For years, most capital raises conducted by private companies have primarily relied on Regulation D as an exemption from compliance with certain burdensome securities laws. In particular, most offerings were conducted under what was known as Rule 506 under Regulation D. Those offerings, which have in recent years been reclassified under new laws as Rule 506(b) offerings, prohibit the use of general solicitation and advertising in the capital raising process.

However, in response to a market that demanded easier access to capital, the Jumpstart Our Business Startups Act created a new type of Regulation D offering. Effective as of September 23, 2013, a new Rule 506(c) was implemented into Regulation D, which allows for general solicitation and advertising. That meant that companies could advertise their offerings in magazines, newspapers, over the radio, on the internet, and even through social media. The catch? All investors in a Rule 506(c) offering must be verified as accredited investors.

Of course, one can still use Rule 506(b) to raise capital through their private networks without generally soliciting. The key advantage with the old rule is that investors can essentially certify themselves as accredited investors. With the new Rule 506(c) however, issuers may not simply rely upon a representation or warranty made by the investor as to his or her own certification; instead, an issuer must take “reasonable efforts” to verify that their investors are accredited investors.

Reasonable Steps

The SEC provides guidelines for what constitutes these “reasonable efforts.” There are two primary methods that qualify as “reasonable efforts”:

The SEC provides guidelines for what constitutes these “reasonable efforts.” There are two primary methods that qualify as “reasonable efforts”:

The principles-based method allows the issuer to make a reasonable determination of accredited investor status by considering elements such as (i) the nature of the purchaser and the type of accredited investor that the purchaser claims to be; (ii) the amount and type of information that the issuer has about the purchaser; (iii) the nature of the offering, such as the manner in which the purchaser was solicited to participate in the offering, and (iv) the terms of the offering, such as a minimum investment amount. However, an issuer relying on the principles-based method bears the risk that their judgment wasn’t reasonable. If it is determined at any single investor wasn’t properly verified, then the issuer could lose the entire Rule 506(c) exemption for their offering with disastrous consequences.

The non-exclusive safe harbor verification methods are recommended by many securities attorneys and preferred by many issuers as they provide certainty of legal compliance. The safe harbor methods generally fall into one of the following categories: (i) verification of a natural person’s income by looking at US tax documentation, (ii) verification of a natural person’s net worth by looking at a US credit report for liabilities and bank statements, brokerage statements, real estate appraisals, etc., for assets, and (iii) verification conducted by certain third-party licensed or registered professionals.

Verification

The concept of verifying investors is still somewhat new. Many issuers, investors, broker-dealers, investment advisers, accountants, and attorneys (even securities attorneys) are confused about the new requirement and what it entails. Part of the confusion can be attributed to the fact that the rules and guidance for proper verification are not contained within a single place, and most people (including experts) have never had to think critically about verification. However, the use of Rule 506(c) in the capital markets is growing rapidly, and verification is a hurdle that issuers, investors, and intermediaries will have to overcome. The following guide is intended to assist the industry in properly verifying individuals as accredited investors.

What is an accredited investor?

An accredited investor is a type of investor. For most individual investors, it is a person who either i) earned income that exceeded $200,000 (or $300,000 together with a spouse) in each of the prior two years, and reasonably expects to achieve the same minimum income for the current year, or ii) has a net worth over $1 million, either alone or together with a spouse (excluding the value of the person’s primary residence). The Securities and Exchange Commission has a helpful page on accredited investors which provides, among other things, a link to the legal definition of “accredited investor.”

How does an Individual get verified?

There are only four ways that individual investors may be verified as accredited investors. Each is described below:

The Insider Method: An investor is an accredited investor if he or she is a director, executive officer, or general partner of the issuer of the securities being offered or sold, or a director, executive officer, or general partner of a general partner of that issuer. Evidence of such position with the issuer might be evidenced by providing governing documents, resolutions, or incumbency or other certificates. In some cases, evidence might be publicly available, such as in securities filings, research reports, or other information provided by reputable third-party sources. Few accredited investors will qualify under this method, but when they do, this is perhaps the easiest method to verify.

The Professional Letter Method: An investor may obtain a written confirmation from a registered broker-dealer, an investment adviser registered with the Securities and Exchange Commission, a licensed attorney who is in good standing under the laws of the jurisdictions in which he or she is admitted to practice law, or a certified public accountant who is duly registered and in good standing under the laws of the place of his or her residence or principal office. The written confirmation provided must certify that reasonable steps were taken to verify that the investor is an accredited investor within the prior three months and that it was actually determined that such investor is an accredited investor. This method is useful if the investor has an accountant or lawyer who can provide a statement certifying that that he or she is an accredited investor for little or no cost to the investor. A cost may be associated with obtaining this letter, and many lawyers or accountants will not feel comfortable providing this letter, especially if they are foreign or if they are not intimately familiar with securities laws.

