Equitise is a “Trans-Tasman Investment Platform” providing access to capital and unique investment opportunities to investors in New Zealand and Australia. Founded in Australia in 2014 by Chris Gilbert, Jonny  Wilkinson and Panche Gjorgjevski, the investment crowdfunding platform soon added Will Mahon-Heap as the executive to lead operations in New Zealand – a country that moved more quickly to enact regulations to empower internet finance platforms.

Wilkinson and Panche Gjorgjevski, the investment crowdfunding platform soon added Will Mahon-Heap as the executive to lead operations in New Zealand – a country that moved more quickly to enact regulations to empower internet finance platforms.

In the past two years, Equitise has evolved rapidly to develop an investment ecosystem that adds value to both big money and small. Equitise wants to provide access to all investors – not just the wealthiest sector of investors. Championing the cause of inclusive investment opportunity, Equitise has embraced a syndicate model, joining a global movement of internet finance platforms pairing professional investors with retail types.

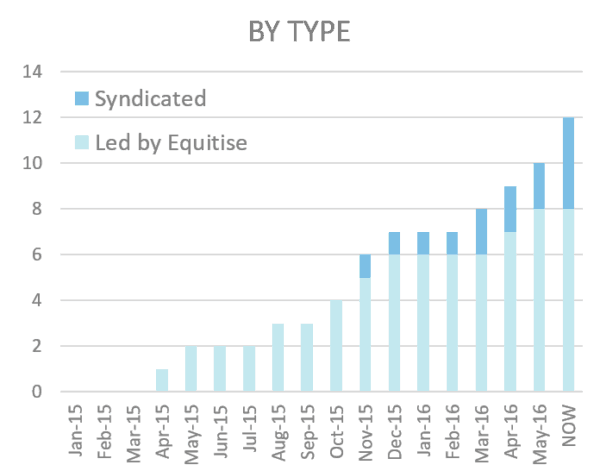

Recently Equitise sent out a missive explaining platform activity has been on the increase;

“…over the past 18 months, the amount of activity within the Equitise platform has been increasing significantly. From small beginnings, we have now initiated 16 transactions…”

Their presence in New Zealand has been growing and the launch of syndicates were all indicative of site traction. In regards to the recent election in Australia, Equitise explained equity crowdfunding has always had Aussie bipartisan support. Both parties want Fintech and crowdfunding to succeed. They expect one of the first pieces of legislation will be to improve the equity crowdfunding ecosystem in Australia.

Crowdfund Insider recently reached out to Will Mahon-Heap to gain additional insight into platform growth and their expectations for both Australia and New Zealand.

Crowdfund Insider: Your transaction activity has been picking up. Can you elaborate?

Crowdfund Insider: Your transaction activity has been picking up. Can you elaborate?

Will Mahon-Heap: We’ve had a busy start to 2016, with deal flow in both Australia and New Zealand. Companies are realizing that we represent a sophisticated offering with Trans-Tasman reach. The uptake in our region has been rapid, as the recent Benchmark report (Sydney Uni/KMPG) said;

“New Zealand has the highest alternative finance volume on a per capita basis outside of China with $59.37 per capita, followed by Australia ($14.83)”.

Which is great news for us, as we operate in NZ/AU.

Crowdfund Insider: I see your syndicate model is picking up speed. Do you believe this will become the dominant method to invest on your platform?

Will Mahon-Heap: Thanks, the Syndicate Model is now established, with some great names running private syndicated transactions through us. It’s certainly going to be a dominant facet of our offering. We will be making some more noise about it later this year.

For those readers that haven’t seen the Equitise Syndicate Model, it’s a service we provide (mainly for private angel/VC type transactions) where you use a special purpose vehicle company, and Syndicate Lead investors can charge carry (a type of success fee on exit) for sponsoring a transaction. It’s the modern efficient way of raising capital, rather than chasing paper and service providers.

Crowdfund Insider: How are you doing with your Private Transaction service?

Will Mahon-Heap: We offer three types of transactions: Private, Public and Syndicated. The private side of things is going well, there are some capital raises which for one reason or another aren’t suited to a full public round. It’s about allowing those companies to use the benefits of our platform (automated legals, transaction facilities etc), without having the public relations element.

Crowdfund Insider: Are you receiving solid deal flow? How are you sourcing companies to raise capital on your platform?

Crowdfund Insider: Are you receiving solid deal flow? How are you sourcing companies to raise capital on your platform?

Will Mahon-Heap: We are getting a strong amount of referral deal flow from the advisory network, and in-bound leads from companies wishing to use the Platform for one of the three models we run.

Crowdfund Insider: Equitise recently said there was nothing to worry about regarding forthcoming elections in Australia as both parties are supportive – yet the last run at crafting a robust investment crowdfunding regime stalled during the legislative process. What is going to be different this time?

Will Mahon-Heap: There’s nothing to worry about with regards to the legislation – as equity crowdfunding is still high on the agenda (it was mentioned in the budget). Both parties are committed to seeing it pass, which is great news for traditional Australian retail investors. The reason it stalled last time around is the Australian political scene was in flux.

The innovative New Zealand framework has proven to be robust, and as a result, we’ve had reservations about the policy for the more restrictive regime in Australia. However, we made that known during the consultation process and believe that some pragmatic changes have been made to the drafting.

We haven’t waited for legislation to come into play either, as a Trans-Tasman provider we’ve been raising capital for Australian companies in New Zealand.

Crowdfund Insider: Any predictions on final rules in Australia?

Will Mahon-Heap: There will be a shift in some of the drafting as a result of our lobbying, which is good news for both companies and investors. The proposed regime was too restrictive, more focused on traditional capital markets than the ease of information flow you get through an online medium such as a platform.

Crowdfund Insider: When is Equitise going to expand into Asia? Any other verticals in the offing?

Crowdfund Insider: When is Equitise going to expand into Asia? Any other verticals in the offing?

Will Mahon-Heap: Singapore is an interesting market to watch, as well as a couple of others. At the moment we are focusing on executing the Syndicate model, which a company anywhere can use. This alongside our other offerings means we can occupy multiple verticals without having to pivot as a business. While I would be happy for us to run a property transaction, such as those being done in the UK, I’m also pleased to see investment outside of property as it’s heavily invested and arguably not as productive for the economy as some of the other businesses we’ve raised capital for.