The Jumpstart Our Business Startups or JOBS Act is celebrating its 5th year anniversary. This is the law enacted during the Obama administration that legalized three different iterations of investment crowdfunding. The JOBS Act under Title II enabled Reg D (506c) issuers to “generally solicit” or advertise online and elsewhere thus ushering in a new area of raising capital. Title III and Title IV of the JOBS Act created retail crowdfunding (Reg CF) and a mini-IPO type exemption referred to as Reg A+. Additional portions of the Act improved the environment for smaller companies to raise needed growth capital.

The Jumpstart Our Business Startups or JOBS Act is celebrating its 5th year anniversary. This is the law enacted during the Obama administration that legalized three different iterations of investment crowdfunding. The JOBS Act under Title II enabled Reg D (506c) issuers to “generally solicit” or advertise online and elsewhere thus ushering in a new area of raising capital. Title III and Title IV of the JOBS Act created retail crowdfunding (Reg CF) and a mini-IPO type exemption referred to as Reg A+. Additional portions of the Act improved the environment for smaller companies to raise needed growth capital.

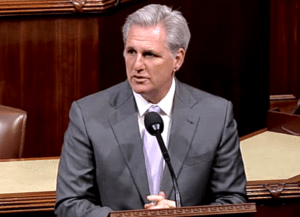

At a bipartisan event hosted yesterday by House Majority Leader Kevin McCarthy and Chief Deputy Whip Patrick McHenry, the following statement was released;

“Today on the five-year anniversary of the JOBS Act, we have much to celebrate and much to do. The JOBS Act is one of those perfect examples of legislation that brought people and ideas from both sides of the aisle together to accomplish something we all agree on: advancing entrepreneurship and job creation. By reducing regulations on companies going public and providing more space for startups to raise capital, the

JOBS act has allowed more than 6,000 companies to raise $1.4 billion in capital. In the past five years, about 83% of all IPO registration and 87% of all completed IPOs have been aided by provisions in the JOBS Act. That translates directly into American jobs and a growing economy.”

“But we can’t rest on our laurels. The rate of new business formation has declined and startups and small businesses still struggle to get the capital they need to grow and thrive. The Innovation Initiative is our answer to this challenge to build upon the success of the JOBS Act. By reforming how government works and empowering private sector innovation, we can recreate the magic of the JOBS Act across all sectors and in every region of America, creating economic opportunity accessible to all.”

Representatives McCarthy and McHenry are correct. There is still much more that needs to be done. And regulatory changes designed to improve the early stage funding ecosystem should be a bipartisan push. While much was accomplished by the JOBS Act, crowdfunding rules must be updated to reflect the realities of shortcomings in existing law – specifically with Reg CF.

A recent post on WealthForge highlights the discrepancy between the US crowdfunding ecosystem with that of the UK. Britain has led the world in most things regarding Fintech and investment crowdfunding is no different.

“One result of these regulatory differences is that the UK has seen larger crowdfunding rounds completed … In several aspects, the UK framework allows for greater participation and volumes, however this is offset by the smaller UK economy. The US has a much larger base of potential issuers, with about 40,000 companies raising capital each year.6 The UK has far fewer companies that raise capital annually, but the percentage of these companies that raise money via crowdfunding is growing, with some stating that crowdfunding investment campaigns accounted for about 20% of these raises in 2016.“

In the US approximately $23.6 million has been raised under Reg CF. Crowdcube, a leading UK platform, has raised over £233 million crowdfunding. Approximately 50 of these issuers have been in excess of £1 million. Some later stage, more mature issuers see value in raising capital online – offers that are frequently joined by VC or Angel money. This is the direction the US must take as well.

Crowdfunding in the UK is not hampered by an arbitrary funding cap. At a certain amount, an issuer must file a prospectus which acts like acts as a speed bump (€5 million). One crowdfunding platform, Crowdcube, raised funding for itself filing a prospectus closing at over £6 million. The US could learn much by reviewing the data from the UK but due to parochial inclinations or time constraints, many US policymakers are not inclined to look across the Atlantic for empirical information. Congressman McHenry is attempting to address the shortcomings that undermine Reg CF today by fixing it with legislation. Let’s hope all factions within Congress come together to help their constituents and the broader economy.

Crowdfunding in the UK is not hampered by an arbitrary funding cap. At a certain amount, an issuer must file a prospectus which acts like acts as a speed bump (€5 million). One crowdfunding platform, Crowdcube, raised funding for itself filing a prospectus closing at over £6 million. The US could learn much by reviewing the data from the UK but due to parochial inclinations or time constraints, many US policymakers are not inclined to look across the Atlantic for empirical information. Congressman McHenry is attempting to address the shortcomings that undermine Reg CF today by fixing it with legislation. Let’s hope all factions within Congress come together to help their constituents and the broader economy.

JOBS act has allowed more than 6,000 companies to raise $1.4 billion in capital. In the past five years, about 83% of all IPO registration and 87% of all completed IPOs have been aided by provisions in the JOBS Act. That translates directly into American jobs and a growing economy.”

JOBS act has allowed more than 6,000 companies to raise $1.4 billion in capital. In the past five years, about 83% of all IPO registration and 87% of all completed IPOs have been aided by provisions in the JOBS Act. That translates directly into American jobs and a growing economy.”