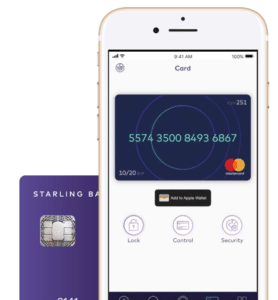

Starling Bank, after recently being voted the Best British Bank, has reportedly become the first fully licensed mobile-only bank to launch business accounts for small businesses and entrepreneurs in the UK. Starling’s app aims to allow small business owners to open an account in less than 10 minutes, directly from their smart phones. Starling emphasized that there are no fees for having an account, no fees for making a payment to another bank account, and no fees for withdrawing cash.

“In a market with almost no meaningful competition, entrepreneurs and small business owners have for too long been marginalised and taken advantage of by big banks. Having spent the past year building an award winning bank and personal current account, today we’re happy to announce that we’re launching a business account which offers all of the same great features and more to small businesses and entrepreneurs,” stated Starling Bank CEO Anne Boden. “Starling’s mobile-only business banking solution is free, uncomplicated and quick, taking the effort out of banking so our customers can spend more time growing their business, and less with their bank.”

“In a market with almost no meaningful competition, entrepreneurs and small business owners have for too long been marginalised and taken advantage of by big banks. Having spent the past year building an award winning bank and personal current account, today we’re happy to announce that we’re launching a business account which offers all of the same great features and more to small businesses and entrepreneurs,” stated Starling Bank CEO Anne Boden. “Starling’s mobile-only business banking solution is free, uncomplicated and quick, taking the effort out of banking so our customers can spend more time growing their business, and less with their bank.”

Starling said that its business customers will be able to manage their business bank accounts entirely from the mobile and make payments to suppliers from the app (including international payments), see monthly categorized breakdown of transactions and export transactions directly to their accounting software. They’ll also be able to set aside money for purposes such as tax using its Goals feature. Lastly, Starling users will also receive an instant notification any time they receive money into their accounts.

[clickToTweet tweet=”.@StarlingBank CEO @AnneBoden: ‘In a market with almost no meaningful competition, entrepreneurs and small business owners have for too long been marginalised and taken advantage of by big banks.’ #MakeMoneyEqual ” quote=”@StarlingBank CEO @AnneBoden: ‘In a market with almost no meaningful competition, entrepreneurs and small business owners have for too long been marginalised and taken advantage of by big banks.’ #MakeMoneyEqual “]

Aiming to offer its business customers seamless access to chosen partners, including accounting and invoicing platforms, via its in-app Marketplace, Starling also recently also announced its intention to launch a merchant acquiring solution which will allow businesses to accept card payments directly into their Starling accounts, further enhancing the selection of services available to businesses. Other upcoming new features include making cash deposits at the Post Office.

Aiming to offer its business customers seamless access to chosen partners, including accounting and invoicing platforms, via its in-app Marketplace, Starling also recently also announced its intention to launch a merchant acquiring solution which will allow businesses to accept card payments directly into their Starling accounts, further enhancing the selection of services available to businesses. Other upcoming new features include making cash deposits at the Post Office.

Friends still owe you money? It may be time to check out Settle Up, a new Starling feature that allows users to request money from any of friends, regardless of whether they have a Starling account or not, by sending them a personal Settle Up link:

“If they are not a Starling customers (yet) or aren’t on their mobiles, the link will open our Settle Up website in the browser,” blogged Starling Javascript Developer Stephan Blakeslee. “So wherever they are, your friends can pay you back seamlessly on any platform or device – whether they’re a Starling customer or not… Chasing money, misplacing account details, chasing again; it’s fair to say that paying back friends and family can be a bit of a minefield. We built our new feature Settle Up to make it a little more straightforward – and a whole lot quicker.”

“If they are not a Starling customers (yet) or aren’t on their mobiles, the link will open our Settle Up website in the browser,” blogged Starling Javascript Developer Stephan Blakeslee. “So wherever they are, your friends can pay you back seamlessly on any platform or device – whether they’re a Starling customer or not… Chasing money, misplacing account details, chasing again; it’s fair to say that paying back friends and family can be a bit of a minefield. We built our new feature Settle Up to make it a little more straightforward – and a whole lot quicker.”

Earlier this month TrueLayer, a computer software company that enables companies to capitalize on new open banking initiatives in the UK, integrated with mobile-only Starling Bank in order to securely access financial data while businesses that use its products can request to access to account data held by Starling Bank through a secure API. Starling Bank’s customers may also share their data and TrueLayer’s personalized fintech products.