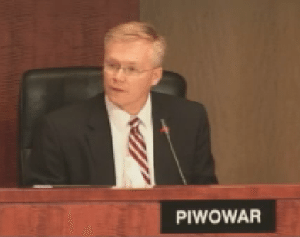

In an interesting speech delivered at the Exchequer Club in Washington, DC, last month, SEC Commissioner Piwowar criticized federal regulators push to expand oversight into areas overlapping with the responsibility of the SEC. Piwowar slammed the infringement;

In an interesting speech delivered at the Exchequer Club in Washington, DC, last month, SEC Commissioner Piwowar criticized federal regulators push to expand oversight into areas overlapping with the responsibility of the SEC. Piwowar slammed the infringement;

“Make no mistake — it is the Commission, not the banking regulators, that has the statutory authority and responsibility for regulating the capital markets. It is the Commission, not the banking regulators, that has the requisite expertise and experience with capital markets. It is the Commission, not the banking regulators, that should be regulating the capital markets. Period.

Piwowar explained the Fed wants to exert its regulatory reach over non-banks or those that have been assigned to the netherworld of shadow banking, thus colliding with the mission of the SEC.

The Commissioner highlighted an interesting point; ironically banking regulators policies failed during the economic crisis, yet they are attempting to expand their oversight into more areas today.

Too frequently imposing new rules and regulations are viewed as beneficial to the system, but with utter disregard to the cost imposed upon consumers and financial firms. Piwowar, from his perspective, would prefer to see “market based prudential regulation” as opposed to “prudential regulation”. He calls the regulators confused stating they lack understanding of the capital markets.

Piwowar hammers the incursion:

Piwowar hammers the incursion:

“Perhaps, if the Fed and other banking regulators were experts on capital markets they would see the folly of “prudential market regulation.” But it is clear that the Fed and the others not only are not experts; they do not even understand the basics.”

Telling a regulator that less regulation can be more is like kryptonite to a super hero. They just can’t stand it. Piwowar highlights the truism;

“…investors should know the significant costs of prudential regulation — not only in terms of direct expenses, but opportunity costs as well”

Excessive regulatory burdens places an undue cost upon society and consumers. It is never just the corporate entity that must pay as the price is always passed on to the consumer. Piwowar returns to the popular theme regarding the most effective form of regulation;

“As Supreme Court Justice Louis Brandeis stated, “sunlight is said to be the best of disinfectants; electric light the most efficient policeman.” Banks should be subject to sunlight, and in fact a direct spotlight, in much the same way as investment companies, such as through market-based prudential regulation.”

He closes his discourse with a solid keep out:

“..banking regulators should not be permitted to expand their reach into capital markets, through “prudential market regulation” or any other mean…”

The entire speech is republished below.

Remarks Before the Exchequer Club of Washington, D.C.

Commissioner Michael S. Piwowar

Washington, D.C.

May 20, 2015

Thank you, Sara [Kelsey], for that wonderful introduction. I am honored to speak to the Exchequer Club of Washington, D.C. The Exchequer Club provides an excellent forum for an open and frank exchange on financial matters that impact all Americans and people around the world. I hope that, in the spirit of the Club, my remarks will prompt an animated discussion.

Those of you familiar with the Securities & Exchange Commission (“SEC”) know that the agency’s mission is to protect investors, maintain fair, orderly, and efficient markets, and facilitate capital formation. As a Commissioner, I am guided by those principles, which are all imperative to spurring economic growth. Lately, though, I find myself spending a great deal of time responding to questions about what type of regulatory approach is best for the capital markets. External parties — chiefly the banking regulators — are calling for the imposition of new regulatory requirements for nonbank financial institutions and on certain activities by all financial actors. Unfortunately, those proposals seem to be premised on a misunderstanding of the capital markets and show little appreciation for the SEC’s mission. I am very concerned about the extent, fervor, and momentum of those proposals.

Make no mistake — it is the Commission, not the banking regulators, that has the statutory authority and responsibility for regulating the capital markets. It is the Commission, not the banking regulators, that has the requisite expertise and experience with capital markets. It is the Commission, not the banking regulators, that should be regulating the capital markets. Period.

Previously, I have spoken about infringements on the Commission’s core mission by the Financial Stability Oversight Council (“FSOC”), the Financial Stability Board (“FSB”), and domestic prudential (banking) regulators as a group. Today, I would like to focus on the Federal Reserve (“Fed”) and, in particular, its call for the development of “prudential market regulation.” My response is quite the opposite — we should leave capital markets to the Commission. But we should consider applying “market-based prudential regulation” to banking institutions. By that, I mean disclosure of key information about banks to the Commission, investors, and all market participants, who can then act based on all available information.

Before I continue, I need to provide the standard disclaimer that the views I express today are my own and do not necessarily reflect those of the Commission or my fellow Commissioners.

