Top banking executives fear that up to a quarter of their business could be at risk from emerging fintech firms, according to research conducted by PwC. The report notes that information on FinTech is somewhat “dispersed and obscure,” which can make data synthesizing challenging. PwC’s findings are based on DeNovo insights and the views of survey participants, highlighting key trends that will enhance customer experience, self-directed services, sophisticated data analytics and cyber security.

Top banking executives fear that up to a quarter of their business could be at risk from emerging fintech firms, according to research conducted by PwC. The report notes that information on FinTech is somewhat “dispersed and obscure,” which can make data synthesizing challenging. PwC’s findings are based on DeNovo insights and the views of survey participants, highlighting key trends that will enhance customer experience, self-directed services, sophisticated data analytics and cyber security.

“Fintech is changing the FS industry from the outside. PwC estimates within the next 3-5 years, cumulative investment in fintech globally could well exceed $150bn, and financial institutions and tech companies are a stepping over one another for a chance to get into the game,” commented Steve Davies, PwC EMEA Fintech Leader. “As the lines between traditional finance, technology firms and telecom companies are blurring, many innovative solutions are emerging and there is clearly no straightforward solution to navigate this fintech world.”

“Fintech is changing the FS industry from the outside. PwC estimates within the next 3-5 years, cumulative investment in fintech globally could well exceed $150bn, and financial institutions and tech companies are a stepping over one another for a chance to get into the game,” commented Steve Davies, PwC EMEA Fintech Leader. “As the lines between traditional finance, technology firms and telecom companies are blurring, many innovative solutions are emerging and there is clearly no straightforward solution to navigate this fintech world.”

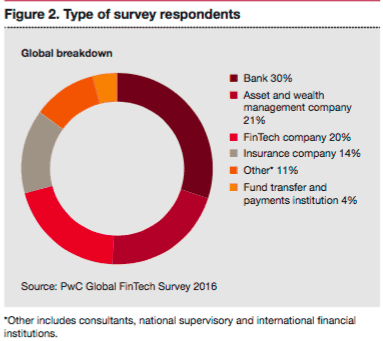

For the study, “Blurred Lines: How FinTech is Shaping Financial Services,” PwC interviewed 544 CEOs, heads of innovation, CIOs and top management involved in digital and technological transformation across the financial services industry in 46 countries.

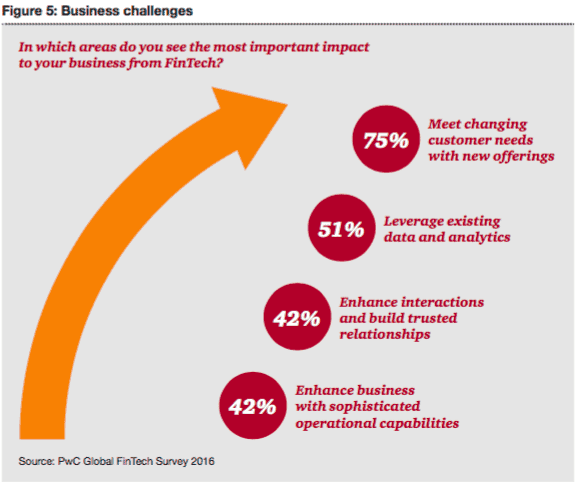

“Disruption of the FS industry is happening and FinTech is the driver. It reshapes the way companies and consumers engage by altering how, when and where FS and products are provided. Success is driven by the ability to improve customer experience and meet changing customer needs,” noted the report.

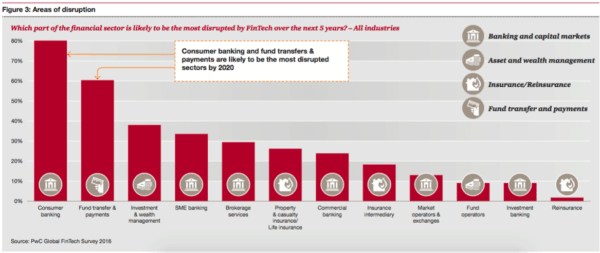

Some statistics include: Incumbents believe 23% of their business could be at risk due to further innovation in fintech, with traditional banking and payments feeling the most heat. Respondents from the fund transfer & payments industry anticipate that in the next five years, they could lose up to 28% of their market share to standalone fintech companies, while bankers estimate they are likely to lose 24%. This compares to around 22% in the case of asset management & wealth management and 21% in insurance.Two-thirds (67%) of incumbents ranked pressure on profit margins as the top fintech-related threat, followed by loss of market share (59%).

