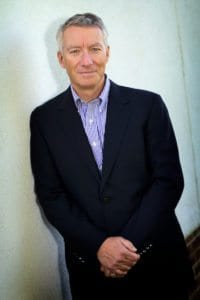

Interested in innovation, both in the finance industry and in the broader economy, Robert Wardrop began his career at Procter & Gamble before moving on to the Anschutz Investment Company and later to DAM Capital. The seasoned entrepreneur presently serves as a Non Executive Director at Asia Broadcast Satellite and Clarity Health Services as well as a Research Fellow in the Finance & Accounting group at the University of Cambridge Judge Business School. His vast experience investing in international companies led to his interest in “understanding how and why alternative channels of finance emerge outside the traditional banking and capital markets system.” Wardrop’s current research at Cambridge focuses on small and mid-sized firms that issue bonds as an alternative to bank financing, and how the markets for these instruments varies by country because of societal differences. The investor-turned-sociologist-advisor continues to make investments in promising early-stage companies led by talented entrepreneurs.

Interested in innovation, both in the finance industry and in the broader economy, Robert Wardrop began his career at Procter & Gamble before moving on to the Anschutz Investment Company and later to DAM Capital. The seasoned entrepreneur presently serves as a Non Executive Director at Asia Broadcast Satellite and Clarity Health Services as well as a Research Fellow in the Finance & Accounting group at the University of Cambridge Judge Business School. His vast experience investing in international companies led to his interest in “understanding how and why alternative channels of finance emerge outside the traditional banking and capital markets system.” Wardrop’s current research at Cambridge focuses on small and mid-sized firms that issue bonds as an alternative to bank financing, and how the markets for these instruments varies by country because of societal differences. The investor-turned-sociologist-advisor continues to make investments in promising early-stage companies led by talented entrepreneurs.

This past November, Wardrop teamed up with Bryan Zhang, PhD Researcher in Crowdfunding & Alternative Finance at the University of Cambridge, Crowdfund Insider and EY, the global professional services organization, to launch European Alternative Finance Benchmarking Survey. This is the largest study to date on crowdfunding, peer-to-peer lending and other forms of alternative finance in Europe. The report seeks to capture the size, transaction volume and growth of the alternative finance markets across Europe. Twelve major national and regional crowdfunding associations in France, Germany, Spain, Italy, the Netherlands, the Nordic countries and the UK participated in this nascent study and participated in an exclusive interview series with Crowdfund Insider.

This past November, Wardrop teamed up with Bryan Zhang, PhD Researcher in Crowdfunding & Alternative Finance at the University of Cambridge, Crowdfund Insider and EY, the global professional services organization, to launch European Alternative Finance Benchmarking Survey. This is the largest study to date on crowdfunding, peer-to-peer lending and other forms of alternative finance in Europe. The report seeks to capture the size, transaction volume and growth of the alternative finance markets across Europe. Twelve major national and regional crowdfunding associations in France, Germany, Spain, Italy, the Netherlands, the Nordic countries and the UK participated in this nascent study and participated in an exclusive interview series with Crowdfund Insider.

I had the pleasure of connecting with Wardrop via email over the last month to discuss his career, his views on crowdfunding and alternative finance, regulations, the Benchmarking Survey data and financial innovation, disruptions and predictions. Our interview and Wardrop’s compelling responses follow:

Erin: You have an envious multifaceted career. Please describe your career path including your interest in innovation, both in the finance industry and in the broader economy, as well as investments in promising early-stage companies.

Robert: I started my career in brand management at Procter & Gamble in Canada, but always wanted to be an entrepreneur. In the 1980s I founded a company called Digital Media Networks, which built and operated an electronic out-of-home media network. Despite ‘digital’ being in the company’s name, the telecom ecosystem at the time was still ‘analogue,’ so it was ahead of the arrival of internet-related technologies that enabled a business model like ours to scale. I came away from the experience with a pretty good understanding of entrepreneurship and innovation and the challenges of financing early stage ventures. I also gained a lot of insight into my own strengths and weaknesses, and concluded that I while I loved entrepreneurship, I wasn’t a particularly good entrepreneur. Since then I’ve focused my personal and professional efforts on investing with, and advising, entrepreneurs.

