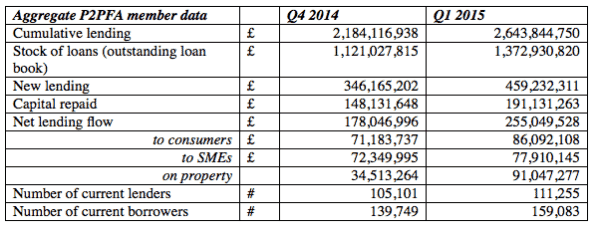

The Peer to Peer Finance Association (P2PFA) has announced Q1 data on P2P lending in the UK. Updated numbers indicate that over £459 million was originated in the first quarter bringing the cumulative lending amount to more than £2.6 billion.

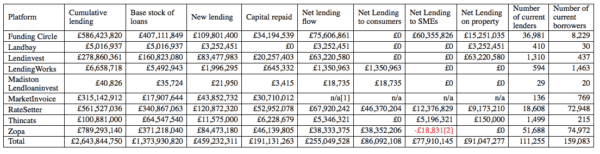

Data provided also showed an increase in lending on the previous quarter (Q4 2014) by almost a third (32.7%) with net lending flow exceeding £255 million. The 2014 total amount of loans topped £1.2 billion. The numbers track only loans facilitated on P2PFA members including; Funding Circle, Landbay, Lending Works, LendInvest, Madiston LendLoanInvest, MarketInvoice, RateSetter, ThinCats and Zopa. RateSetter was the top lender for the quarter at over £120 million in loans, followed by Funding Circle at £109 million. Zopa remains the largest lender for cumulative total.

Christine Farnish, Chair of the P2PFA commented on the update;

“These numbers are excellent and reflect the strong industry growth into 2015. We are continuing to see strong appetite in the consumer market and a significant increase in lending flow to businesses too”

“The future decision around how peer-to-peer lending will work within the ISA wrapper remains crucial for the industry this year. It is important to ensure a separate ‘Lending ISA’ is created, a decision that will not only create greater consumer choice, but will avoid any confusion of placing peer-to-peer loans with stocks and shares, a completely different and riskier asset class.”

The UK government has announced inclusion of P2P assets in ISAs later in 2015. Final requirements and structure are being worked out now but the industry expects a significant boost to occur following this event.