UpStart, a three year old marketplace lending platform founded by former Googlers, is a next generation direct lender that wants to leapfrog existing platforms by providing turbocharged data processes to making loans.

The first generation marketplace lenders saw opportunity in the bloated and punch drunk banking process. Drive to a bank and endure an inquisition type experience to be told no, sorry, you do not qualify for a loan. Those days are quickly going away and than goodness for that. The economic efficiencies driven by matching borrower to lender online will eventually migrate all loan making away from bricks and motor torture. These web based platforms are growing quickly but the disruption will become even more complete as the technology and software becomes even more effective. UpStart is targeting this foregone conclusion as Dave Girouard explains;

“The second generation of lending platforms will combine modern data science, inexpensive cloud computing, and behavioral economics to make a giant leap forward in credit modeling.”

“All lenders are in the business of predicting the future and, unsurprisingly, computers can do this better than people. When someone applies for a loan on Upstart, we run more than 68,000 simulations in just a few seconds to understand what might occur over the term of the loan. By modeling a wide array of potential outcomes and events in the applicant’s future, we can understand the likelihood of repayment and price the loan appropriately.”

Now other direct lenders are not sitting idle, watching the competition zip by, but UpStart just raised a hefty $35 million to fuel its deep dive into loan making data. UpStart recognizes that for younger generations (IE Millennials) driving to a bank branch is up there with trips to the dentist and dealing with their ISP/Cable provider. The connected generation wants to transact and manage everything online and they expect a transparent and effective experience. UpStart is going back to the future by innovating quickly, “even while maintaining proactive and transparent relationships with regulators …”

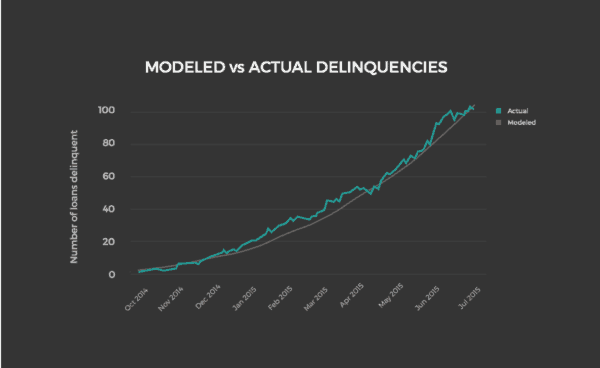

UpStart’s model is working too. After loaning a relatively small $128 million investors have experienced a 100% positive return. That is impressive. The overall IRR stands at 7.44%. Pretty good in the low interest rate world that we all live in today. While Upstart is not default free, their modeling has been a solid indicator of actual defaults. Their model forecasted 104 delinquent loans as of July 1st (about 1.2% of all loans). The actual result came in at 102. Over $800 million in institutional capital currently funds UpStart loans.

The most recent Series C funding round was led by Third Point Ventures. Existing investors include a list of regular suspects including Khosla Ventures, First Round Capital and Collaborative Fund.

UpStart has launched with a single product, an unsecured personal loan. Expect this type of loan to be the first of many as it migrates its process into other forms of credit in the coming months.