GrowthFountain is the newest entry into the Reg CF crowdfunding space. The platform received its regulatory approval in December and today has officially launched. As of today, 22 platforms have received regulatory approval with one, uFundingPortal, being pulled from the list for operational shortcomings leaving 21 Reg CF portals. Under Reg CF, small businesses may raise up to $1 million online issuing securities to both accredited and non-accredited investors. GrowthFountain has launched with three different issuers:

- Cogent Education – The company works with teachers to support student learning of difficult science concepts.

- Oma’s Spirits – A family recipe for cherry infused vodka

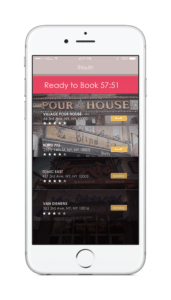

- Venue – a mobile-based application that lets you book parties of all sizes – from a small gathering of friends to corporate events, in a few short clicks.

GrowthFountain reports that it has partnered with “credit union thought leader” Callahan & Associates to help boost local connections to small business. Working together the two entities have developed custom marketing for numerous partners, such as Digital Federal Credit Union, making crowdfunding available to over 750,000 members.

The concept is to be able to offer an alternative for access to capital when small businesses turn to credit unions for funding they now have an additional option – selling equity.

GrowthFountain is providing tutorials and tools specifically tailored for local equity crowdfunding, including a series of calculators to help companies determine the amount of capital to raise and explore possible valuations. GrowthFountain says it will also provide a streamlined process to facilitate the creation of SEC-required documentation.

GrowthFoundtain was founded by CEO Ken Staut, who sold his event-driven hedge fund Tiburon Capital Management for $50 million.

“We started GrowthFountain to level the playing field for small businesses. Until now, small business finance options were cost prohibitive and inefficient – and only a limited number of people met wealth or income thresholds that allowed them to invest. The JOBS Act has improved capital access and we’ve made it simple,” said Staut. “No longer will America’s small businesses – which comprise roughly half of our economy – be considered the forgotten asset class.”