Baromètre du Crowdfunding en France 2018

Recently the French Crowdfunding Association (Financement Participatif France or FPF) published their annual report on alternative finance in France. The report, produced in partnership with KPMG, is now in its third year and provides an important snapshot of sector growth for online capital formation including both debt and equity-based financing.

At the end of 2018, there were 194 registered platforms in France with the 70 most important being members of FPF.

As Crowdfund Insider reported last year, in 2017 the French Alternative Finance market grew by 50%, driven by SME lending growth, nearing the billion euro mark, at €940 million.

A mid-year report from FPF showed alternative finance jumping 59% during the first 6 months. For all of 2018, the growth continued, albeit at a slower pace, increasing by 39%.

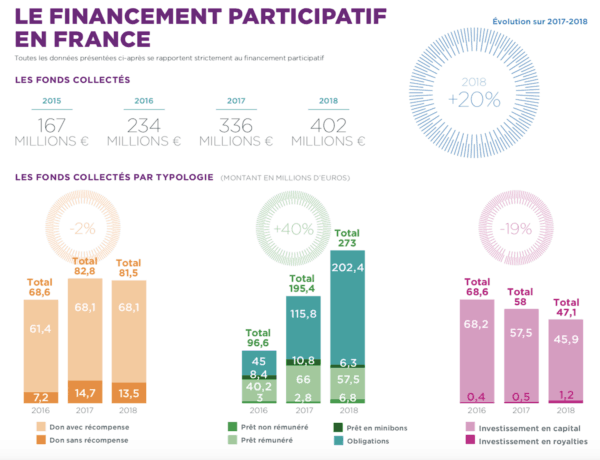

Since 2015, the amounts raised via alternative finance have increased by more than 4X as €297 million was collected in 2015 with €1.4 billion raised in 2018. But this growth was largely driven by debt-based platforms whereas equity crowdfunding has stalled. The FPF report includes both rewards and donation offerings but these subsectors are small and getting smaller.

Debt-based crowdfunding dominates the alternative finance sector in France. This should really not come as a surprise as traditional debt markets are huge. But the growth for debt based platforms has been pronounced jumping from a total of €195.4 million in 2017 to €273 million in 2018.

Equity crowdfunding, on the other hand, has been a bit of a disappointment having declined for three years straight dropping by 19% during the year.

The reports have been widely covered in the French media with write-ups in important publications like Les Echos and Le Monde. France, in many respects, has engendered a robust ecosystem of alternative finance.

The reports have been widely covered in the French media with write-ups in important publications like Les Echos and Le Monde. France, in many respects, has engendered a robust ecosystem of alternative finance.

The publishing of the report was joined by two statements. Stéphanie Savel, President of FPF, said the double-digit growth in crowdfunding is a sign of real market maturity. Savel explained the decline in equity crowdfunding as a “sign of wise behavior” from individuals.

Mikaël Ptachek, Head of Fintech Practice at KPMG, added that alternative finance was picking up momentum and driving real value creation.

“…they bring more innovation and offer new products and business models that individuals and companies are adopting more and more,” said Ptachek. “At the same time, these new entrants allow established players to challenge each other, to better integrate innovation at all levels of their organizations.”

FPF also publishes a separate report that digs a bit deeper into the French alternative finance marketplace.

The FPF states that since the launch of the first platforms in 2008, the development of crowdfunding has established a “sustainable rhythm.” The association points to three essential foundations for the industry:

- Accessibility – All investors may participate

- Transparency – The individual can decide what he wants to invest in with no hidden costs nor conditions.

- Traceability – The investor can follow the progress of the investment.

FPF states that transparency is the “keyword” for platforms. Additionally, the platforms have no interest in financing “canards boiteaux” as only 3% of projects pass by the filters. FPF notes “it is important to understand the reputational risk for large platforms” as they do not want to tarnish their image and desire to preserve confidence in the market.

The FPF has created a charter of conduct for their members which sets a high standard for the French crowdfunding industry. The expectation is for a platform to align its interests with the investor.

Since crowdfunding rules came into force in France, the makeup of industry participants has changed.

Two platforms that were struggling were absorbed by other platforms: Finsquare by October [formerly Lendix] in 2016 and Prêtgo by Happy Capital in May of 2018.

Three platforms have been taken over by larger institutions.

KissKissBankBank and Lendopolis were acquired by Banque Postale 2017. Credit.fr was purchased by Tikehau Capital in June of 2017 and Lumo, a renewable energy platform was purchased by Société Générale in 2018. In January of this year, Credit.fr took over real estate platform Hommunity.

In November of 2018, Unilend – a pioneer in the French crowdfundings sector, liquidated with PretUp taking over their portfolio.

Multiple platforms have pivoted or added/changed the services they provide.

FPF reports that they are currently engaged with two big projects.

- “Blockchain applications in transactions. Experiments are underway with the support of Caisse des Dépôts. There is considerable potential in these technologies for dealing with and securing contracts; and savings in production costs that will facilitate collective mobilization around projects. The blockchain also opens prospects for facilitating a secondary market for crowdfunding. Some applications of artificial intelligence are also being studied in the largest platforms on how to best select project leaders.

2. The pan-European development of participatory finance [crowdfunding]: Few platforms today can work in more than one country at a time. Beyond language barriers, the aim is to promote standardized and safe regulations. The protection of funders, be they lenders, investors or patrons, is one of the essential criteria of FPF in its contributions to reforms. As part of the implementation of a harmonized regulation at the European level, FPF contributes to the work carried out by the European authorities and works in collaboration with the association European Crowdfunding Network [ECN].”

It is always interesting to look into different alternative finance markets to view how platforms, regulations, and ecosystems are evolving. Minus the stagnation of early-stage equity financing, France appears to be on a good track, due in no small part to the FPF as an important advocacy group shepherding the growth of online capital formation.