To considerable fanfare, Ethereum inventor Vitalik Buterin proposed a new type of “Decentralized Autonomous” Initial Coin Offering at ethresear.ch on January 5, 2018, a model that would allow investors to vote for the incremental release or refund of investor capital.

To considerable fanfare, Ethereum inventor Vitalik Buterin proposed a new type of “Decentralized Autonomous” Initial Coin Offering at ethresear.ch on January 5, 2018, a model that would allow investors to vote for the incremental release or refund of investor capital.

Although the proposal was received as very promising by serious participants in the crypto space, few DAICOs have since been announced and no projects are known to have modified their existing model at this time.

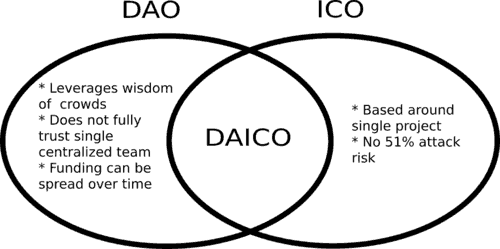

Many remember the notorious DAO (Decentralized Autonomous Organization) hack in which hackers made off with millions of dollars of Ethereum pooled at the DAO community platform for vote-based funding of commercial and non-profit Ethereum ventures. The robbery of the “stateless” fund left many questions as to how the hack might be prosecuted and led to the forking of Ethereum into “Classic” and “Legacy” versions.

Though many in the mainstream interpret the hack as an indication of the inevitable weakness of cryptocurrency systems, especially that of Ethereum, to crypto enthusiasts the DAO hack is largely seen as a necessary incident in the cryptosphere’s maturation process, and the DAICO a sign of further maturity

According to Buterin’s proposal at Ethresear.ch:

“A DAICO contract is published by a single development team that wishes to raise funds for a project. The DAICO contract starts off in “contribution mode”, specifying a mechanism by which anyone can contribute ETH to the contract and get tokens in exchange. This could be a capped sale, an uncapped sale, a dutch auction, an interactive coin offering, a KYC’d sale with dynamic per-person caps, or whatever other mechanism the team chooses. Once the contribution period ends, the ability to contribute ETH stops, and the initial token balances are set; from there on the tokens can become tradeable.

After the contribution period, the contract has one major state variable: tap (units: wei / sec), initialized to zero. The tap determines the amount per second that the development team can take out of the contract.”

The announcement provoked enthused discussion on the March 28th edition of the crypto podcast, “Buy or Sell? What the Hell.”

In it, veteran mainstream-turned-crypto trader Jason Jenkins stated that he believes recent crypto market downtowns will be relieved when much discussed regulations go into effect.

“The narrative that’s taking us down is gonna take us to new highs.”

Co-host (and Chief Technical Officer of the Rhythm Network) Chinmay Patel cited his research conducted at Token Listings that indicates 46% of ICOs have already failed and at least 130 more have gone completely dark online, “…due to no accountability.”

[clickToTweet tweet=”46% of #ICOs have already failed and at least 130 more have gone completely dark online #Cryptocurrency” quote=”46% of #ICOs have already failed and at least 130 more have gone completely dark online #Cryptocurrency”]

In the DAICO system, human “Oracles” would track a blockchain project’s progress and provide information to an investor network making majority rules-based decisions on whether to release more funds or possibly vote for a contract’s “self-destruction” (complete refund of contributed funds).

In the DAICO system, human “Oracles” would track a blockchain project’s progress and provide information to an investor network making majority rules-based decisions on whether to release more funds or possibly vote for a contract’s “self-destruction” (complete refund of contributed funds).

Jenkins saw the potential for issues if investors, “yank the rug out” unfairly or at inopportune times, but he also saw benefits for getting projects funded faster.

“A company considering putting in $10 million could start with $2 (million) instead of sitting around evaluating a project for three months.”

Details would also have to be worked out around the staking of tokens required to stabilize certain networks and the effect large scale exits might produce.

All the hosts agreed that they had never seen workable exit models in ICOs.

“Does the acquiring company get to kill the token and release another token or get two tokens going simultaneously or absorb the product?” asked Jenkins.

Another host noted that by combining a ‘softer’ corporate structure with “the hardness of the blockchain,” the DAICO could be a successful modernization of the board-governed corporate structure seen by some as responsible for much industrial growth in the 20th century.

Another host noted that by combining a ‘softer’ corporate structure with “the hardness of the blockchain,” the DAICO could be a successful modernization of the board-governed corporate structure seen by some as responsible for much industrial growth in the 20th century.

But so far, only three DAICOs can be easily unearthed in a simple Internet search.

One is The Abyss Platform, “a crypto-reward system for gamers and developers…delivering all types of video games…in a groundbreaking motivational and multilevel referral system, allowing gamers (and developers) to earn (tokens) from in-game and social activities.”

The other two DAICO projects are YouToken: “We take people’s creative ideas and commitments and convert them into tokens,” and Ethearnal, “a peer-to-peer freelance system in which employers and freelancers meet (and) enter into trustless smart contracts with reputation and money in escrow.”

Because industry self-regulating DAICOs grant investors voting rights absent in ICOs, Jenkins believes,

“It’s a pretty good correction -not an overcorrection- from what was happening at the end of 2017.”