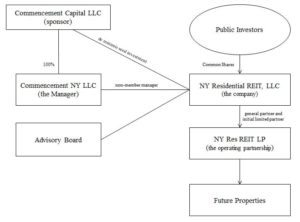

Commencement Capital LLC has launched a Reg A+ offer for the NY Residential REIT. The REIT is seeking a minimum of $1 million and up to $50 million, the maximum amount currently allowed under the securities exemption. The offer is open to both accredited and non-accredited investors joining a growing list of real estate platforms using Reg A+ to raise capital for various property investment approaches. As the name infers, the NY Residential REIT will purchase, invest in, and manage a portfolio of residential properties located in Manhattan – one of the hottest real estate marketplaces in the world.

The REIT is expected to primarily target condominiums, single-family, and multi-family properties, and was designed to provide a much wider investor audience with the opportunity to participate in an asset class that has historically been primarily limited to institutional or wealthier investors.

The REIT is expected to primarily target condominiums, single-family, and multi-family properties, and was designed to provide a much wider investor audience with the opportunity to participate in an asset class that has historically been primarily limited to institutional or wealthier investors.

“Manhattan has been one of the preeminent real estate markets in the world for a long time, but it has been difficult for most investors to participate in its appreciation,” stated Jesse Stein, CEO of NY Residential REIT. “With this offering, we sought to level the playing field and provide access to everyone who has wanted to invest in Manhattan but has not had the opportunity to do so.”

According to their Offering Circular, the company says it will pursue a listing of the REIT shares prior to the completion of the offering either on NASDAQ, NYSE or with OTC Markets Group.

Shares are being sold at $10/each with a minimum purchase of 100 shares. There is a 7% sales commission baked into the share offer of the REIT. At some point in the future, the REIT is expected to declare distributions for shareholders. Beyond organization and offering expenses, the REIT is expected to pay the managers a quarterly asset management fee equal to 0.50% annually. There is a section in the Offering Circular that provides detailed description of all of the fees.

Ryan Serhant, a NY Residential REIT Advisory Board Member, said they believe this is a great time to invest in Manhattan real estate.

“I think there’s real potential upside in buying at today’s values, which is why I am excited to be involved with NY Residential REIT.”

Jonathan Morris, NY Residential REIT President and a faculty member at Georgetown University, stated;

Jonathan Morris, NY Residential REIT President and a faculty member at Georgetown University, stated;

“Our ‘Pure Play’ REIT platform is an exciting new opportunity for investors to participate in the opportunities that we identify in one of the world’s tightest residential markets. I’ve worked as an executive for three REITs, all of which began focusing on individual investors yet changed course and are now owned mainly by institutions. I look forward to embarking on this new platform where the individual investor is not only our primary focus, but our total focus.”

Reg A+ is becoming a popular vehicle for REITs. In fact, much of the successful funding under Reg A+ has taken place via real estate platforms.

Have a crowdfunding offering you'd like to share? Submit an offering for consideration using our Submit a Tip form and we may share it on our site!