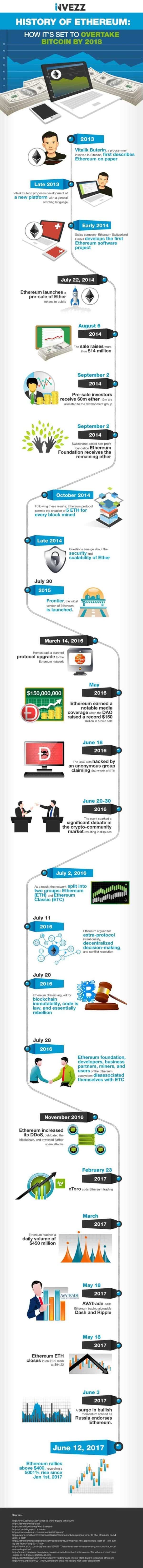

This is kind of interesting. Invez has created an infographic on the history of Ethereum and how it will soon surpass Bitcoin in valuation. According to the write up, ethereum is set to overtake bitcoin in 2018. Invez is of the opinion that Ethereum will inevitably become the most important cryptocurrency in the market that year. They could be right. Or perhaps not. But time will tell. You never know, another challenger could be lurking in the ethersphere.

The authors point to the fact that both Ethereum and Bitcoin are as similar in many respects but Ethereum has some critical differentiators. Invez bullets out some of the main differences and comparisons between the two entities.

- Bitcoin identifies as a cryptocurrency whereas Ethereum offers a lot more than just a medium of exchange. It features smart contracts, Ethereum Virtual Machine (EVM) and also uses its currency, Ether, for peer-to-peer contracts

- Bitcoin’s average block time is 10 minutes whereas that of Ethereum is 12 seconds. The faster block time allows for more block confirmations which give Ethereum clients an opportunity to complete more blocks and thereby receive more Ether.

- Ethereum raised its capital in a presale by fans from around the world whereas majority of the Bitcoin in circulation is owned by the early miners

- The majority of the Bitcoins have already been mined whereas, it is estimated only about half of all Ethereum’s coins will have been mined by the year 2021.

- Ethereum uses Ethash, an algorithm that allows decentralized mining by Ethereum clients whereas, Bitcoin uses a centralized ASICs.

- Ethereum costs transactions depending on storage needs, application complexity and bandwidth usage. Bitcoin, on the other hand, limits transactions by block size with these blocks competing with each other equally to the blockchain.

- Ethereum features its own Turing complete internal code whereas Bitcoin does not have this capability.

- Ethereum allows both permissioned and permissionless transactions to take place, whereas Bitcoin only works in a permissionless way.

Not everything is rosy, though. There are risks. Invez states;

“Ethereum has faced heavy criticism for potential security problems and after $50M in Ether was claimed by an anonymous entity in June 2016. This attack raised more questions than answers resulting in a dispute that saw Ethereum split into two Ethereum (ETH) and Ethereum Classic (ETC). Subsequent attacks saw Ethereum improve its DDoS protection, de-bloat the blockchain, and thwart further spam attacks by hackers.”

Invez has published even more. You can read it here.