Last week the House Subcommittee on Capital Markets, part of the powerful House Financial Services Committee, debated several important bills that may boost access to capital for SMEs. One of the bills, the Fix Crowdfunding Act (HR 4855), has the profound potential to turn Title III crowdfunding (Reg CF) into something quite powerful by addressing several shortcomings prescribed in existing rules. But probably the most important aspect of the Fix Crowdfunding Act is the fact that it will incorporate significant changes that will dramatically enhance investor protection while providing improved opportunity for smaller investors to generate wealth.

While much of the discussion regarding HR 4855, sponsored by Congressman McHenry, lined up along party lines, what was striking was the disconnect between the empirical and the speculative. Several Representatives expressed a “wait-and-see” approach – something that may do their constituents harm. The Fix Crowdfunding Act should be pushed forward quickly – for the benefit of all.

While much of the discussion regarding HR 4855, sponsored by Congressman McHenry, lined up along party lines, what was striking was the disconnect between the empirical and the speculative. Several Representatives expressed a “wait-and-see” approach – something that may do their constituents harm. The Fix Crowdfunding Act should be pushed forward quickly – for the benefit of all.

Why Wait?

A major criticisms of existing Title III rules is one of negative selection. While the intent was to protect those individuals who could least afford to lose money, the cumbersome rules may ironically do the exact opposite. The law of unintended consequences is at play here. Using Reg D, the most popular securities exemption, is a far easier method of raising capital. All you have to do is make certain your investors are accredited (wealthy). As the thesis goes, some of the companies raising capital under Title III will be businesses that were unable to raise smart money using Reg D. If the VCs or professional Angel investors aren’t interested perhaps you can convince the “crowd” of retail investors.

A major criticisms of existing Title III rules is one of negative selection. While the intent was to protect those individuals who could least afford to lose money, the cumbersome rules may ironically do the exact opposite. The law of unintended consequences is at play here. Using Reg D, the most popular securities exemption, is a far easier method of raising capital. All you have to do is make certain your investors are accredited (wealthy). As the thesis goes, some of the companies raising capital under Title III will be businesses that were unable to raise smart money using Reg D. If the VCs or professional Angel investors aren’t interested perhaps you can convince the “crowd” of retail investors.

One of the most glaring shortcomings of existing Title III rules is the inability to use a Special Purpose Vehicle or SPV. An SPV can be a legal entity where a group of individuals invests in a company while being represented as a single investor on the cap table. Small companies need to be spending their time building their business and not dealing with the whims of every small investor. At the same time, a bloated cap table may be a disincentive for future investors to come on board. The SPV, if allowed to be structured correctly, may allow a professional investor to help guide smaller investors along the way. This approach has been described as the “killer app” of equity crowdfunding by MIT Sloan Professor Christian Catalini. His research has correlated nicely with some of the most successful investment crowdfunding platforms around the world.

One of the most glaring shortcomings of existing Title III rules is the inability to use a Special Purpose Vehicle or SPV. An SPV can be a legal entity where a group of individuals invests in a company while being represented as a single investor on the cap table. Small companies need to be spending their time building their business and not dealing with the whims of every small investor. At the same time, a bloated cap table may be a disincentive for future investors to come on board. The SPV, if allowed to be structured correctly, may allow a professional investor to help guide smaller investors along the way. This approach has been described as the “killer app” of equity crowdfunding by MIT Sloan Professor Christian Catalini. His research has correlated nicely with some of the most successful investment crowdfunding platforms around the world.

Not too long ago I had the opportunity to speak with a founder of one of the most successful equity crowdfunding platforms around. The company spends an incredible amount of time in due diligence. The platform lists securities where you can invest side by side with some of the most famous investors in the world. This is where smaller investors should want to allocate their risk capital and, in fact, the results have been pretty impressive. Asked about whether or not Title III incorporation is on the horizon the founder stated he would love to but unfortunately cannot, mentioning specifically the lack of an SPV. Once again, the small guy gets shut out.

