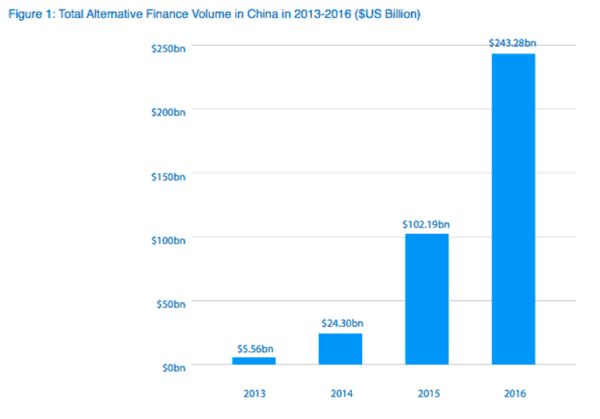

The Cambridge Centre for Alternative Finance (CCAF) is out with their 2nd annual report quantifying the growth of alternative finance for the Asia Pacific Region in 2016. Entitled, “Cultivating Growth,” the benchmarking report shows an emerging industry that grew dramatically versus year prior as it rose to $245.28 billion delivered mainly by the huge China market. The alternative finance sector in Asia-Pacific totaled $102.8 billion in 2015, the first year for the survey. The research is based on data collected from 628 platforms across the Asia-Pacific region, including 463 from China and 165 platforms from the wider region.

The research was produced by the Cambridge Centre for Alternative Finance at University of Cambridge Judge Business School, the Australian Centre for Financial Studies at the University of Monash Business School in Australia and Tsinghua University in China. CCAF also received financial backing from KPMG Australia, CME Group Foundation and HNA Capital.

Bryan Zhang, co-founder and Interim Executive Director of CCAF, commented on the report;

Bryan Zhang, co-founder and Interim Executive Director of CCAF, commented on the report;

“As the online alternative finance market continues to grow, it is perhaps more imperative than ever to explore what kind of growth is desired and needs to be achieved…. To have a long-term, sustainable and inclusive growth, online alternative finance industry needs to adhere to best practices and cultivate trust, keep innovating in products and services and provide returns to investors.”

As one would expect, China dominates the alternative finance market in the region in just about all areas. This is similar to the first years’ report and the industry continues to scale.

Out of the almost quarter trillion in aggregate funding activity, most all of it came from China at $243.3 billion. China actually strengthened its position as the global alternative finance market leader accounting for 99.2% of the total Asia Pacific and an estimated 85% of the total global market in 2016. The rest of the region grew dramatically as well but the sheer scale of China is hard to ignore.

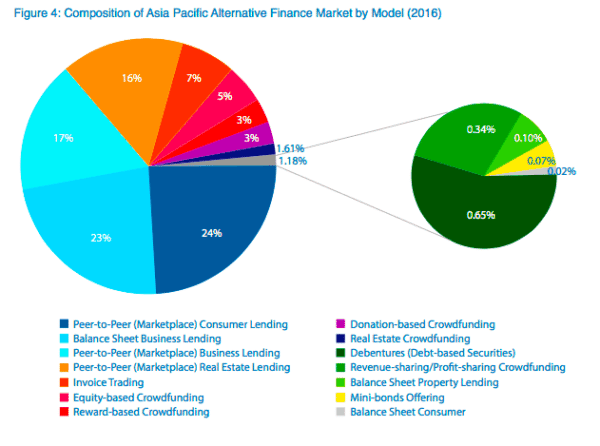

In China, the largest alternative finance model continues to be marketplace/peer-to-peer consumer lending with US $136.54 billion. The marketplace/peer-to-peer business lending model came second with a total of US $57.78 billion. Balance sheet business lending totaled US $27.29 billion while balance sheet consumer lending tallied US $9.38 billion. It is interesting to note that the majority of this funding is not from institutional money but from individual investors. This is in stark contrast to the US market.

In the wider AsiaPac market, not including China, the same held true. Marketplace/peer-to-peer consumer lending was the largest model with US $484.86 million. Balance sheet business lending accounted for around US $466.08 million in 2016.

