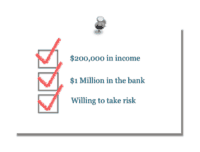

tZero Has Acquired VerifyInvestor for $12 Million in Cash

Buried within the tZero Offering Memorandum for its ongoing initial coin offering were several interesting items of note. The first was the fact the SEC was in the process of reviewing the offering. Another interesting bit of information was the fact tZero has acquired a… Read More

Read more in: Fintech | Tagged jor law, overstock, saftlaunch, tzero, verifyinvestor