Fea, UK-based fintech that offers a mobile-first, fixed fee credit card, is now seeking £100,000 through its equity crowdfunding campaign on Crowdcube. The startup reported that it is on a mission to make borrowing “a better experience.” The company’s idea comes from its founder Faisal Khalid’s personal experiences, with $130,000 of student and credit card debt. The team came together over the summer of 2018.

“Credit cards represent a large and profitable business in the UK; we estimate £7bn in annual revenues, and growing – last year credit card balances grew by 9%+. At present, almost all incumbents are banks, and the largest players – BarclayCard and Lloyds – together account for 50%+ market share. We are coming in as a technology-first player, targeted at millennials, with a proposition around simpler pricing, better borrowing controls, user experience, and higher availability.”

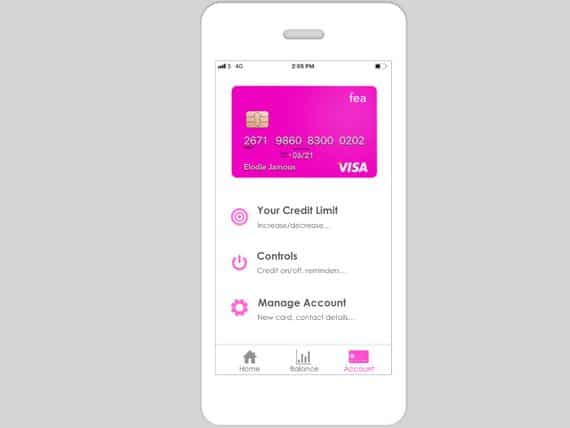

The company reported it is aiming to generate income by charging a fixed fee from consumers, which is £2 in fee for every £100 that each consumer borrows. Funds raised through the Crowdcube round will be used to build Fea’s mobile app, which will initially be for iOS, as well as hire part of the launch team and apply to the FCA for authorization. The company noted it aims to launch prepaid card first, in April 2019, and follow up with credit card in September/October 2019, subject to FCA approval.

Since launching, the crowdfunding campaign has successfully raised more than £75,000 from nearly 120 investors. It is set to close at the end of November.

Have a crowdfunding offering you'd like to share? Submit an offering for consideration using our Submit a Tip form and we may share it on our site!