RateSetter, one of the UK’s largest P2P lenders, has announced its foray into small business loans with the aid of government backing, reported the Financial Times. In preparation for its expansion anticipated by this week’s end, Ratesetters hired a specialist team and built a technology platform to support business loans.

“Our aim is to help SMEs [small-and medium-sized enterprises] scale up and become more productive . . . that is where they’re saying is underinvested by traditional banks,” commented RateSetter Head of Commercial Finance Divisions Paul Marston to the FT. “One of the reasons I left one of the bigger banks is because I could see constant restructuring going on and a reduction in overall customer service and [the] ability to act for SMEs. There are so many internal systems that the whole thing is drawn out.”

RateSetter aims to lend between £25,000 and £1M, with terms spanning three months to five years. To the FT Marston indicated the business-lending sector “is underserved as high-street banks cut lending to smaller companies with a turnover between £500,000 and £15M.” He also disclosed key details about RateSetter’s new platform which will “facilitate funding for companies within two weeks, compared with months at a typical established bank” and that lending would not be offered to startups due to their higher risk, but instead would focus on companies with a longer trading history.

“We’re investing in relationship managers to offer a fundamentally true alternative for SMEs who are not getting lending decisions through banks; they’re not sure who to speak to because their relationship managers are being restructured,” Marston said to the FT.

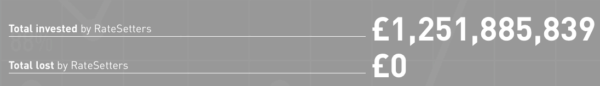

Earlier this month RateSetter reported its surpassing £250 million in lending to UK businesses. The platform noted the participation by the British Business Bank, updated lending limits and a growing executive bench helped to propel its success. RateSetter has lent over £1.25 billion in total to individuals, businesses and property developers. Last year, the UK online lender facilitated over £500 million. RateSetter currently has approximately 40,000 investors on its platform including individuals, institutions, and corporations.

Earlier this month RateSetter reported its surpassing £250 million in lending to UK businesses. The platform noted the participation by the British Business Bank, updated lending limits and a growing executive bench helped to propel its success. RateSetter has lent over £1.25 billion in total to individuals, businesses and property developers. Last year, the UK online lender facilitated over £500 million. RateSetter currently has approximately 40,000 investors on its platform including individuals, institutions, and corporations.