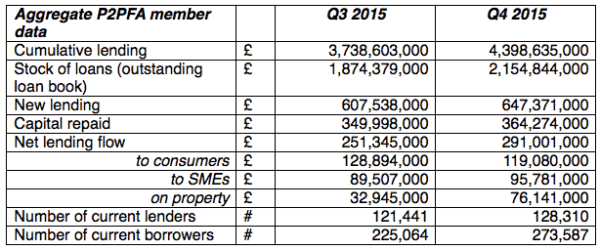

The UK Peer to Peer Finance Association (P2PFA) has published end of year numbers for 2015. The P2PFA tracks the top peer to peer lenders in the UK. In Q4 of 2015, P2PFA members generated just shy of £650 million in loans. Their numbers also indicate a growing user based. During the past 12 months the number of investors grew to 128,000 or by 22%. Borrowers nearly doubled to 273,000 or 96% growth.

Christine Farnish, Chair of the P2PFA, commented on the results;

Christine Farnish, Chair of the P2PFA, commented on the results;

“Year-on-year, peer-to-peer lending continues to grow and have a strong impact across all markets. The growth demonstrates that more lenders and borrowers believe our industry to be a real alternative to traditional lenders. This is only enhanced by our members’ approach to transparency and strict business conduct rules.”

P2P assets will be accepting into a newly created ISA later in 2016. Industry participants expect this event to boost investor participation and awareness.

“2016 is another important year for the industry as we look forward to the April launch of the Innovative Finance ISA,” stated Farnish.

Rhydian Lewis, CEO at RateSetter, released the statement;

“As an industry, we’re getting to the point where banks and large institutions are taking notice. In January, RateSetter became the fastest platform to lend £1bn cumulatively, and with the Innovative Finance ISA just weeks away, we’re looking forward to further growth in 2016.”

Kevin Caley, founder and Chairman of ThinCats, explained the forthcoming ISA should provide a dramatic boost to industry participants;

“The low interest environment has drastically altered the investment market, creating a booming alternative lending sector, as savers cut out the banks to access average returns of as much as 9% on secured loans. Today’s figures from the P2PFA demonstrate that the sector grew at a truly remarkable rate in 2015 and we expect this trend will continue, especially if the new Innovative Finance ISA launches as expected in April. By allowing people to invest their full ISA allowance into peer-to-peer while gaining tax-free returns the new tax-wrapper will help to bring peer-to-peer into the mainstream investment arena and attract many more people to the emerging asset class. Our own research suggests that one in three investors will consider moving money into peer-to-peer once the new ISA comes into play.”

Some interesting highlights from the P2P report:

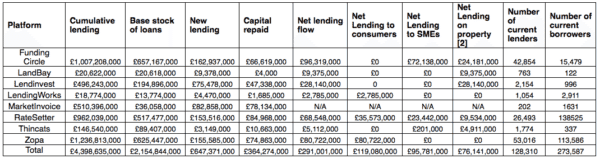

- Single largest lender remains Zopa with a cumulative total of £1.237 billion

- Next largest lenders are Funding Circle and then RateSetter

- RateSetter claims the highest number of current borrowers at 138,525

- RateSetter has repaid the most capital at £85 million

- Funding Circle has the highest Net Lending Flow at £96.3 million

Current membership includes Funding Circle, Landbay, Lending Works, LendInvest, MarketInvoice, RateSetter, ThinCats and Zopa. Collectively P2PFA members serve over 90% of the current UK market. The P2PFA requires all members to adhere to strict standards of operation that demonstrate high standards of transparency and balanced information to consumers while maintaining high standards of credit risk and operational risk management. The P2PFA also presently demands members to secure some lender funds from retail consumers where possible.

Current membership includes Funding Circle, Landbay, Lending Works, LendInvest, MarketInvoice, RateSetter, ThinCats and Zopa. Collectively P2PFA members serve over 90% of the current UK market. The P2PFA requires all members to adhere to strict standards of operation that demonstrate high standards of transparency and balanced information to consumers while maintaining high standards of credit risk and operational risk management. The P2PFA also presently demands members to secure some lender funds from retail consumers where possible.