Cambridge Centre for Alternative Finance Publishes 2nd Annual Research Report on European Alternative Finance

The Cambridge Centre for Alternative Finance (CCAF) has published its 2nd report on the rapid growth of alternative finance across Europe. Entitled “Sustaining Momentum“, the CCAF research has quickly become the definitive report quantifying the growth and documenting the evolution of alternative finance around the world. CCAF has previously published research on new forms of finance covering both the Americas and Asia Pacific.

The Cambridge Centre for Alternative Finance (CCAF) has published its 2nd report on the rapid growth of alternative finance across Europe. Entitled “Sustaining Momentum“, the CCAF research has quickly become the definitive report quantifying the growth and documenting the evolution of alternative finance around the world. CCAF has previously published research on new forms of finance covering both the Americas and Asia Pacific.

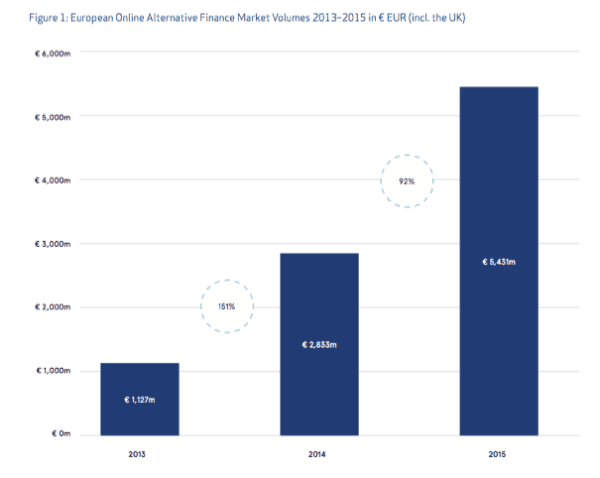

Sustaining Momentum documents the ongoing growth of alternative finance including peer to peer lending, crowdfunding and more. CCAF states that alternative finance jumped 92% year over year to €5.4 billion in 2015.

The research garnered the support of the CME Group Foundation and KPMG. CCAF has established partnerships with 17 European industry associations and 367 various platforms and intermediaries covering 32 countries across Europe. CCAF estimates they have captured a minimum of 90% of the visible market.

Robert Wardrop, Executive Director of the Cambridge Centre for Alternative Finance, commented on the report;

Robert Wardrop, Executive Director of the Cambridge Centre for Alternative Finance, commented on the report;

“European alternative finance transaction volume increased to more than €5 billion in 2015, with volume outside of the UK market exceeding €1 billion for the first time. The European alternative finance industry is still small, however, and the slowing rate of growth during the year is a reminder of the risks the industry must contend with in order to transition from a start-up to a sustainable funding channel within the European financial services ecosystem.”

According to CCAF, as one would expect, the UK continues to dominate the continent at €4.4 billion in aggregate funding. France and Germany are second and third with €319 million and €249 million. The Netherlands had a solid showing at €111 million. If you remove the UK, European alternative finance increased by 72% year over year going from €594 million in 2014 to €1.019 billion in 2015. While the overall rate of growth slowed, the industry is sustaining momentum as new regulations kick in and platforms mature.

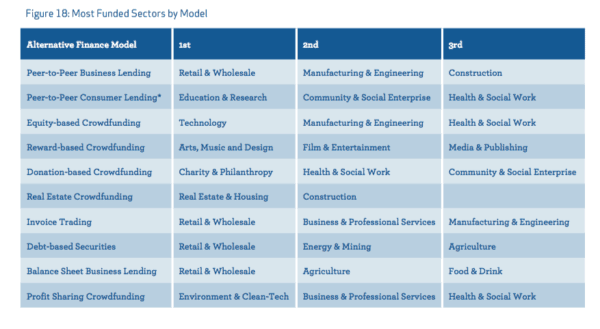

The largest sector of alternative finance remains peer to peer or marketplace lending. Debt based consumer funding registered €366 million for 2015. Peer-to-peer business tallied €212 million. Equity crowdfunding delivered €159 million. Rewards trailed the pack at €139 million. Invoice trading is said to be the fastest growing sector going from just €7 million in 2014 to €81 million in 2015. Similar to the US, more institutional money is flowing into the P2P sector encouraged by automated processes. CCAF states that 26% of P2P consumer lending and 24% of P2B lending is funded by institutions such as pension funds, mutual funds, asset management firms and banks. Equity crowdfunding also experienced greater institutional participation with 8% of funding came from VCs, family offices and other funds.