Erin: How have your financial and investment ideologies shifted and morphed while a Managing Director and Anschutz Investment Company, the Co-CEO of DAM Capital and now in academia?

Robert: I think the most profound shift has been in the area of corporate governance and the role of firms within a society. When I finished business school I didn’t really question the view that the role of a managers was to maximise financial return for shareholders. It took me a long time to realize that there are often social costs associated with this model, particularly when the financial return horizon is

very short term. I became familiar with the German ‘Mittelstand’ model while I was at DAM Capital, and came to admire it. The typical Mittelstand company is a small or medium-sized manufacturer owned by the same family for multiple generations, and these firms are considered to be the backbone of the German economy. Part of my current academic research studies how the high level of trust that Germans have in the Mittelstand enables these firms to borrow at a lower cost than similar firms in other countries. Mittelstand firms are trusted social institutions in Germany, in large part because Germans understand that the owners of Mittelstand firms take the interest of their communities into account in their decision-making and are not focused on maximizing short-term financial return.

Erin: What on-the-job lessons did you learn from entrepreneur Phil Anschutz?

Robert: Phil Anschutz is one of the greatest entrepreneurs of our era. There are very few billionaires that have made more than a billion dollars in five distinctly different industries. In this context it may sound a bit odd, but the most important on-the-job lessons I learned were more about the importance of human values in how you conduct business than investment techniques.

Erin: Given your vast experience, when thinking about various fundraising innovations such as proliferation of venture capital and angel investing, over the course of your career, where would you place crowdfunding and alternative finance as far as their impact and overall disruption?

Robert: I believe that crowdfunding and other forms of alternative finance have greater potential for disruption and impact compared with venture capital and angel investing. Venture capital and angel investing were new sources of finance that didn’t really change the competitive landscape for incumbent financial institutions. By contrast, online alternative finance platforms are changing the landscape and challenging the concept of what a ‘bank’ is and what it does. The finance industry, like many industries, is being ‘digitalised.’ This process is lowering barriers to entry at a time when incumbent institutions in most developed economies are suffering a loss of public trust. In consumer lending, for example, the competitive advantage derived from historical credit data is declining in value as new entrants use advanced data analytics to develop more sophisticated credit risk modeling systems than those being used by incumbents. I personally think alternative finance will establish a ‘new normal’ in the finance industry and this will have significant consequences for incumbents that do not understand how to work with, rather than against, these disruptive forces.

Erin: If you had a crystal ball, what would the next innovations be?

Robert: There is a lot of talk about web data analytics, and a lot of talk about neuroscience, and I think these two will converge in a way that will provide firms with significantly greater cognitive insight into their customers than they have today. In the alternative finance industry, for example, I think this will introduce deeper behavioural analysis into credit scoring. I can envision neuroscience-based applications that will provide lenders with a better idea of how borrowers will behave under financial stress – the credit history of an individual or a firm can be a poor predictor of this behavior if neither has experienced financial stress previously. How might this work at a practical level? If we take a view that individuals more concerned with the opinions of others in the community around them are more likely to feel obligated to repay their debts, then these individuals are probably a better credit risk. Recent neuroscience research has found that test subjects could be categorised as either ‘pro-individual’ or ‘pro-social.’ Commercial firms are already marketing emotion analytics services for identifying our emotions based on digitizing our facial expressions using the web cam on our computers, so I suspect that analyzing our emotions in order to benchmark us on that pro-individual to pro-social continuum may not be that far in the future. My guess is that individuals wanting to obtain loans will agree to some amount of cognitive assessment as part of the application process.

If the convergence of web data with neuroscience occurs, it’s not difficult to see that the competitive landscape across a number of industries will be radically altered, with significant implications for incumbents relying on sources of competitive advantage that will become less relevant.

Erin: What are your thoughts on the democratization of access to capital and transparency in stark contrast to the “public markets” today?

Robert: To me, ‘democratization’ refers to an increase in the participation of individuals in deciding how resources are allocated within a society. As a grassroots-led phenomenon in the early days, I think crowdfunding did increase access to capital for individuals and entities. I think this is still the case in the reward-based and donation-based segments. Transaction volume has grown rapidly in segments like P2P lending as institutional investors have come into the market, and I think the ‘democratization’ thesis in segments dominated by institutional investors is being diluted.

