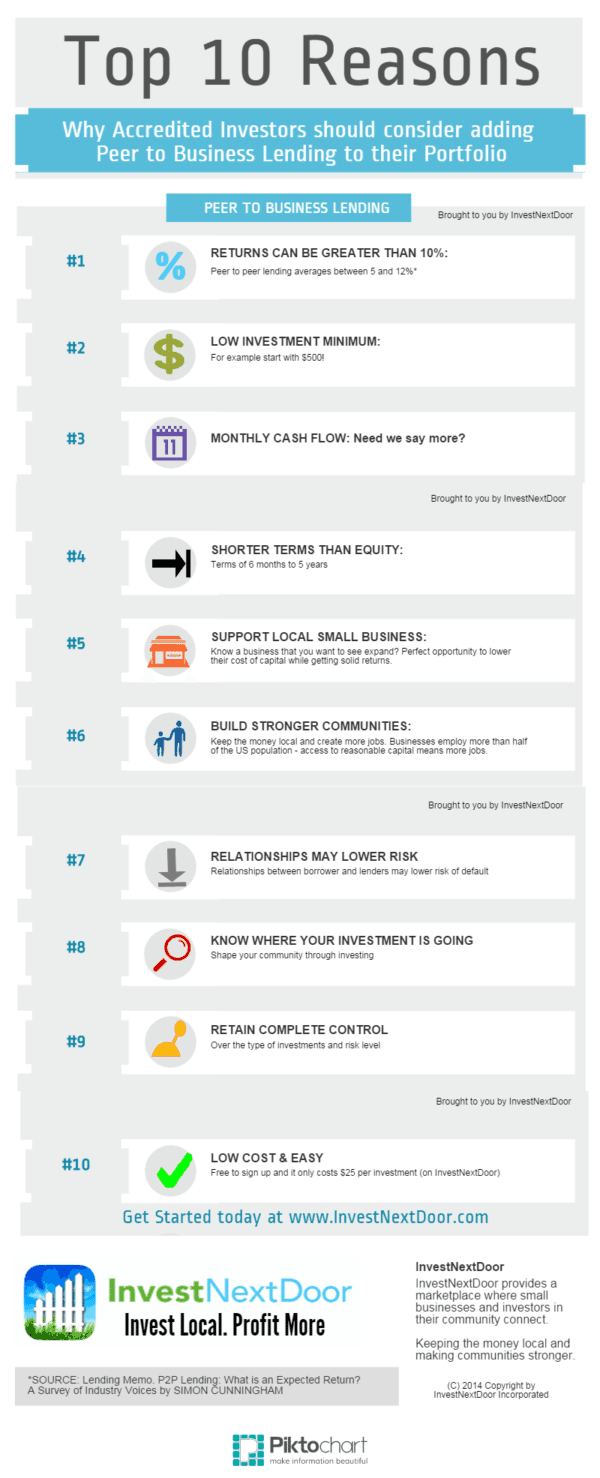

The infographic below outlines the “Top Ten Reasons” why accredited investors should add peer to business lending to their portfolio. Courtesy of InvestNextDoor, a new p2p lending site that wants to leverage local communities to create a new paradigm for funding small business, they have created a list showing why they believe P2P, or P2B, makes sense. From higher returns to community impact it is just about all there. Peer lending has the potential to disrupt traditional banking. It may just be a matter of time.