SEC Regulation A (commonly referred to as Regulation A+) was implemented by the SEC in 2015 pursuant to major Congressional legislation, the Jumpstart Our Business Startups Act of 2012 (the JOBS Act). It allows companies to raise up to $50 million in a 12 month period from both accredited and non-accredited investors – and broadly solicit and advertise the offering – without engaging in a fully SEC-registered IPO, and without the same burdensome level of ongoing disclosure to investors.

You will, however, have to prepare a fairly detailed disclosure document, including audited financial statements, and have it reviewed and “qualified” by the SEC before you can accept investor subscriptions. The review process can generally be completed in a two-month time frame if you engage qualified securities counsel and auditors to guide you through the process.

Then Comes the Hard Part – Selling the Securities

Though the market has seen a dozen or so Regulation A+ offerings underwritten by brokers on a “best efforts” basis, many companies choose to go it alone – in what is commonly referred to as a self-underwritten offering. This may or may not be advisable, depending upon your business model and the strength and depth of your network.

Though the market has seen a dozen or so Regulation A+ offerings underwritten by brokers on a “best efforts” basis, many companies choose to go it alone – in what is commonly referred to as a self-underwritten offering. This may or may not be advisable, depending upon your business model and the strength and depth of your network.

But the marketing of securities comes with its own rules – and its own risks. If you don’t follow these rules, meticulously, your company as well as the persons that control it, may find themselves personally responsible to return investor money. Worse yet, you may find yourself entangled with securities regulators, including the Enforcement Division of the SEC.

Some of these rules are nothing more than common sense: make sure your statements of fact are truthful and contain no material omissions.

There are expensive, and unnecessary, consequences of a poorly constructed marketing campaign. They are entirely avoidable if you take the time to have your securities counsel review all marketing materials before they go out the door. No point in raising money if you can’t keep it – or worse yet – have it siphoned off through unnecessary legal bills fighting disgruntled investors or securities regulators.

The XY Network Regulation A+ Offering – a Teachable Moment

Back in August 2018, when surfing the internet, I came across an advertisement for the XY Network Regulation A+ offering. It wasn’t too hard to find. In fact, it seemed impossible to avoid. It seemed that wherever I went on the Web I was followed by a Google Ad Sense ad for the offering. It was attractive “click bait” to be sure:

“11,000% BIGGER THAN BTC? -Meet the company taking on an $11.2 trillion market. Don’t miss this one”

My curiosity got the better of me. So, yes, I clicked on the ad – where I was whisked to a site with what appeared to be a third party article dated July 7, 2018, authored by a Marg Teixeira, touting the company and its offering. The article, on website www.decentric.org (now defunct), stated as follows:

“OK, so we’re admittedly biased with this one because a core group of our team is behind XYO. But we’re not excited about XYO for that reason alone. Actually, some of technology’s most influential names are more excited about XYO than we are!”

The company testimonial was replete with a celebrity endorsement by Charlie Shrem: “Charlie Shrem, tech pioneer and founder of one of its most respected foundations, just recently joined XYO Network.”

The article also created a sense of urgency for this investment opportunity:

“At the time of this writing, XY is currently offering a SEC Qualified Reg A+ Securities Offering. However, there’s a limit to the amount they’re able to sell — and that’s $50 Million.

Once this amount of XY Equity is sold out, you won’t be able to purchase from the team directly ever again.

To discover if it’s still available to purchase, simply click here to head over to the official website.

We recommend purchasing from the team directly for one major reason…

When you purchase XY Equity from the official website, 100% of the funds go directly towards developing the XYO Team and Technology.

Alternatively, if you were to purchase through a third-party, your money just goes to flippers, traders and speculators. And there’s a possibility it might not even be the real thing!”

So I clicked on the link to head over to the “official website.” Along with a glowing (as in red hot) sales pitch, I was informed that I had less than 42 minutes to make an investment decision – or risk losing the opportunity of a lifetime. So I clicked again – on the link to go directly to the company’s “investment” site.

So I clicked on the link to head over to the “official website.” Along with a glowing (as in red hot) sales pitch, I was informed that I had less than 42 minutes to make an investment decision – or risk losing the opportunity of a lifetime. So I clicked again – on the link to go directly to the company’s “investment” site.

Upon landing on the company’s investment page I was informed that I now had only eight minutes to make an investment decision – else risk losing the investment opportunity of a lifetime. My securities lawyer training had me immediately searching for the Regulation A+ Offering Circular, that SEC reviewed disclosure document. After scrolling down to the bottom of a very long page I finally found the link – which took me to a page of eight or so SEC filings by XY. Meanwhile, I was bombarded by pop ups, appearing three or four times a minute, letting me know who (with first name and last name initials) was investing, how much and where they lived – by city and state.

