The Peer to Peer Finance Association (P2PFA), the trade group that represents P2P lending platforms in the UK, has published data reflecting member loans for Q3 of 2015. The P2PFA represents over 90% of loan volume in the UK and is highly representative of industry growth. Simultaneously the association updated its transparency standards which apply to all members of the P2PFA. The group has advocated on behalf of the nascent industry acting as a single voice on important issues that impact all online lenders. The P2PFA was created to ensure high standards were maintained for both borrowers and investors.

The Peer to Peer Finance Association (P2PFA), the trade group that represents P2P lending platforms in the UK, has published data reflecting member loans for Q3 of 2015. The P2PFA represents over 90% of loan volume in the UK and is highly representative of industry growth. Simultaneously the association updated its transparency standards which apply to all members of the P2PFA. The group has advocated on behalf of the nascent industry acting as a single voice on important issues that impact all online lenders. The P2PFA was created to ensure high standards were maintained for both borrowers and investors.

The new “Operating Principles” (embedded below), are said to “strengthen standards of transparency, risk management and governance in the P2P lending sector”. The P2PFA states that members continue to “set the benchmark” of operational practices for the online lending industry. The group will now require all members to publish debt data, using a standard approach, while making loan books transparent and ensuring that small, retail investors are treated equally with institutional investors. The new principles are said to “supplement and reinforce the FCA’s formal regulatory regime”.

“Our new Operating Principles set a benchmark of fair dealing and transparency. By the New Year, all our members will publish their full loan books, show bad debt losses in a comparable way, and commit to enuring that retail investors get a fair deal compared with institutions,” stated P2PFA Chair Christine Farnish.

“These new measures will help build further consumer confidence, demonstrate our commitment to ethical practice and set a beacon of good practice across the market.”

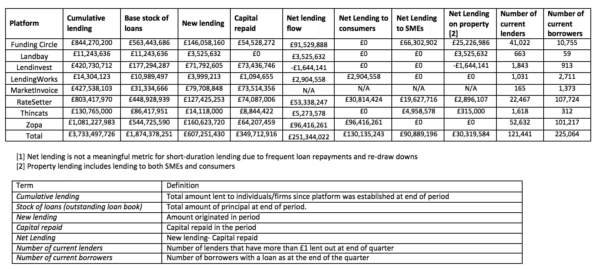

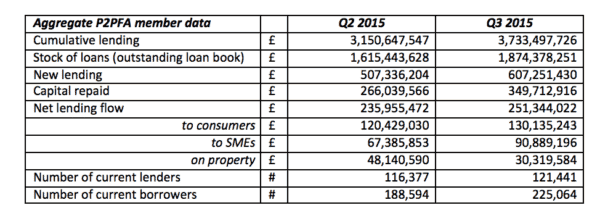

The Q3 data indicates further platform growth. Zopa remains the largest platform in the country by volume of loans. New lending totaled over £600 million for Q3. The number of current borrowers jumped to 225,064 from 188,594 in Q2.

“With almost £2 billion of new lending in 12 months, it’s important that the P2PFA continues to set standards of good practice in the sector. Consumers can be confident that they are dealing with responsible platforms when they see the P2PFA logo,” Farnish added.

[scribd id=286151344 key=key-YyGU3x3Jexd9jT1Y1GNS mode=scroll]