Australia came in second place at $610 million. While small in comparison, it was a significant increase versus the $398 million generated in 2015. Combined with New Zealand, which totaled $223 million in 2016, Oceania was the largest regional market in the Asia Pacific outside of China. The Australian market largely consisted of balance sheet business lending ($217 million), peer-to-peer consumer lending ($158 million) and invoice financing ($130 million), while peer-to-peer consumer lending led the way in New Zealand with $163 million in 2016.

The research highlights other key markets in the region. Japan totaled $398 million, South Korea at $376 million, Singapore at $164 million, and India at $124 million.

The authors state that online alternative finance platforms that have emerged across the region since 2013 “have changed the way people, businesses and institutions can access, raise and invest money.”

The report’s other key findings include:

- China continues to see “distinctively low levels” of institutional participation in alternative finance compared to other markets such as the US and UK, with only 5% of peer-to-peer business lending coming from institutions in 2016. Online lending models in China are led by individual retail lenders.

- In the Asia Pacific outside of China, about $1.5 billion was raised by businesses through alternative finance channels, up 72% from the previous year, with an estimated 43,000 business entities utilizing alternative channels of business finance.

- China is dominated by non-business alternative finance with US$146.8 billion raised for non-business purposes – a stark difference when compared to the rest of Asia Pacific.

- In China, 72% of peer-to-peer consumer lending platforms see cyber-attacks as the biggest threat to the industry, while more than 50% across all platforms in China see current and proposed regulatory norms to be adequate.

- Outside of China, 69% of platforms in Japan see existing regulation as inadequate or too relaxed, while in Singapore, Australia, New Zealand and Malaysia around two thirds of platforms see current regulations as adequate.

The document says that alternative forms of finance are fast taking root across the Asia Pacific region but with quite divergent and distinct characteristics. “The question now going forward is what type of growth must now be cultivated across the Asia Pacific region over the coming years to realize the benefits offered by the alternative finance industry.”

The document says that alternative forms of finance are fast taking root across the Asia Pacific region but with quite divergent and distinct characteristics. “The question now going forward is what type of growth must now be cultivated across the Asia Pacific region over the coming years to realize the benefits offered by the alternative finance industry.”

“The innovative digitisation of financial services by Alt-Fi platforms is lowering transaction costs, enhancing convenience for customers, and increasing access to credit and investments for underserved segments,” said Ian Pollari, Global Co-Leader, KPMG FinTech Practice. “Australia has an opportunity to lead the way, but we must proceed mindfully. Regulation can have a profound impact on the development of the sector. For example, the uncertain regulatory environment for equity crowdfunding, ahead of legislation taking affect this year, no doubt contributed to a notable drop in activity in 2016. This underscores the vulnerabilities that might impede future growth which need to be identified, understood and prudently managed for the long-term viability of Australia’s alternative finance industry.”

Kieran Garvey, Head of Regulation & Policy at the Cambridge Centre for Alternative Finance, pointed to the fact that Asia Pacific is the worlds largest alternative finance market but there are vast differences between countries within the region.

Kieran Garvey, Head of Regulation & Policy at the Cambridge Centre for Alternative Finance, pointed to the fact that Asia Pacific is the worlds largest alternative finance market but there are vast differences between countries within the region.

“China leads the alternative finance industry in terms of total market activity and this has no doubt led to increased financial inclusion amongst businesses and consumers there,” said Garvey. “Perhaps one of the most interesting developments over the coming years will be the extent that China’s leading platforms can export their alternative finance models to the wider Asia Pacific region – a trend that is really yet to emerge.”

Professor Edward Buckingham, Executive Director of the Australian Centre for Financial Studies, added that Fintech enabled financial services has triggered diverse policy and entrepreneurial responses that are shaping the future of finance;

Professor Edward Buckingham, Executive Director of the Australian Centre for Financial Studies, added that Fintech enabled financial services has triggered diverse policy and entrepreneurial responses that are shaping the future of finance;

“The many emergent forms of alternative finance will profoundly shape our economies for decades to come. They promise to challenge the regulatory environment, test political will, and challenge our ability to embrace change.”

The report includes country specific synopses providing an interesting and contrasting view to market idiosyncrasies. This is a must read document for all policymakers and alternative finance industry participants.

[clickToTweet tweet=”This is a must read document for all policymakers and alternative finance industry participants #AsiaPac #AltFi” quote=”This is a must read document for all policymakers and alternative finance industry participants #AsiaPac #AltFi”]

The Benchmarking Report may be downloaded here.