This article highlights three takeaways for Fintech firms from Mary Meeker’s 355-page-long report: 1) The Internet’s center of gravity shifts to Asia; 2) The biggest get bigger; 3) Fintechs must use gamification to improve customer engagement.

Since 2001, Mary Meeker, a Partner at venture capital and private equity firm Kleiner Perkins Caufield & Byers, has released a yearly Internet Trends Report. Year after year, she and her team never fail to enlighten readers about the unceasing stream of Internet innovations and the market changes they cause. Browsing through this year’s edition, a 355-page-long slide deck, gives readers a good opportunity to step back and gain perspective.

Since 2001, Mary Meeker, a Partner at venture capital and private equity firm Kleiner Perkins Caufield & Byers, has released a yearly Internet Trends Report. Year after year, she and her team never fail to enlighten readers about the unceasing stream of Internet innovations and the market changes they cause. Browsing through this year’s edition, a 355-page-long slide deck, gives readers a good opportunity to step back and gain perspective.

Below, we picked from the report three issues that we find should be on the strategic agenda of every fintech firm.

The Internet’s center of gravity shifts to Asia

If you work for a European Fintech, Asia may seem far away. Still when the Internet’s center of gravity shifts, it’s a tectonic change that impacts everybody.

In 2016, Asia became the largest Internet continent, representing more than 50% of the world’s 3.4 billion-strong online population. India made a big leap forward, passing the US as the second largest single-country Internet population after China. Globally, the Internet population grew by 10% in 2016 – that would have been 8% without India.

[clickToTweet tweet=”The sheer size of Asian markets portends their future domination of the Internet and #Fintech” quote=”The sheer size of Asian markets portends their future domination of the Internet and #Fintech”]

The sheer size of Asian markets portends their future domination of the Internet and Fintech. Indeed, they still have plenty of room to grow. Internet penetration there lies on average below 50%. By contrast, Western countries have reached nearly 90% Internet penetration in North America, and nearly 80% in Europe – the markets there grow mostly through increased usage. And then, there is economic growth…

China is the No. 1 market in the world in number of Internet and Fintech users

Chinese Internet and fintech companies are huge, and ready to conquer the world, starting with their large international diaspora.

- At the end of 2016, China had 731 million Internet users, 95% of whom, i.e. nearly 700 million, were accessing the Net through their smartphone. At +30%, Internet usage grows even faster than Internet penetration which is currently at 53% (+12%).

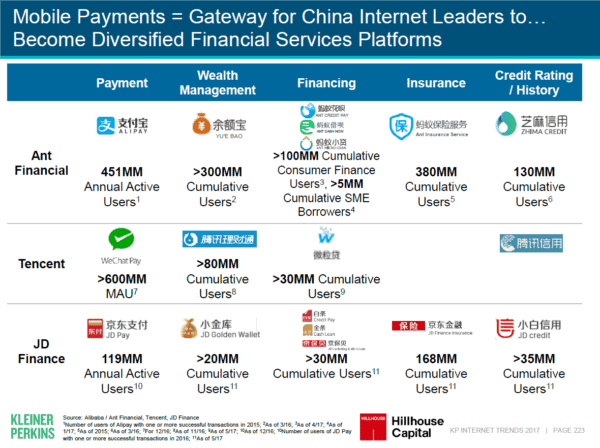

- China has massively adopted mobile payments: Alipay by Ant Financial counts 450 million users, WeChat Pay by Tencent 600 million and JD Pay by JD Finance. WeChat Pay recently opened to international customers. Together Alipay and WeChat Pay have over 90% of the Chinese $5,000 billion online payment market, with Alipay, because of its ties with the eCommerce group Alibaba still dominating in $ share.

- Chinese fintech companies have expanded from payments to become diversified financial services platforms offering savings accounts, credit and insurance. As an example, money market fund Yue Bao, launched in 2013, has conquered 300 million clients.

US and Chinese Suppliers Are Battling with Indians for the Fast-Growing Indian Market

As the fastest-growing large Internet market, India is a much-coveted market.

- Thanks to the lowering of the cost of fixed and mobile Internet access, the Indian online population jumped from 277 million in 2015 to 355 million in 2016, a 24% growth rate. 80% of Internet usage is mobile. The growth opportunity is huge as Internet penetration was still at a low 27% in 2016 (34% as of May 2017 according to Internet World Stats).

- Several reforms such as the demonetization of large bank notes and pro-digital government policies such as the financial inclusion policy and the generalization of the digital Identity system called Aadhaar (82% penetration) favor the emergence of fintech in India.

- Paytm the leading Indian mobile payments provider received investments from China’s Ant Financial and from Japanese venture fund Softbank. It recently launched Paytm bank.

- The Indian market is coveted by US and Chinese Internet giants such as Shareit, Amazon and Facebook. However, the market is still suffering from structural barriers such as its 29 spoken languages.

The biggest get bigger – GAFAA et al.

Due to the network effect, the internet tends to be a winner-take-all market, where leaders draw disproportionate rewards from their leading position, which in turn helps them strengthen their dominance. Global leaders emerge.

One would have thought, however, that new waves of innovation would unsettle the leaders of the previous waves. It was the case until recently (see AOL, Yahoo!). But the current global leaders, the GAFAAs (Google, Apple, Facebook, Amazon, Alibaba) seem to be successfully riding the waves, and often even increase their dominance.