Erin: Shifting back to investment, please describe your process of identifying early-stage companies. Do you personally utilize crowdfunding and P2P lending platforms for investment?

Robert: I have used reward-based crowdfunding platforms, but not lending platforms. In identifying early stage companies I spend a lot of time getting to know the team, and my most successful investments have been those in which I knew the team well and was reasonably close to the business as either an advisor or board member. That’s an approach to risk management that I’m comfortable with – if I have a good relationship with the team, and I have a reasonable amount invested then the teams tends to keep me well informed and I have some influence in the direction of the business. P2P lending is a bit different, and I accept that hyper-diversification is an effective approach to risk management in lending activity. The early stage of development for P2P lending in Europe, however, may be exposed to ‘adverse selection’ risk if the borrower pool consists of those firms that can’t get funding elsewhere. In some of the more mature P2P markets, for example the UK, I think the adverse selection risk is subsiding and P2P is becoming an attractive asset class.

Erin: You currently are a Research Fellow at the Judge Business School at The University of Cambridge. What led you to academia and to your initiating and co-authoring the European Benchmarking Report?

Robert: I’ve been interested in finance and the teaching of finance for many years, partly as a result of my involvement on the Global Advisory Board of the University of Chicago Booth School of Business. As we went through the financial crisis I observed some financial decision-making behavior that didn’t square with orthodox finance theory. In particular, I observed the decisions that owners of firms made when their businesses came under financial stress, and how two different types of owners in very similar situations often made very different financial decisions, even when the firms they owned had the same credit rating. As a lender to these firms, these decisions could produce very different financial outcomes, despite having the same rating. It struck me that the conventional credit rating methodology was a static analysis of historical data, and didn’t incorporate any behavioural analysis that could predict the likely future behavior of a borrower. I also recognized that while I had accumulated observations about financial decision-making I really had little insight into what social mechanisms were driving the behavior I had observed. I was fortunate to be in a position where I could radically switch careers, and so I decided to take some time out to study, starting with a graduate degree in social and cognitive anthropology and then a PhD in economic sociology.

Erin: Please describe the process of analyzing, reporting and virtualizing the data.

Robert: This was a big data gathering and data analytical exercise. We eventually gathered data from 255 platforms, which we estimate captures 85% to 90% of the online alternative finance transaction volume in 27 European countries. We achieved this high level of participation because of the close working relationship we have forged with 14 leading national/regional associations.

Erin: Please expound on observations that you and your team found surprising, revelatory, and/or disappointing.

Robert: There are definitely some surprising findings in our research, and we hope these will be practically useful to inform regulators and policy makers in a number of European countries. There is a large body of evidence demonstrating a positive relationship between access to finance and economic development, and we hope our findings will be food-for-thought for policy makers struggling to kickstart GDP growth and avoid deflation in their economies.

Erin: In a discussion on 15 January attended by Prime Minister David Cameron and by economist Oliver Blanchard, IMF Chief Christine Lagarde said: “The UK is leading in a very eloquent and convincing way in the European Union.” Lagarde admitted last June that the IMF’s forecasts had been wrong, after the UK economy started to recover this year as George Osborne had predicted. How will the UK’s recovery affect crowdfunding and alternative finance? How will the IMF’s more conservative outlook for European growth affect the field?

Robert: I think the UK government has done a pretty good job in striking a balance between protecting investors while not overly-burdening the platforms with regulatory constraints. That being said, it’s not clear to me how the trajectory of the UK recovery will affect crowdfunding and alternative finance because I think its development is more a structural than cyclical change in how finance is provisioned, and is being driven more by fundamental technology change. Some observers question the viability of the online alternative finance industry in the event of rising interest rates – which might be an outcome of a stronger UK economy – but I am a strong believer that the industry is here to stay. As for the rest of Europe, the sluggish growth prospects should motivate policy makers to create a more supportive regulatory environment that will help increase individuals and SME’s access to finance. But I sense there might be a certain amount of cultural discomfort and political hesitation with going in that direction amongst decision-makers in several countries that currently have very low levels of alternative investment activity.

