Indiegogo was originally envisioned as a vehicle to sell securities in small companies to the masses. That was back in 2008 and, as we all know, the regulatory environment had not yet caught up to the realities of a world with internet access. Thus Indiegogo pivoted and dove into the perk-based crowdfunding world. Since then, Indiegogo has helped to raise over $1 billion for projects and businesses around the world.

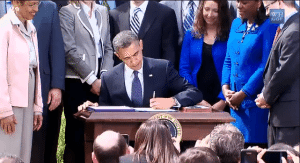

When President Obama signed the JOBS Act into law back in 2012, most people thought regulators would move rapidly and build out the rules that would allow companies to raise capital online.

When President Obama signed the JOBS Act into law back in 2012, most people thought regulators would move rapidly and build out the rules that would allow companies to raise capital online.

That did not happen. The wheels of government can move rather slow.

It took four years for each of the crowdfunding exemptions to be completed. The final being Title III of the JOBS Act, the crowdfunding exemption that has received the most popular attention from the media.

While Title IV (Reg A+) and Title II (Reg D 506c accredited crowdfunding) of the JOBS Act allow issuers to raise a lot more money online, Title III or Regulation Crowdfunding (Reg CF) was ostensible positioned to benefit the smallest startups or the mom-and-pops in need of growth capital. Ignored by VCs and Angel investors, and being too small for bank loans, these companies clearly lacked access to capital. Thus Reg CF was born.

In May 16, 2016, the new exemption went into effect. Newly minted “funding portals”, a type of broker-dealer light entity that could sell these securities online, listed the first investments under Reg CF. One year later, over $35 million has been raised for more than one hundred small companies.

As it stands today, Wefunder and StartEngine lead the space with most dollars raised. But Indiegogo, a late entry into Reg CF crowdfunding, is quickly catching up.

As it stands today, Wefunder and StartEngine lead the space with most dollars raised. But Indiegogo, a late entry into Reg CF crowdfunding, is quickly catching up.

Launched in partnership with MicroVentures (First Democracy VC), an already established accredited crowdfunding platform, Indiegogo has diligently pushed into investment crowdfunding. In stark contrast to the free-wheeling, wild-west world of perk-based crowdfunding, Indiegogo has taken a more selective and conservative approach.

Out of twelve crowdfunding rounds listed by Indiegogo, twelve have fully funded. So Indiegogo is batting a thousand. As far as we know, there is only one other active Reg CF portal that can claim the same.

The deals are interesting too. From a restaurant in Washington, DC, Republic Restoratives, raising $300,000 to the Field Guide of Evil (a film) raising half a million dollars.

The deals are interesting too. From a restaurant in Washington, DC, Republic Restoratives, raising $300,000 to the Field Guide of Evil (a film) raising half a million dollars.

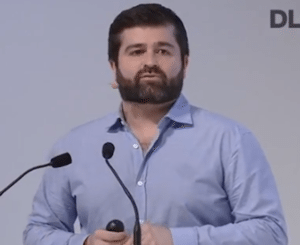

On Tuesday, I hopped on the phone with Slava Rubin for a quick update as to how he things are progressing for Indiegogo in the equity crowdfunding side of his business. Rubin, co-founder and Chief Business Officer of Indiegogo, passed the mantel of CEO to David Mandelbrot at the beginning of 2016. He is still very much engaged with Indiegogo and is spending his time focusing on innovation and growth.

Rubin said the Reg CF Anniversary was super exciting and they are generating real data and feedback on selling securities online;

“We launched in the middle of November, so only half the amount of time in operation. We are 12 for 12 for businesses that have reached their target. We are at a 100% success rate.”

I asked Rubin if he is seeing any parallels to the perk-based platform.

I asked Rubin if he is seeing any parallels to the perk-based platform.

“There is no question there is a benefit to the history and experience with the perk business. We have worked with thousands of entrepreneurs and millions of backers. That comes with a lot of people having a good experience and trust. We are building our trust in equity crowdfunding. It has been very helpful.”

Rubin said that it was exciting to see Indiegogo alumni raise funding on their investment side. The perks side is a funnel for potential investment rounds. Rubin also added that having the large existing network of backers has been helpful in getting the businesses funded. “Many times these investors are complete strangers,” said Rubin.

Asked if equity crowdfunding had matched his expectations?

“Yes. Things are going well. It is early, but we expect more growth to come.”

Rubin explained they were receiving a ton of inbound requests because of awareness from their perks side. He said they are making certain that issuers are solid companies. Perks is open but equity – not so much. While he did not know the exact acceptance rate, Rubin said they were far more companies applying than getting posted. Sometimes they will provide feedback to a potential company telling them they need to wait or work to accomplish some more milestones. Sometimes they go to other equity platforms too.

“We are very proud of the offering companies we are putting up,” added Rubin.

Speaking about challenges for the investment crowdfunding side, Rubin explained;

“Equity crowdfunding is a brand new industry. Most people do not really know what it is. Especially for the everyday man or women. Some of the more sophisticate investors understand it. There is still a lot of learning to be done.”

He also believes existing Reg CF rules create limitations that can be hard to navigate. On the top of the list is the $1 million cap. He believes it should be capped far higher, perhaps $10 million. This is a common gripe in the US investment crowdfunding industry and one policymakers must address. Rubin believes other improvements are needed too, like the ability to create funds (SPVs) and testing the waters.

He also believes existing Reg CF rules create limitations that can be hard to navigate. On the top of the list is the $1 million cap. He believes it should be capped far higher, perhaps $10 million. This is a common gripe in the US investment crowdfunding industry and one policymakers must address. Rubin believes other improvements are needed too, like the ability to create funds (SPVs) and testing the waters.

While Indiegogo is set up to allow side-by-side Reg D offerings that are a workaround to the cap they have done only one so far. They are looking into getting into the Reg A+ space as you may raise up to $50 million using the updated rules.

Rubin said they were constantly improving the site and tweaking features. They are already accepting credit cards and may be the first platform to do so. They incorporate iDisclose to streamline the securities filings for issuers. They are constantly looking at the investor side of operations so investors can keep track of their investments and receive reports from portfolio companies. They want a swifter flow through the tunnel. An experience that is streamlined and efficient. They are also set up to accept international investors;

“We are super surprised as to how many foreign investors have participated.”

Asked about future plans and predictions, Rubin said;

“I think you are going to see continuous growth. If you look at how Indiegogo grew in the early days… if you look at how Crowdcube grew in the UK. I think we are seeing the same type of growth.”

“We are full circle a decade later. We have come back to our roots. We are really excited to democratize access to capital.”