[clickToTweet tweet=”Many bankers believe that the financial sector is immune to a global concentration of power and to #Fintech disruption” quote=”Many bankers believe that the financial sector is immune to a global concentration of power and to #Fintech disruption”]

Many bankers believe that the financial sector is immune to such a global concentration of power (and to fintech disruption at that). They should meditate on the following striking facts taken from the 2017 Internet Trends Report:

- In 2016 mobile advertising surpassed desktop advertising. Google and Facebook, together, captured 2/3 of the $73 billion US Internet advertising revenues and 85% of the $13 billion market growth (+22%).

- Google, with its Product Listing Ads embedded in search results, represents 52% of all US retail paid clicks (from 29% in 2014).

Alibaba in China has 507 million monthly active users, +24% in 2016.

Alibaba in China has 507 million monthly active users, +24% in 2016.- WeChat (Tencent) and Alipay (Alibaba) have respectively a 40% and 54% market share of the $5,000 billion Chinese mobile payment market.

- Facebook has over 200 million users in India alone. WhatsApp (a Facebook company) and Facebook Instant Messaging are the top instant messaging applications in India, ahead of Chinese Shareit.

- Amazon is opening stores while US retailers are closing them. Amazon not only enjoys a 43% share of US online retail. It also sells white-label products. Nearly 1 in 3 batteries sold on Amazon is an Amazon-branded one.

- Within 10 years, US recorded music revenues went from over 80% physical recording to 80% online distribution (streaming and downloads) and the total market size was cut in half. Meanwhile, streaming leader Spotify gained a 20% global market share of online music subscriptions.

As Mary Meeker puts it:

“Very few companies will win – those that do – can win big.”

Fintechs Must Use Gamification to Engage Customers

With customer acquisition costs being extremely high (thank you GAFAAs!), fintech firms should prioritize customer engagement and customer retention. For Mary Meeker, interactive games are the “motherlode” of online services innovation. They should be a major source of inspiration for generating customer engagement.

To being with, online customers are gamers. In 2016, they were 2.6 billion, men and women of average age 35 who spent around $100 billion on interactive games. Of course, the younger ones, Generation X and the Millennials, have been “gamified since birth.” Gaming has shaped their expectations of how they should obtain information, learn, train, pursue their goals, interact with services, and collaborate with each other in multiplayer games.

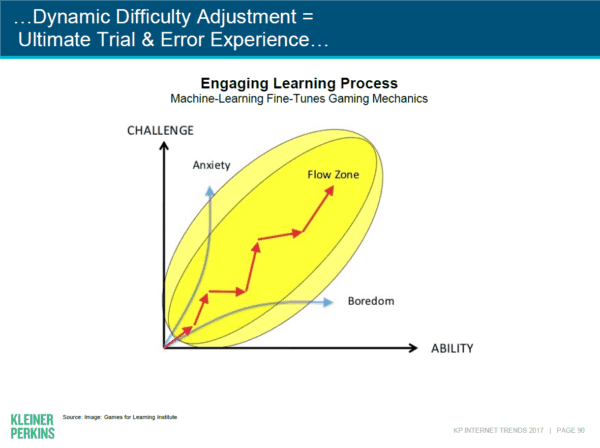

Secondly, games are the one form of online activity that gets the undivided attention of online users ‒ who have otherwise a very short attention span. Interactive games have perfected a vast array of techniques to drive engagement:

- Repetition: let users learn by trial and error.

- Dynamic difficulty adjustment: adapt game mechanics to keep users in the flow, without anxiety nor boredom.

- Rules: let gamers learn rules by pattern recognition.

- Planning: let them think strategically, focusing on the end goal.

- Leveling up: keep moving users from one level to the next.

- Exploring: let users discover their environment.

- Quantifying: deliver performance statistics to stimulate users to compete with self and others.

- Collaboration: make users collaborate in multiplayer games.

- Rewards: award badges, stars, rankings.

- Story telling: capture the gamer’s imagination and their emotions.

These techniques are successfully employed in eCommerce and Social Media. It seems that the motherlode had not yet been much exploited by online financial services.

Incorporating gaming techniques will become increasingly useful as computer interactions become a more and more important part of consumers’ life.

[scribd id=351176897 key=key-mGDUIwALoWuELjftEndg mode=scroll]

Therese Torris, PhD, is a Senior Contributing Editor to Crowdfund Insider. She is an entrepreneur and consultant in eFinance and eCommerce based in Paris. She has covered crowdfunding and P2P lending since the early days when Zopa was created in the United Kingdom. She was a director of research and consulting at Gartner Group Europe, Senior VP at Forrester Research and Content VP at Twenga. She publishes a French personal finance blog, Le Blog Finance Pratique.

Therese Torris, PhD, is a Senior Contributing Editor to Crowdfund Insider. She is an entrepreneur and consultant in eFinance and eCommerce based in Paris. She has covered crowdfunding and P2P lending since the early days when Zopa was created in the United Kingdom. She was a director of research and consulting at Gartner Group Europe, Senior VP at Forrester Research and Content VP at Twenga. She publishes a French personal finance blog, Le Blog Finance Pratique.

Alibaba in China has 507 million monthly active users, +24% in 2016.

Alibaba in China has 507 million monthly active users, +24% in 2016.