Erin: What are your predictions for Pan-European regulations and cross-border alternative finance and crowdfunding opportunities?

Robert: The larger platforms are already starting to scale their activities outside of their country. At Cambridge we are starting to look at cross-border investment flows on online platforms, and I think our analysis of this activity can help policy decision-makers develop a more conducive and coordinated European regulatory framework. However, even with a pan-European regulatory framework, I still expect to see geo-spatial bias in the distribution of investors. In other words, investors are not ‘location agnostic’ and may prefer to provide financing for projects, to firms and to individuals in close proximity to where they are located despite the ability to invest anywhere.

Erin: What solutions would you recommend for increasing these international ventures?

Robert: Personally, I think it makes sense to implement a pan-European regulatory framework similar to the UCITS [Undertakings for Collective Investment in Transferable Securities] framework that enables fund managers to market fund products across Europe providing they satisfy certain regulatory requirements. This would significantly reduce the confusing and sometimes contradictory regulatory requirements across countries. For example, national regulations requiring that a ‘loan’ be originated by a regulated bank and subsequently resold to a P2P platform in some countries, while an equivalent loan can be originated directly by a platform in other countries appears to restrict access to finance while providing no substantive incremental protection for the ultimate lender.

Erin: If you could set international crowdfunding and alternative finance regulations, which key elements would you include and why? How can the US benefit from learning more about Europe’s crowdfunding and alternative financial markets and regulations?

Robert: Frankly, I don’t think it’s realistic to have a global regulatory framework for crowdfunding. Regulation is a form of legal sanction aimed at reducing malfeasance, such as fraud, by firms and individuals in markets where there are incentives to engage in such behavior. Thus regulation can help to facilitate trust, and people tend to transact more when they have more trust in the economic system. Legal sanctions are not the only type of sanction in a society, for example, and the form of a legal sanction should fit within the social fabric of a country to be effective. Some countries have stronger social sanctions than other countries with the result that the likelihood of malfeasance in alternative finance is probably reduced, and therefore implementing a set of legal sanctions more appropriate for countries with weak social sanctions would be overkill.

The experience of the recent financial crisis highlights some of the differences in social sanctions between the US and countries like Germany. A large number of homeowners in the US handed the keys for their houses to their mortgage lenders after the value of their house fell below the amount of their mortgage debt, and there did not appear to be strong negative social repercussions with doing so. By contrast, many Germans had negative equity value in their homes in the late 1990s and early 2000s but did not give up their homes.

So one question for US platforms seeking to expand outside of the US market is to what extent credit scoring models can be universally applied across cultures. Platforms I’ve queried about this say they can be, but their experience so far is limited to the US and the UK markets. These are both countries with ‘Anglo Saxon’ values systems, so they may have more in common with each other than with countries on the European continent.

Erin: Do you think that women will continue to make up the majority of fundraisers in both donations based and rewards based crowdfunding? What initiatives can be made to encourage women’s movement into the predominantly male P2P and equity crowdfunding sector?

Robert: I think the reported level of participation of women in P2P and crowdfunding sectors may be underestimated. In the interviews with P2P investors that I’ve conducted, the male head of household is the named investor – but the investment is often made after consulting with the investor’s spouse so there is indirect female participation that is not being captured in investor data. I think demographics can also explain some of the differences in gender participation. The typical P2P investor is of retirement age or pre-retirement, and the financial decision-making in these households is more gender-skewed towards men than in younger households. The issues around gender participation in alternative finance need to be better understood, and this is an area of research that Dr. Mia Gray at Cambridge is pursuing.

Erin: How will you utilize the European Alternative Finance Benchmarking Survey data as a foundation for other studies? What’s next on your agenda?

Robert: Our goal at Cambridge is to make this an annual study, and also to go to a level deeper and collect anonymised transaction level data so we can gain a better understanding of what lies behind the European market trends we have found in the benchmarking report. We’re very interested in engaging with platforms and researchers in countries across Europe in pursuing a collaborative alternative finance research agenda. Bryan Zhang and I have been discussing the best structure to facilitate this, and we hope to announce a new Cambridge-based initiative soon.