Earlier this week, Prosper altered the way it handled charged-off loans. According to a company report, Prosper has now incorporated a “debt sale recovery strategy” created to increase the level of returns to investors. Prosper will now bundle charged-off loans to be sold. Prosper states this will provide significant benefits to investors;

Earlier this week, Prosper altered the way it handled charged-off loans. According to a company report, Prosper has now incorporated a “debt sale recovery strategy” created to increase the level of returns to investors. Prosper will now bundle charged-off loans to be sold. Prosper states this will provide significant benefits to investors;

“First charged-off loans will be lumped together and sold to a single debt buyer on a monthly basis, delivering a return to investors on a significantly reduced timeline. Second, the current market for debt sales is at historically high levels – we have negotiated a debt sale rate that will deliver a meaningfully higher net recovery amount than is currently being realized by the collections agency.”

Prior to the debt sales, bad loans were handed over to a “recovery agency” that provided collection services for Prosper. Typically repayments involved reduced monthly payments over an extended period of time. Now investors will be able to view proceeds from the debt sales following the transaction.

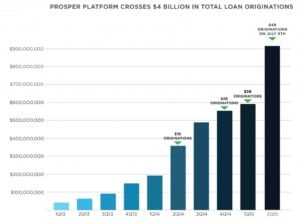

Prosper announced surpassing $4 billion in loans earlier this month. The direct lending platform is on track to double total loans above the $1.4 billion in originations for all of 2014.