Thailand and Australia Forge Partnership to Boost Fintech Industry

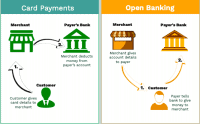

Thailand and Australia have entered into a new phase of financial collaboration with the signing of a memorandum of understanding (MoU) on financial technology (fintech) cooperation. The agreement, aimed at bolstering the local fintech industries of both nations, was formalized this week between the Thai… Read More

Read more in: Fintech, Asia, Global | Tagged australia, fintech australia, Thai Fintech Association, thailand