Fintech companies are more bullish, believing they could capture a third of incumbents’ business. The release cited a report by McKinsey from last year that forecasted that as much as 60% of bank profits in five retail businesses – consumer finance, mortgages, small-business lending, retail payments and wealth management – are at risk from a combination of shrinking margins and competition from fintech startups. Indeed, PwC’s survey shows the most widespread form of collaboration with fintech companies is joint partnership (32%), which, says Davies, is indicative of a reluctance among incumbents to go all in and invest fully in emerging technology startups.

Asked what challenges they face in dealing with fintech companies, 53% of incumbents cite IT security, regulatory uncertainty (49%) and differences in business models (40%). In the case of fintech companies, differences in management and culture (54%), operational processes (47%) and regulatory uncertainty (43%) are deemed the top three challenges when dealing with traditional financial services firms.

The report concluded,

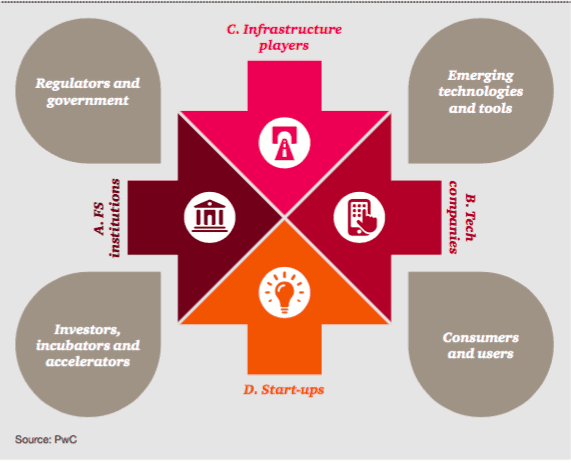

“In response to this rapidly changing environment, incumbent nancial institutions have approached FinTech in various ways, such as through joint partnerships or start-up programmes. But whatever strategy an organisation pursues, it cannot afford to ignore FinTech. The main impact of FinTech will be the surge of new FS business models, which will create challenges for both regulators and market players. FS rms should turn away from trying to control all parts of their value chain and customer experience through traditional business models, and instead move toward the centre of the FinTech ecosystem by leveraging their trusted relationships with customers and their extensive access to client data.

“For many traditional financial institutions, this approach will require a fundamental shift in identity and purpose. The new norm will involve turning away from a linear product push approach, to a customer-centric model in which FS providers are facilitators of a service that enables clients to acquire advice and interact with all relevant actors through multiple channels. By focusing on incorporating new technologies into their own architecture, traditional financial institutions can prepare themselves to play a central role in the new FS world in which they will operate at the centre of customer activity and maintain strong positions even as innovations alter the marketplace. FIs should make the most of their position of trust with customers, brand recognition, access to data and knowledge of the regulatory environment to compete. FS players might not recognize the financial industry in the future, but they will be in the centre of it.”

“For many traditional financial institutions, this approach will require a fundamental shift in identity and purpose. The new norm will involve turning away from a linear product push approach, to a customer-centric model in which FS providers are facilitators of a service that enables clients to acquire advice and interact with all relevant actors through multiple channels. By focusing on incorporating new technologies into their own architecture, traditional financial institutions can prepare themselves to play a central role in the new FS world in which they will operate at the centre of customer activity and maintain strong positions even as innovations alter the marketplace. FIs should make the most of their position of trust with customers, brand recognition, access to data and knowledge of the regulatory environment to compete. FS players might not recognize the financial industry in the future, but they will be in the centre of it.”