Rise of the CBDC Coin? Perhaps.

The Bank for International Settlements have added their $0.02 to the discussion in a recently published paper from the Committee on Payments and Market Infrustructure, Markets Committee. The report entitled Central Bank Digital Currencies (or CDBCs) is the work of Klaus Löber of the European Central Bank, and Aerdt Houben of the Netherlands Bank.

Britcoin

Several central banks have hypothesized about the potential for central banks to issue their very own cryptocurrency. Most prominently, perhaps, is the Bank of England that published a paper some time ago reviewing this very possibility. In a recent speech by Bank of England Governor Mark Carney, he lambasted existing cryptocurrencies such as Bitcoin as failing as a medium of transaction. Simultaneously, he stated there is an active research program ongoing at the Bank regarding a CBDC and he is of the opinion this could be “truly transformative.”

The paper from the Bank of International Settlements is a bit more sober in its assessment.

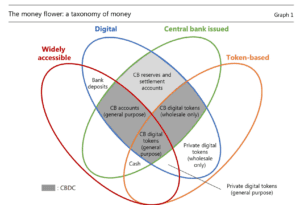

Organizing the discussion around three central themes; payments, monetary policy implementation and financial stability, the paper then picks apart the thesis regarding the creation of a CBDC.

Organizing the discussion around three central themes; payments, monetary policy implementation and financial stability, the paper then picks apart the thesis regarding the creation of a CBDC.

The authors question if a future central cryptocurrency is truly much of an improvement over what already exists.

Basic mechanics of monetary policy would most likely remain consistent. Payments may find a speedier settlement process with a CBDC but faster alternatives are already in the offing. And what about the commercial banks? If traditional banks and the hub and spoke association between public and private may be disrupted. Do consumers really need to hold deposits at the corner bank? Why not just hold it at the central bank? And what about privacy for consumers and businesses. Do we really want the big brother bank knowing how you spent your last crypto-dollar?

The authors state:

“Any steps towards the possible launch of a CBDC should be subject to careful and thorough consideration. Further research on the possible effects on interest rates, the structure of intermediation, financial stability and financial supervision is warranted. The effects on movements in exchange rates and other asset prices remain largely unknown and also deserve further exploration.”

In brief, the paper believes that now is the time for monitoring and reflection on digital innovations. While the current round of digital currencies are considered “inadequate” engagement with the new technology is the advised approach.

In brief, the paper believes that now is the time for monitoring and reflection on digital innovations. While the current round of digital currencies are considered “inadequate” engagement with the new technology is the advised approach.

More generally, central banks and other authorities should continue their broad monitoring of digital innovations, keep reviewing how their own operations could be affected and continue to engage with each other closely. This includes monitoring the emergence of private digital tokens that are neither the liability of any individual or institution nor backed by any authority. At this time, the general judgment is that their volatile valuations, and inadequate investor and consumer protection, make them unsafe to rely on as a common means of payment, a stable store of value or a unit of account.

“Going forward, technology will likely offer even more opportunities to enhance convenience, increase safety, lower overall costs and further improve resilience.”

The paper is embedded below.