Crowdfund Insider has been writing about big tech getting into banking and other financial services for a long time now. The disruption taking place within the financial services industry is profound and traditional finance is struggling to keep up with the revolutionary change. While many early Fintech entrants have sliced away portions of old banking business, in many respects big tech is better positioned to completely reimagine the future of financial services. In China, big tech like Tencent and Alibaba have already trail-blazed this path. In the US, things have moved more slowly for multiple reasons, mainly the byzantine regulatory environment.

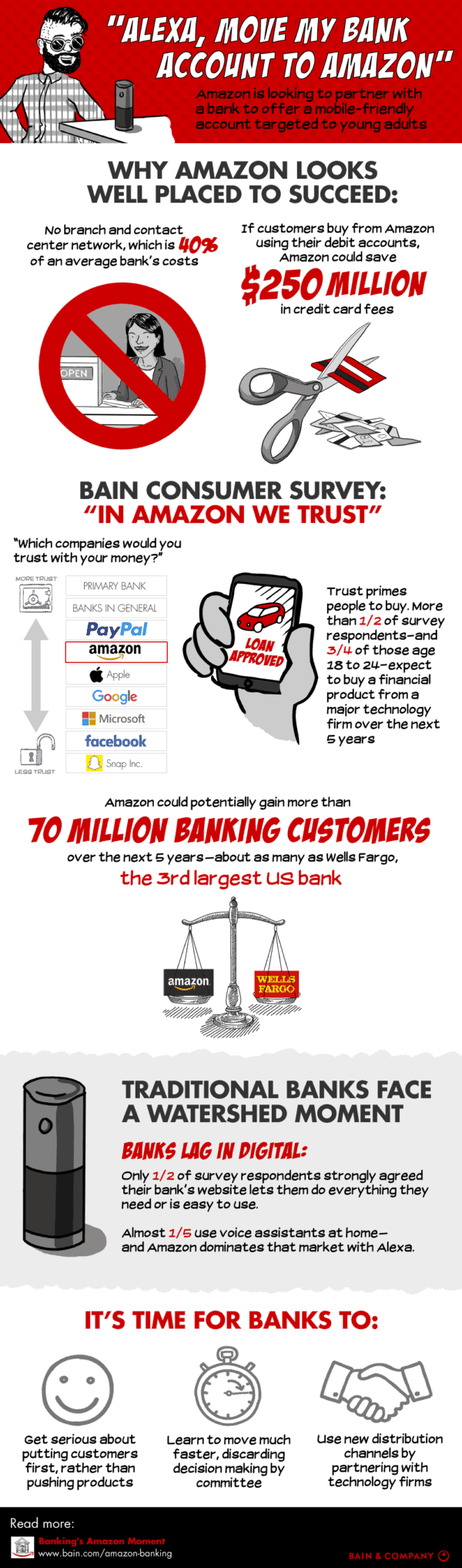

This past week, the consulting group of Bain and Company, put their spin to the thesis of big tech getting into banking by reviewing the possibility of the Bank of Amazon. In their estimation, “Amazon stands a very good chance of succeeding in banking by disrupting the industry as it has in retailing.” So big banks look out. Your are not going to be Uberized but Amazoned. The footsteps are approaching.

Bain consultants Gerard du Toit and Aaron Cheris believe that Amazon (NASDAQ:AMZN) is the best positioned tech company to succeed in the highly regulated world of banking. And why is that? For many reasons, including:

Bain consultants Gerard du Toit and Aaron Cheris believe that Amazon (NASDAQ:AMZN) is the best positioned tech company to succeed in the highly regulated world of banking. And why is that? For many reasons, including:

- Amazon has earned the trust of consumers. Banks are pretty much despised

- Their customer base is enormous. Everyone shops at Amazon providing a powerful connection to users

- Amazon is known for its customer service excellence. Traditional banks, well, not so much

- When it comes to digital acumen and foresight, Amazon is unparalleled

- Amazon is already a huge online lender providing access to credit to the legions of merchants that leverage their global platform

- Amazon is digitally native. Their applications on smartphones, laptops and iPads are awesome. Traditional banks fall far short in this category

- Innovation thrives at Amazon. Big banks are where risk taking and change goes to die.

- You will be able to manage your banking needs by chatting up Alexa. With traditional banks, you still need to queue up and wait for a disinterested teller

Traditional banks are saddled with a legacy of expensive branches, a tech stack that causes panic attacks within IT departments, and a decision making process designed to crush innovation in its tracks. Amazon just gets things done. Look at the recent acquisition of Whole Foods. Amazon has now become a Kroger killer.

[clickToTweet tweet=”Traditional banks are saddled with a legacy of expensive branches, a tech stack that causes panic attacks within IT departments, and a decision making process designed to crush innovation in its tracks #Fintech” quote=”Traditional banks are saddled with a legacy of expensive branches, a tech stack that causes panic attacks within IT departments, and a decision making process designed to crush innovation in its tracks #Fintech”]

The Bain consultants believe Amazon is more inclined to partner with existing banks and they reference ongoing discussions with JPMorgan Chase. Bain believes this is the preferred path but this is where this writer believes they are wrong. Similar to Goldman Sachs, and their successful launch on online lender Marcus, Amazon will inevitably go it alone. Old banks are the old ball and chain and Blockchain free. Why anchor yourself to a business that is struggling to adapt? Amazon would be better off becoming a  digital only challenger bank or acquiring one that is already in operation. There are plenty of digital banks in Europe that have aspirations to cross the Atlantic.

digital only challenger bank or acquiring one that is already in operation. There are plenty of digital banks in Europe that have aspirations to cross the Atlantic.

Will banks fight back? Of course they will. Banks are already doing this with their lobbyist minions. These legislative foot soldiers are already spreading FUD on Capitol Hill duping unsuspecting legislative aides about how the sky will fall, and cats will sleep with dogs, if big tech gets into banking. And who wins if Amazon (and other big tech like Apple, PayPal and Google) provides the panoply of banking services? Consumers, of course, and the many under-banked and small business that would benefit from better financial services at a lower cost. Who loses if old banks stop, or delay, the shift to digital banks by leveraging their lobbying prowess? We all do. The Bank of Amazon is just gonna happen.

See the infographic created by Bain embedded below.