The Fed’s Calls for “Prudential Market Regulation”

In the wake of the 2008 financial crisis, banking regulators, led by the Fed, have sought to expand their regulatory oversight to include capital markets actors or, as the Fed refers to them, “shadow banks.” There is some irony that the regulators of the banks, which played a central role in the financial crisis and evidenced failed regulatory policies and a flawed framework, are trying to expand their reach to include more entities.

Since 2014, the Fed has been particularly vocal about its desire to regulate nonbank financial institutions. In May 2014, Fed Governor Daniel Tarullo proclaimed the “need to broaden the perimeter of prudential regulation, both to certain nonbank financial institutions and to certain activities by all financial actors.” He followed up those remarks the next month by asserting that “any firm whose failure could pose systemic risk is subject to prudential regulation, quite apart from its relationship with [insured depository institutions].” In March of this year, the chair of the Board of Governors of the Fed, Janet Yellen, in a speech on improving the oversight of large financial institutions, made clear she was not only focused on large U.S. banks and foreign banking organizations with extensive U.S. operations; she also included “other large and complex financial firms.”

Clearly, if it had its way, the Fed would exert its regulatory authority over nonbanks, especially entities that it says engage in so-called shadow banking. The list of “shadow banks” and “shadow banking activities” is so long that, according to Governor Tarullo, “it is … necessary for policymakers to identify some priority areas within which to focus work on developing an appropriate set of regulations.” Topping his list of priorities are asset management activities. The Fed apparently believes that because asset managers and investment companies have been so successful, they somehow pose a systemic threat to the financial system and therefore have earned an additional layer of regulation — “prudential market regulation.” Of course, what they ignore is that those entities have been subject to extensive and highly effective regulation by the Commission for 75 years. Moreover, they did not precipitate the 2008 financial crisis and in fact continue to flourish today.

Just what would the Fed’s so-called “prudential market regulation” entail? According to Governor Tarullo, the goal of “macroprudential” regulation for the capital markets is to develop “a policy framework that builds on traditional investor protection and market functioning aims of securities regulation by incorporating a system-wide perspective.” Let that sink in. The banking regulators purport to know what is in the best interests of the financial system as a whole and therefore think they should have the right to discard decisions made by individual participants in the capital markets. In their mind, they, as omniscient regulators, should be the sole judge.

Let’s take that theory to its logical conclusion in connection with Governor Tarullo’s priority — the asset management industry. Trying to mitigate risks on a macro level likely would result in a narrowing of the differences in the way assets are managed, which could result in all financial firms having similar investments. If all firms are invested in the same types of assets, then during a period of market stress the entire financial system is more likely to collapse. Surely this would be a terrible result. Introducing “prudential market regulation” also could force, for example, asset managers to face the impossible task of balancing their fiduciary duties to their clients and investors with regulatory obligations to do what is best for the financial system as a whole.

Make no mistake — it is the Commission, not the banking regulators, that has the statutory authority and responsibility for regulating the capital markets. It is the Commission, not the banking regulators, that has the requisite expertise and experience with capital markets. It is the Commission, not the banking regulators, that should be regulating the capital markets. Period.

The Fed and Other Banking Regulators Do Not Understand Capital Markets

Perhaps, if the Fed and other banking regulators were experts on capital markets they would see the folly of “prudential market regulation.” But it is clear that the Fed and the others not only are not experts; they do not even understand the basics.

Capital markets and capital market actors, or, as the Fed labels them, nonbank financial institutions, are not engaged in “shadow banking.” Investors in the capital markets operate with the knowledge that the money they invest is subject to risks and, unlike bank deposits, is not guaranteed. Investors make a tradeoff between the risk of loss of principal and the hope of earning a higher return on their investment. The Fed may be risk averse and suspicious of those motivated by profits, but risk taking and profit seeking are the cornerstones of the capital markets.

The banking regulators’ lack of understanding of the capital markets is best exhibited by their confusion surrounding the very industry that the Fed has identified as its priority for application of “prudential market regulation” — the asset management industry. In September 2013, the Office of Financial Research (“OFR”) released a much maligned report that laid the groundwork for the Fed and other banking regulators to subject the asset management industry to enhanced prudential standards and supervision. From the report, it was clear that banking regulators do not understand the asset management industry or that asset managers and investment companies are already subject to comprehensive regulation by the Commission. Investors have the benefit of disclosures mandated by the Commission in making their decisions. And the Commission can evaluate the disclosures of a firm as part of its oversight function.

“Prudential Market Regulation” Could Lead to Reduced Economic Growth

“Prudential market regulation” in all likelihood would lead to a reduction in economic growth. The balance between capital market finance and bank lending matters. As a recent study found, an overreliance on banks comes at a cost in terms of reduced economic growth. The study also documented that capital markets are good for research and development (“R&D”). For example, European firms’ R&D intensity is positively correlated with the level of equity financing. In contrast, firms in bank-based economies have less flexibility in their financing decisions and therefore follow a more conservative financing strategy, which might lead to underinvestment in R&D.

