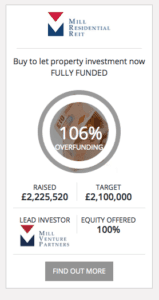

As reported earlier this week, Mill Residential became the first successfully crowdfunded REIT to publicly trade shares on the LSE’s AIM market. The company raised capital on Syndicate Room with the intent of listing soon after the offer closed on the equity crowdfunding platform. According to the listing page, 72 investors participated in the offer. In a release published by the LSE, it was reported the total crowdfunded amount stood at £1.5 million out of a total raise of £2.226 million. Trading under the ticker symbol “MRR”, the REIT saw shares price at 100 pence / share. The first day of trading saw shares close at 108.50 on volume of 12,000 shares traded generating a nice gain for early investors. Market capitalization was stated at £3.5 million.

As reported earlier this week, Mill Residential became the first successfully crowdfunded REIT to publicly trade shares on the LSE’s AIM market. The company raised capital on Syndicate Room with the intent of listing soon after the offer closed on the equity crowdfunding platform. According to the listing page, 72 investors participated in the offer. In a release published by the LSE, it was reported the total crowdfunded amount stood at £1.5 million out of a total raise of £2.226 million. Trading under the ticker symbol “MRR”, the REIT saw shares price at 100 pence / share. The first day of trading saw shares close at 108.50 on volume of 12,000 shares traded generating a nice gain for early investors. Market capitalization was stated at £3.5 million.

David Toplas, Mill Residential REIT CEO stated;

“We are delighted to have successfully joined AIM as the UK’s first ever residential REIT focused on the mainstream, residential property market and are looking forward to delivering our growth strategy. I firmly believe that the Company will be an attractive way for people to invest their pension savings in a familiar asset class of “buy-to-let” property, via a hassle-free format of a tax efficient REIT company share. This sector has regularly out-performed all other real estate asset classes over the last 30 years on a total returns basis and look forward to the future.”

The initial portfolio of the REIT comprises seven “buy to let” properties located in London and Southern England. The groups strategy is to create a low risk, diversified portfolio of rental properties. The company wants to become a “consolidator” in the growing private renter sector. The REIT expects to pay dividends on a semi-annual basis with an estimated annual yield of 3%.

Mill Residential REIT Chairman Ian Ellis said:

“The housing shortage facing the UK is well known and, with the young professionals and families of ‘Generation Rent’ struggling to obtain traditional mortgages, long term renting has become an alternative to home ownership. Despite this, the private rented sector remains dominated by individual buy-to-let landlords so I am very excited about the potential for the Mill Residential REIT to play a long term role in helping to consolidate what is a highly fragmented market place.”

Have a crowdfunding offering you'd like to share? Submit an offering for consideration using our Submit a Tip form and we may share it on our site!