Irene Pitter, Global Executive, Banking & Capital Markets and member of the FinTech Leadership Team at KPMG, said the report shows that alternative finance continues to grow and mature;

Irene Pitter, Global Executive, Banking & Capital Markets and member of the FinTech Leadership Team at KPMG, said the report shows that alternative finance continues to grow and mature;

“…2016 marks a significant year for ‘alternative finance’ in Europe as the market demonstrates clear signs of continued strong growth and increased maturation in the sector as a whole. European activity, excluding the UK, showed solid growth of 72 percent last year and demonstrated client demand for alternative finance solutions even in the smaller EU countries.”

Rumi Morales, Executive Director, CME Ventures, pointed to the borderless characteristics of Fintech

Rumi Morales, Executive Director, CME Ventures, pointed to the borderless characteristics of Fintech

“No one country is harnessing alternative financial markets or business models to the exclusion of any other. Rather, from the UK to Estonia and from Finland to Monaco, the entire European continent is experimenting and expanding upon innovations that can provide greater access to capital and financial services to more people than ever before,” said Morales.

Other interesting facts highlighted in the research:

- Estonia is 1st in Europe in alternative finance volume per capita at €24, followed by Finland at €12 and Monaco at €10 (outside of the UK).

- UK per capita volume stood at over €65

- Balance Sheet lending was very small at just € 2 million, excluding the UK

- About 38% of surveyed platforms felt their national regulations for crowdfunding and peer-to-peer lending were adequate and appropriate, 28% perceived their national regulations to be excessive, and a further 10% said current regulations were too relaxed.

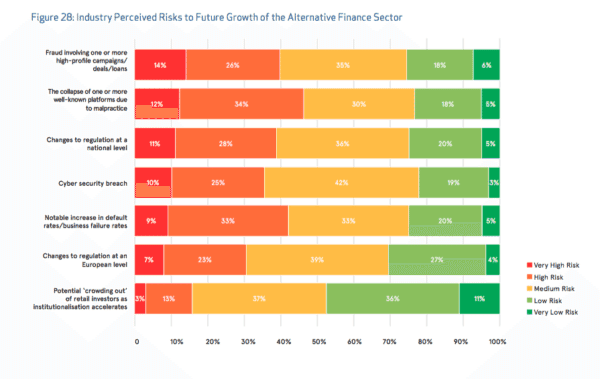

- The biggest risks cited were increasing loan defaults or business failure rates, fraudulent activities or the collapse of platforms due to malpractice.

- The UK had the most platforms (94) followed by France (49), Germany (35) & Italy (30)

- Just shy of 50% of firms indicated no in flow of funding from outside their country, while 72% of platforms indicated no out flow of funds to other countries

CCAF said that since last years’ report some countries have altered their regulatory approach to alternative finance. CCAF stated this was indicative of policy-makers “gaining a better understanding of this emerging form of finance and developing innovative approaches for prudently regulating its activities.”

While some countries have worked to improve the environment so new forms of finance can benefit both consumers and businesses, CCAF said Italy was an example where the government continue to “effectively prohibit certain alternative finance activities despite public statements expressing concern about access to financing constraining economic development.”

The authors of the report hope their analysis will help to contribute to an effective and sustainable future path for growth and a valuable tool for thoughtful policy makers.

The report is embedded below.

[scribd id=323110388 key=key-cA1GGGScaPdpMsqRuzpv mode=scroll]