The study’s authors argue that the availability of funds for long-term risky investments combined with the incentives for improving corporate governance would result in an estimated one-to-one relationship between stock market growth and the long-term real growth rate in GDP, i.e., stock market growth of one-third would increase real economic growth by one-third. Overall, they estimate that growing capital markets by one-third would increase the long-term real growth rate in per capita GDP by about 20%.

Simply said, capital markets play an integral role in economic growth. Stifling those markets through ill-advised additional regulation could work to the detriment of the economy as a whole.

A Better Approach — “Market-Based Prudential Regulation”

For me, there is an obviously better approach. Rather than imposing prudential regulations on markets, I would argue that exposing banks to the disclosure-oriented focus of market-based regulation would provide better protection to the financial system. In other words, instead of “prudential market regulation,” the financial system would be safer with “market-based prudential regulation.”

One of the most important lessons from the financial crisis is that bank investments are not adequately disclosed. There is limited public information about how banks are investing their assets, so investors have difficulty making informed investment decisions, and creditors cannot assess the true creditworthiness of banks. Moreover, the Commission and the banking regulators do not have key information that would allow them to monitor bank risk at the individual bank level and/or across the banking system.

While I would never be so bold as to call banks “shadow investment companies,” it is worthwhile to think of banks as being similar to investment companies in that their assets are invested in a myriad of products. Investment companies are subject to the Commission’s disclosure regime, which requires extensive information about an investment company’s portfolio holdings. Banks are not. Using a “market-based prudential regulation” approach, such as applying the Commission’s investment company portfolio holdings disclosure regime to banks would provide investors and creditors with the information necessary to make informed investment decisions and facilitate Commission oversight and monitoring of banks.

Current Investment Company Portfolio Holdings Disclosure

It may be helpful for me to provide an overview of the investment company disclosure regime to which I am referring. Registered investment companies have long filed a schedule of their portfolio investments as part of their financial statements required by Regulation S-X, and for the last decade the Commission has required the filings to be made on a quarterly basis. These disclosures are made on our EDGAR system and are immediately available to the public. Among other information about each holding, mutual funds must identify the name of the issuer, the title of the security, the number of shares or principal amount of debt instruments held at the close of the period, and the value at the close of the period.

Since the 2008 financial crisis, the Commission has undertaken a reassessment of what information investment companies should disclose about their portfolio holdings. In 2010, the Commission adopted Form N-MFP, which greatly increased the information available to the Commission and investors about the portfolio holdings of money market funds. In addition to the information that is required by Regulation S-X, money market funds must provide for each investment, among other things, the category of investment, the maturity date, whether the instrument has certain enhancement features, the current amortized cost value, the percentage of the fund’s assets invested in the security, whether the security is illiquid, and the market-based values of each security. Money market funds file N-MFP monthly with the Commission in an XML tagged data format, which allows for useful analysis of the data, and each month’s information is publicly disclosed.

Under Chair Mary Jo White’s leadership, the Commission continues to evaluate its investment company and investment adviser disclosure requirements to determine, based on changes in the asset management industry, what information about a fund’s portfolio holdings and assets managed by investment advisers should be disclosed. In December 2014, Chair White laid out a set of initiatives aimed at ensuring that the Commission’s regulatory program fully addresses the increasingly complex portfolio composition and operations of the asset management industry. Included among the initiatives is enhancing data reporting for both funds and advisers. Chair White noted that our reporting obligations have not kept pace with the development of new products and strategies in the asset management industry. In particular, she identified opportunities to enhance reporting of fund use of derivatives and securities lending. On the investment adviser side, she identified a need for more data on separately managed accounts. Chair White suggested that changes to address these issues were needed so as to enable the Commission and its staff to better identify, monitor, and evaluate risks in the asset management industry. I wholeheartedly agree.

This morning, the Commission proposed a comprehensive set of amendments to our data reporting requirements for both investment companies and investment advisers. The proposed changes on the investment company side include, among other things, the introduction of two new forms (as well as the rescission of two existing forms) and amendments to Regulation S-X. The amendments would require additional disclosures including the contractual terms for debt securities and derivatives held by a fund and information describing a fund’s securities lending activities and repurchase and reverse repurchase agreements. Also, funds would be required to disclose risk sensitivity measures at the portfolio level and, in some instances, at the position level. The two new forms, unlike the two forms they would replace, would be required to be filed in an XML structured format, so the data could be readily analyzed by investors, advisers, analysts, academics, and other professionals. Finally, under today’s proposed amendments, portfolio holdings information that is currently provided to the Commission and investors quarterly would be provided to the Commission monthly while continuing to be provided to investors quarterly.