The eight-minute clock was ticking down. I took a pass on this one, but not before doing my own due diligence.

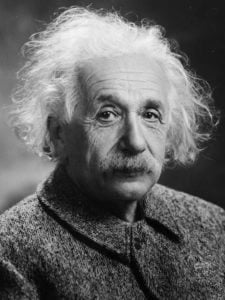

Q. Who was Charlie Shrem, tech pioneer?

I couldn’t locate any information about him in the company’s Offering Circular. Turns out he is a big name in bitcoin He launched BitInstant, at one point processing $1 million per day in bitcoin transactions, attracting investors such as the Winklevoss twins along the way – until he attracted unwanted attention from federal regulators – by facilitating bitcoin transactions for a website on the dark web, Silk Road, which reportedly trafficked in illegal narcotics.

According to a press release issued by Preet Bharara, the U.S. Attorney for the Southern District of NY, in connection with a felony guilty plea: “Charlie Shrem opted to travel down a crooked path – running an illegal money transmitting business that catered to criminals bent on trafficking narcotics on the dark web drug site, Silk Road.”

Mr. Shrem reportedly went on to serve a 14-month sentence in a federal penitentiary. According to published reports, he surrendered himself to authorities on March 30, 2015, and subsequently entered Lewisburg Federal Prison Camp in Pennsylvania until he was released from prison in June 2016.

Most recently, Mr. Shrem found himself the subject of a lawsuit by his marquis investors, the Winklevoss twins, alleging he owes them millions of dollars in connection with their Bitinstant investment.

Buying Shares Direct from XY? Not Necessarily!

According to the July 2018 pitch article:

When you purchase XY Equity from the official website, 100% of the funds go directly towards developing the XYO Team and Technology.

Alternatively, if you were to purchase through a third-party, your money just goes to flippers, traders and speculators. And there’s a possibility it might not even be the real thing!

However, the Offering Circular tells an entirely different tale. In fact, 100% of the funds do not go directly to the company. You see, according to the Offering Circular, 11% of the shares being offered are shares owned by founder, CEO, CFO and principal shareholder, Arie Trouw. This is not a small chunk of change. If the $50 million offering is fully subscribed Mr. Trouw would clear more than $5 million for his personal account. Not a bad haul for a company founder, CEO and CFO.

And though the July 2018 article warns against purchasing shares “through a third party,” according to the first page of the Offering Circular there is no secondary market for these securities. So yes, it may be possible to purchase shares from a third party outside this offering, but this would not be a likely scenario for a member of the general public.

A Virtual Boiler Room?

The general public is now very familiar with traditional broker boiler room type operations, with glowing testimonials, high-pressure sales tactics and misleading information. The XY Company appeared to replicate this high pressure, boiler room atmosphere with its “countdown clocks,” and only a limited time to read the company’s mandatory SEC disclosures – well under an hour to go through a nearly 40 page single spaced offering document. Not nearly enough time to read and digest these disclosures for the average investor, in my opinion, let alone ask questions of the company’s management.

And while the company is advising that both time and share quantities are limited, a reader is bombarded with popup messages three or four times per minute indicating that buyers are out there snapping up shares.

One of the disclosures you might have missed if you rushed to get in on the next big thing before carefully reading the Offering Circular is the massive dilution resulting from more than 20 million options issued to insiders and consultants in March 2018 at $1.00 per share, well below the offering price set on March 19, 2018 of $8.00 per share – a hefty bump in share price from the $1.00 offering price set in 2016. Nor was this a trivial issuance of options, as the Offering Circular indicates that approximately 32 million common shares were outstanding in March 2018, before the offering of more than 7 million new company shares in the Regulation A+ offering.

Another disclosure you might have missed if you rushed to get in on this opportunity is learning that more than $13 million of the reported $15 million in revenues for the first six months of 2018 were derived from the proceeds of yet another offering, an ICO for the company’s XYO tokens. Digging deeper, there appear to have been storm clouds brewing over this ICO.

If you bothered to read Note 2 to the company’s financial statements in its June 2018 semi-annual report filed with the SEC in September 2018, you would have been informed of the following:

“On May 24, 2018, the Company issued a rescission offer to customers who purchased XYO Tokens from the Company (the “Rescission Offer”). Pursuant to the Rescission Offer, the Company offered to repurchase XYO Tokens that may not have been properly registered under the Securities Act of 1933, as amended, or issued pursuant to an exemption thereunder, at the price originally paid for the XYO Tokens plus interest, if applicable.