The Professional Letter Method: An investor may obtain a written confirmation from a registered broker-dealer, an investment adviser registered with the Securities and Exchange Commission, a licensed attorney who is in good standing under the laws of the jurisdictions in which he or she is admitted to practice law, or a certified public accountant who is duly registered and in good standing under the laws of the place of his or her residence or principal office. The written confirmation provided must certify that reasonable steps were taken to verify that the investor is an accredited investor within the prior three months and that it was actually determined that such investor is an accredited investor. This method is useful if the investor has an accountant or lawyer who can provide a statement certifying that that he or she is an accredited investor for little or no cost to the investor. A cost may be associated with obtaining this letter, and many lawyers or accountants will not feel comfortable providing this letter, especially if they are foreign or if they are not intimately familiar with securities laws.

The Income Method: An investor may choose to prove that he or she is an accredited investor because he or she is a natural person with income exceeding $200,000 in each of the two most recent years or joint income with a spouse exceeding $300,000 for those years and a reasonable expectation of the same income level in the current year. To prove this, it is best if the investor can provide government or official records that that show his or her income, such as tax filings or pay stubs. Otherwise, the investor might attempt to obtain a letter from his or her accountant or employer confirming that his or her annual income or wages exceeded those amounts in the past two years and will exceed it in the current year. The investor also needs to make an affirmative statement that his or her expected income in the current year will meet the minimum income level.

The Net Worth Method: An investor may choose to prove that he or she is an accredited investor because he or she is a natural person whose individual net worth, or joint net worth with that person’s spouse, exceeds $1,000,000. This method requires the investor to disclose his or her assets and liabilities so that net worth may be calculated. Note that the positive value of the investor’s primary residence is not counted toward net worth for the purposes of accredited investor verification; however, debt incurred in the last 60 days against the primary residence as well as debt in excess of the value of the primary residence is deducted from net worth for the purposes of accredited investor verification. For investors that have no liabilities and a single large bank account, this method could be very easy. For investors who have multiple assets or liabilities, this could be very complicated and time-consuming.

There are three primary components to the net worth verification method:

1. The credit report for the investor and his or her spouse (to the extent the spouse is also being verified or a spouse’s assets is being used to qualify). The investor should provide a US credit report if it is available. If it is not, the investor should provide his or her country’s equivalent. If no credit report is available at all, then investor should explain that no credit report is available.

2. Disclosure of the investor’s liabilities. If there are any liabilities, the investor should disclose them as the liabilities deduct from the investor’s net worth. If there are no liabilities, the investor should make an affirmative representation that he or she has no liabilities.

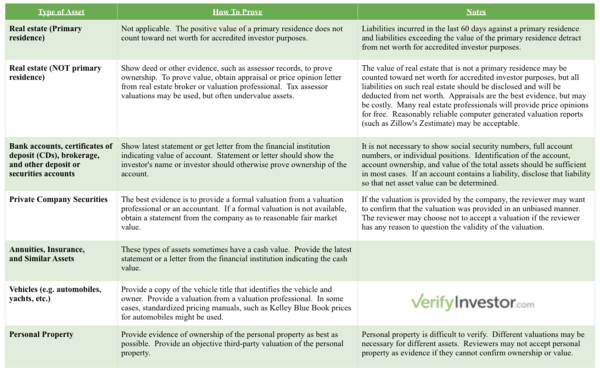

3. Disclosure of the investor’s assets. Assets must be supported with evidence that clearly shows that the investor owns the asset and the value of the asset. Please refer to the chart below for guidance as to what type of evidence might be necessary for different assets.

Tips & Tricks:

- All evidence must be no older than three months.

- Evidence should be provided by objective third-parties where possible.

- If a verification method seems to call for US specific documents, provide them if they are available or use similar documents from the investor’s country. For example, an accredited investor in the US might provide a W-2 income and tax statement to prove income. A foreign individual might not have that same form, but they may upload their country’s equivalent. In the United Kingdom, for example, that’s a P60 End of Year Certificate. If the investor’s country doesn’t have an equivalent, they should explain this to their verifier.

- All thresholds in the accredited investor definition are denoted in US Dollars.

- If evidence is in a foreign language, provide a translation of relevant excerpts at the minimum. For simple items, such a bank statements, a screenshot of a computer translation result might be sufficient.

- Pay careful attention to who the owner of the asset is. For example, if an investor owns an asset, such as real estate, through a company, then the investor’s asset for net worth verification purposes is the value of his or her interest in the company instead of the value of the underlying asset itself.

- Most verifications are valid for only three months; however, there’s generally no need for an investor to be re-verified so long as the investor does not make another Rule 506(c) investment after expiration of the original verification.

Jor Law is a co-founder of Homeier & Law, P.C., where he practices corporate and securities law, including helping companies take advantage of alternative forms of capital raising such as Regulation D, Rule 506(c) offerings and crowdfunding. He is also a co-founder of VerifyInvestor.com, the resource for accredited investor verifications trusted by broker-dealers, law firms, companies, and investors who insist on safety and reliability.

Jor Law is a co-founder of Homeier & Law, P.C., where he practices corporate and securities law, including helping companies take advantage of alternative forms of capital raising such as Regulation D, Rule 506(c) offerings and crowdfunding. He is also a co-founder of VerifyInvestor.com, the resource for accredited investor verifications trusted by broker-dealers, law firms, companies, and investors who insist on safety and reliability.