With respect to investment advisers, the proposed amendments to Form ADV would provide for, among other things, more specific information about advisers’ separately managed accounts, including the percentage of separately managed account assets invested in ten broad asset categories, the identity of custodians that account for at least 10% of separately managed account assets under management, and, for certain advisers, information on the use of borrowings and derivatives in the separately managed accounts.

Opportunities to Enhance the Information Provided by Bank Holding Companies in Filings with the Commission

Bank holding companies do provide certain information in filings with the Commission, but that information is much more limited than for investment companies. In any event, it is unclear if the information provided reflects today’s markets. Industry Guide 3 expresses the policies and practices of the Division of Corporation Finance in administering the disclosure requirements of the federal securities laws to bank holding companies. Although the Industry Guides, such as number 3, are neither rules nor regulations of the Commission, they assist issuers, their counsel, and others in preparing disclosure documents. Despite potentially being the source of very valuable information about banks, Industry Guide 3 has not been updated in almost three decades.

When the Commission first authorized for publication an industry guide for bank holding companies in 1975, we noted that our staff had long sought to encourage issuers to provide full disclosure of factors that have a material effect upon earnings. We further observed that as banks had grown in size and complexity, “it has become increasingly difficult for the investor to identify the sources of income of the bank.” In authorizing Industry Guide 3, we stated that, due to the wide range of risk characteristics associated with various sources of income, investors may have difficulty “assessing the future earnings potential of a bank holding company without detailed information concerning the company’s sources of income and exposure to risk.”

During the first decade of Industry Guide 3’s existence, the Commission revisited the guidance multiple times. Indeed, upon initial adoption, the Commission undertook an obligation to perform a retrospective review of the new guidance, which it did three years later and resulted in changes in 1980 intended to eliminate unnecessary elements and improve the quality of disclosure. In 1983, Industry Guide 3 again was revised, this time with respect to disclosures about nonperforming loans and various risk elements involved in lending activities.

Several years later, in 1986, Industry Guide 3 was further modified in response to concerns about outstanding borrowings to certain foreign countries that were experiencing liquidity problems. So, if you were counting along, that is three updates to Industry Guide 3 in the first eleven years it existed. In the last thirty years, there have been no more substantive amendments, despite the fact that the scope and nature of banking has changed dramatically in that time.

Nearly eighteen months ago, the staff recommended reviewing the Industry Guides to evaluate whether they still elicit useful information and conform to industry practice and trends. The staff reported that this review could include an evaluation of the guidance set forth in Industry Guide 3 in light of the growth and complexity of financial institutions and developments in international regulatory reforms. I wholeheartedly endorse such a review, and am pleased to report that our staff in the Division of Corporation Finance is working on that project.

It is my hope our staff takes a broad view in updating Industry Guide 3, for which the formal title is “Statistical Disclosure by Bank Holding Companies.” I support dropping the narrow scope of statistical disclosure and including additional quantitative and qualitative information. Investors need more transparency about the material effects of prudential regulation, such as the impact on the issuer from the comprehensive capital analysis and review, or CCAR, process and the resolution plans, or living wills, imposed by the Fed, as they directly affect a bank’s capital structure, dividend policy, and treatment in bankruptcy. Moreover, investors should know the significant costs of prudential regulation — not only in terms of direct expenses, but opportunity costs as well — resulting from new regulatory requirements arising out of the Dodd-Frank Act, the Basel Committee on Banking Supervision, CCAR, and living will obligations. Any revisions to Industry Guide 3 should include, at minimum, a requirement to disclose an estimate of the costs a bank faces from all of the new and complex regulations.

Conclusion

The Commission’s disclosure regime is integral to, and an engine for, well-functioning capital markets. Well-functioning capital markets provide investors with the confidence to invest and to earn returns in line with their risk tolerance, which in turn provides entrepreneurs with access to the capital that they need to grow their businesses and hire workers, thereby sparking economic growth.

As Supreme Court Justice Louis Brandeis stated, “sunlight is said to be the best of disinfectants; electric light the most efficient policeman.” Banks should be subject to sunlight, and in fact a direct spotlight, in much the same way as investment companies, such as through market-based prudential regulation.

In closing, let me reiterate that banking regulators should not be permitted to expand their reach into capital markets, through “prudential market regulation” or any other means. It is wholly inappropriate for them to impose their regulatory judgment in place of investment decisions made by informed investors, business decisions made by boards and officers, and regulatory policy decisions made by capital markets regulators. The Commission, as always, will continue to carry out its mission and, in so doing, reassess its disclosure requirements as markets and technology change to ensure that investors, boards, and other market participants have access to the information necessary to make informed decisions.

Thank you for the opportunity to speak my mind on issues that matter to all of us.