As of June 23, 2018, the expiration date of the Rescission Offer, the Company paid a total of $731,504.98 to 94 XYO Token purchasers for the repurchase of XYO Tokens, this amount is considered a reduction in the transaction price and has been reflected accordingly in our financial statements.”

So what about the investors who purchased the remaining $12 million of tokens not yet rescinded? The answer to this question is nowhere to be found in either the Offering Circular or the subsequent semi-annual SEC report. This might be considered as a “contingent liability” of the company. Yet no guidance from the company on this loose end. This is certainly a question I would think that a prospective investor would want answered by the company before making an investment.

Fast Forward to November 2018

Well, it seems that someone decided to modify this marketing approach in the past few weeks. Gone is the countdown clock; gone is the third party statement that 100% of the offering proceeds go to the company. But the Google Ad Sense ads continue, together with the sales pitch creating an unmistakable sense of urgency.

Some Parting Thoughts

It is not clear if the glowing third-party July 2018 article was authored or approved by the company. If it was, the company will have some explaining to do to investors who relied upon this article, not to mention regulators who become aware of this very public marketing campaign. Even if the author of the July 2018 article is not an “offering participant,” from the SEC’s point of view this information would be attributable to the issuer if it were involved in the article’s preparation or expressly or implicitly endorsed or approved the information. Seems to me that based upon the number of Google Ad Sense ads promoting this article, it is a good bet that the company’s marketing money was behind this ad.

It is not clear if the glowing third-party July 2018 article was authored or approved by the company. If it was, the company will have some explaining to do to investors who relied upon this article, not to mention regulators who become aware of this very public marketing campaign. Even if the author of the July 2018 article is not an “offering participant,” from the SEC’s point of view this information would be attributable to the issuer if it were involved in the article’s preparation or expressly or implicitly endorsed or approved the information. Seems to me that based upon the number of Google Ad Sense ads promoting this article, it is a good bet that the company’s marketing money was behind this ad.

Regardless, the “countdown clock” on what was represented as an official company offering site is the wrong foot for an issuer to start off on. Not only will it likely garner regulatory attention, but it will be front and center in any investor lawsuit seeking rescission of their investment. If an issuer encourages an investor to “act in haste,” as the proverb goes, it may find itself repenting in leisure.

So a word to the wise – especially for issuers who go it alone without a broker-dealer in their Regulation A+ offering. Be sure to have all of your offering marketing materials vetted by securities counsel before they hit the light of day – especially after investing countless hours and dollars to “qualify” your offering with the SEC.

Samuel S. Guzik, a Senior Contributor to Crowdfund Insider, is a corporate and securities attorney and business advisor with the law firm of Guzik & Associates, with more than 30 years of experience in private practice. Guzik is also former President and Board Chair of the Crowdfunding Professional Association (CfPA) and CfPA Legislative & Regulatory Special Counsel. A nationally recognized authority on the JOBS Act, including Regulation D private placements, investment crowdfunding and Regulation A+, he is and an advisor to legislators, researchers and private businesses, including crowdfunding issuers, service providers and platforms, on matters relating to the JOBS Act. As an advocate for small and medium-sized business, he has engaged with major stakeholders in the ongoing post-JOBS Act reform, including legislators, industry advocates and federal and state securities regulators. His articles on JOBS Act issues, including two published in the Harvard Law School Forum on Corporate Governance and Financial Regulation, have also served as a basis for post-JOBS Act proposed legislation.

Samuel S. Guzik, a Senior Contributor to Crowdfund Insider, is a corporate and securities attorney and business advisor with the law firm of Guzik & Associates, with more than 30 years of experience in private practice. Guzik is also former President and Board Chair of the Crowdfunding Professional Association (CfPA) and CfPA Legislative & Regulatory Special Counsel. A nationally recognized authority on the JOBS Act, including Regulation D private placements, investment crowdfunding and Regulation A+, he is and an advisor to legislators, researchers and private businesses, including crowdfunding issuers, service providers and platforms, on matters relating to the JOBS Act. As an advocate for small and medium-sized business, he has engaged with major stakeholders in the ongoing post-JOBS Act reform, including legislators, industry advocates and federal and state securities regulators. His articles on JOBS Act issues, including two published in the Harvard Law School Forum on Corporate Governance and Financial Regulation, have also served as a basis for post-JOBS Act proposed legislation.