The European P2P platform specializing in short-term investments and founded and owned by entrepreneur Sergey Sedov, Robo.cash marked the start of the Q4 2017 with a record growth of its investors’ number by having attracted 32% more the average figure and came closer to hitting the milestone of € 100.000 earned by customers since the start of the platform.

“The P2P lending market is undergoing significant changes at the time and there are many issues are yet to be solved. Being relatively quite a young market but demonstrating such an intensive dynamic on a global scale, it has lots of questions to be answered in the coming couple of years. Among them is how the market will be regulated within a single country or the European Union? Who knows exactly how the Brexit will affect the global market and what new centers will it highlight? How will the related financial markets contribute to the P2P lending? However, it does not really matter how things might go, innovations will definitely continue setting the pace and demanding you to keep up with the times,” commented Robo.cash Founder and CEO Sergey Sedov via email. “It is great that Robo.cash has already become a part of that story. We continue studying the market and noticing the growing demand on the fully automated investment process, which provides an investor with an opportunity to freely manage the time and money. This trend is greatly proved by Robo.cash dynamics in the number of investors keeping pace and their income gained. I believe, that the last here is the most indicative and significant figure that directly reflects the performance of the platform. At the moment, Robo.cash is focused on the even better quality of its work and the steadily growing figures are the evidence that we follow the right way.”

“The P2P lending market is undergoing significant changes at the time and there are many issues are yet to be solved. Being relatively quite a young market but demonstrating such an intensive dynamic on a global scale, it has lots of questions to be answered in the coming couple of years. Among them is how the market will be regulated within a single country or the European Union? Who knows exactly how the Brexit will affect the global market and what new centers will it highlight? How will the related financial markets contribute to the P2P lending? However, it does not really matter how things might go, innovations will definitely continue setting the pace and demanding you to keep up with the times,” commented Robo.cash Founder and CEO Sergey Sedov via email. “It is great that Robo.cash has already become a part of that story. We continue studying the market and noticing the growing demand on the fully automated investment process, which provides an investor with an opportunity to freely manage the time and money. This trend is greatly proved by Robo.cash dynamics in the number of investors keeping pace and their income gained. I believe, that the last here is the most indicative and significant figure that directly reflects the performance of the platform. At the moment, Robo.cash is focused on the even better quality of its work and the steadily growing figures are the evidence that we follow the right way.”

Taking into account that 150 new investors on average join Robo.cash monthly, the October’s figure is 32% higher the average and comprised 198 customers that is 10 points more the previous record made by the platform in August 2017. By the moment, there are 1,268 registered investors.

Taking into account that 150 new investors on average join Robo.cash monthly, the October’s figure is 32% higher the average and comprised 198 customers that is 10 points more the previous record made by the platform in August 2017. By the moment, there are 1,268 registered investors.

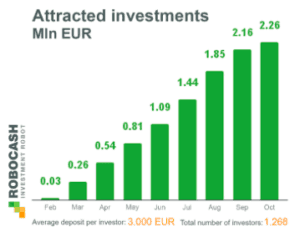

The sum of attracted amounts reportedly continues growing too. According to Robo.cash, there has been a 5% increase in comparison to the previous month and more than €2.26 million attracted in total. Overall, investors funded more than 181,000 short-term loans issued in Spain and Kazakhstan, with an average loan size of €81.

[clickToTweet tweet=”.@Robocash1 gains ground in Q4 2017 #p2plending @fintechinsider_” quote=”Robo.cash posts positive beginning for Q4 2017″]

The income gained by investors came closer to hitting the first €100,000 Euro milestone. According to the performance results, Robo.cash customers earned €23,500 in October that is 11.3% higher than in September, with investors of the P2P platform posting more than €96,000 in profits since its February 2017 launch.

In October the automated P2P lending platform reported steady growth during 2017 Q2, noting that its total amount of investments exceeded €1.8 million.