Not too long ago I had the opportunity to speak with a founder of one of the most successful equity crowdfunding platforms around. The company spends an incredible amount of time in due diligence. The platform lists securities where you can invest side by side with some of the most famous investors in the world. This is where smaller investors should want to allocate their risk capital and, in fact, the results have been pretty impressive. Asked about whether or not Title III incorporation is on the horizon the founder stated he would love to but unfortunately cannot, mentioning specifically the lack of an SPV. Once again, the small guy gets shut out.

AngelList is a global pioneer in internet finance. Since platform launch, AngelList has matched hundreds of millions of dollars from accredited investors into early stage startups. Their syndicate structure (which uses an SPV) has allowed smaller, accredited individuals to join along with professional investors thus combining the pros with the (accredited) ordinary Joes. During the subcommittee hearing last week, Kevin Laws, COO of AngelList, shared his real-world experience explaining to the subcommittee members;

AngelList is a global pioneer in internet finance. Since platform launch, AngelList has matched hundreds of millions of dollars from accredited investors into early stage startups. Their syndicate structure (which uses an SPV) has allowed smaller, accredited individuals to join along with professional investors thus combining the pros with the (accredited) ordinary Joes. During the subcommittee hearing last week, Kevin Laws, COO of AngelList, shared his real-world experience explaining to the subcommittee members;

“This bill [HR 4855] … simply brings the protections afforded to accredited investors to the unaccredited investors where they are likely to be even more necessary.” [emphasis added]

And who would be against that?

Retail crowdfunding is not only about providing access to capital for SMEs but investment opportunity to a wider audience. Congress should create an exemption that the very best companies seek out – not just the last company to be selected for the team roster.

Retail crowdfunding is not only about providing access to capital for SMEs but investment opportunity to a wider audience. Congress should create an exemption that the very best companies seek out – not just the last company to be selected for the team roster.

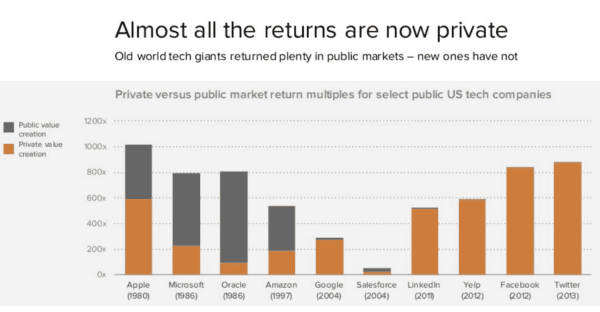

It is a fact that most wealth is vacuumed up by professional investors in private companies before trading on a public exchange. This fact means the current IPO market has become more of an exit instead of an entrance as small IPO’s have all but dried up. While the cause of this phenomena is multi-factorial, much of this has to do with the economics of going public. These days the most promising companies remain private as long as possible raising capital in successive private funding rounds. The graph below, courtesy of Andreessen Horowitz, is a visual depiction of the enigma. You would think our elected officials would want to help alleviate this glaring inequality – one that continues to exacerbate the problematic wealth gap.

The other provisions of the Fix Crowdfunding Act such as enabling “Testing the Waters”, so an issuer can gauge investor interest before launching (and paying for) an offering is an obvious fix. And increasing the funding amount to $5 million is a common sense change. There are other positive elements in HR 4855 that can turn an OK exemption into a truly promising one. While I have great confidence the Title III market will launch with fanfare and a solid deal flow, it is  incumbent upon our policy makers to do what they can to make things better. Having interacted with many of the platforms intent on leveraging Title III retail crowdfunding, I know they will do what it takes to make it work.

incumbent upon our policy makers to do what they can to make things better. Having interacted with many of the platforms intent on leveraging Title III retail crowdfunding, I know they will do what it takes to make it work.

Investing in early stage companies is a risky endeavor. Many small firms will inevitably fail, and investors will lose money. But that is how capitalism works. As it stands now, the deck is stacked against retail investors. Turning the Fix Crowdfunding Act into law will help address many of the existing shortcomings while improving access to capital and opportunity for all investors – both large and small.

[scribd id=307458976 key=key-oJ17pl5e7AcIuY3UAYJF mode=scroll]