Recently we marked the second anniversary of the SEC’s issuance of an Investigative Report finding that the DAO Tokens were securities. While this killed the hopes of those who had interpreted SEC silence to mean consent to the unregulated issuance of tokens, it still left a significant amount of uncertainty. With the SEC’s approval of a Reg A+ token offering and its issuance of its second token No-Action Letter, blockchain-based tokens have reached their cat food moment.

What is a “cat food moment”? Clearly, you have not met my father. My Dad tells a very insightful story.

There was once a new cat food. Everyone loved the cat food – the company president, directors, sales, marketing, in short – everyone.

When the product was launched to poor results, it became clear that there was one small, almost insignificant, problem that had been overlooked …. the cats would not eat it. With the SEC having defined several acceptable paths to market, it is now time to find out if there is an appetite for tokens outside of investors buying for purely speculative purposes. In other words, will the cats eat the cat food?

If you have attended any crypto event over the last couple of years, one recurring theme was that the crypto market was primed for takeoff, held-back by “regulatory uncertainty” and by regulators, they meant primarily US regulators.

No Regulation Before its Time

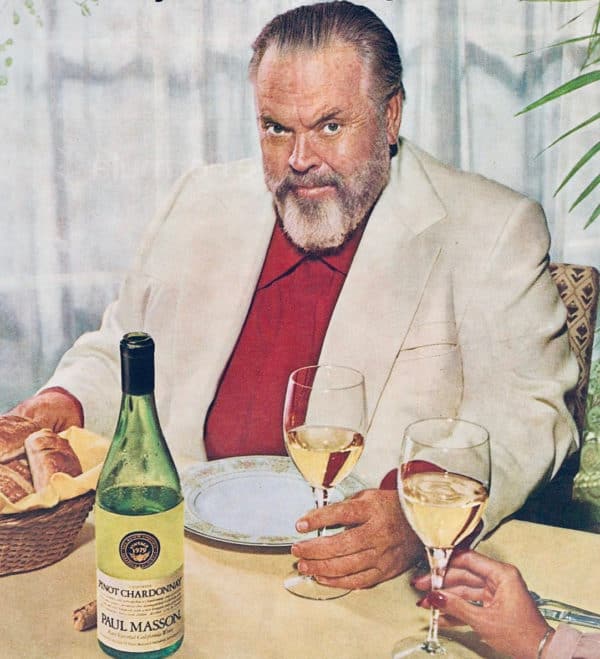

To their credit, US regulators did not take the bait. The SEC adopted the Paul Masson approach to regulation – promulgating no regulation before its time. The SEC actually devoted a lot of time and resources “getting up to speed” on the crypto world. I think they realized that this is still a very early stage technology with rapidly evolving business models. Regulations, once announced, are difficult to rescind or revise – a near-certain occurrence as a nascent technology and related market mature. Rather than promulgate regulations, they adopted a case-by-case approach and used a limited number of enforcement actions, primarily against bad actors, to remind the market as a whole that they were watching.

In the absence of broad SEC guidance, advisers in the space promulgated several waves of purported “solutions” that would allow the issuance of tokens that would not raise the ire of the SEC.

Initially, many took the position that the tokens were “utility tokens” since they had a consumptive use. In a series of statements and actions, the SEC made it clear that even if a token has a utility it still can be, and usually, is, a security.

Next came the SAFT, a convertible instrument that was supposed to birth utility tokens with funds raised in a security offering. Other untested and ultimately invalidated structures, such as airdrops (token giveaways) and dual tokens (a security token and a “perk” utility token) – were also promoted.

Finally, STO’s (security token offerings) became the most recent flavor-du-jour. As SEC enforcement actions and statements increased, the market finally got the message and the volume of token issuances dropped dramatically.

After two years, a great deal of uncertainty still remains. What remains elusive is a clear path to what programmers call a “full-stack solution.” What constitutes a full-stack solution for tokens?

- A token issued in a compliant fashion

- A token that can subsequently trade in a compliant fashion

- A token that works with the issuer’s business model, even with restrictions imposed on the token to meet with criteria #1 and #2.

To illustrate, in an STO the token that is issued is a security. In the US, the issuance is typically done under Reg D of the Securities Act, a private placement exemption limited to accredited investors. Tokens then cannot be traded for a year. Even if the holding period works with the issuer’s business plans, the tokens remain securities and if they are considered “equity,” they are subject to Section 12(g) of the Exchange Act (“equity” for purposes of this Section has been interpreted more broadly than the common understanding of the term).

Section 12(g) requires companies with more than 500 non-accredited investors or 2000 total investors to register with the SEC and become a reporting company (with it comes the expense and reporting burden of being a public company).

In addition, token transfers require the services of a transfer agent. This clearly will not work for many utility use cases which seek to have large numbers of users and no trading friction. So even if an issuer meets criteria #1 and #2, the resulting restrictions may prevent the issuers token from supporting their business model.

Where Does this Leave Us?

Applying two years of SEC actions and commentary, there are appear to me to be four categories for compliant token issuances under US securities laws. The table below names and summarizes critical characteristics. Since three-letter acronyms seem to be mandatory in this space, I have created new acronyms. A few important notes:

1. Categorization of tokens is not a straightforward call and each category comes with significant restrictions. These are not determinations token issuers should be making “at home when mom & dad (a/k/a legal counsel) are not at home.”

2. The table does not include “utility tokens” and “security tokens.” These omissions are intentional. Ironically, the use case of a token arguably is not its most important characteristic for determining its securities status. Contrary to claims made early in the ICO craze, the fact that a token has utility is not by itself enough to take a token outside the ambit of the securities laws. The term “security token” is actually used to refer to at least three different kinds of tokens (securitized assets, digitized equity interests and utility tokens that “failed” the Howey test). Again, the use case is only one of several factors in analyzing these tokens at the point of issuance and in the secondary market.

3. While the categories all focus on issuance, the secondary market introduces an additional layer of regulatory concerns and not every category is suitable for every proposed secondary market.

4. In late 2018, the SEC issued an Order against the Munchee token. While applying the Howey test, Munchee stands out for the emphasis the SEC place on the manner of sale. Although the Munchee facts were fairly egregious, the SEC made it clear that where the token appreciation potential was marketed, it is likely to find a security. In many ways, it supersedes a refined Howey analysis. I believe that this will be the downfall of many issuers in SEC enforcement actions. As was recently the case in the complaint filed by the SEC against the issuers of the Kik token, many issuers are likely to have marketing videos and troves of tweets and emails in which they promote the appreciation potential of their tokens. The manner of promotion can take a token out of one of the neat categories identified below.

5. This article focuses on US securities regulation. In theory, an issuer could avoid US purchasers, but in practice, this is exceedingly difficult to enforce. For a US issuer, this is even harder. Reg S could be used for an offer targeting only non-US purchasers, but in practice, this is also difficult to complete. In addition, regulations vary from country to country, with many having similar degrees of regulatory uncertainty.

6. I have not discussed offerings under Reg CF which allow for raises of up to $1 million, an amount that seems well below the issuer and buyer interest in this space. I have also assumed that a registered offering (an IPO) is not a practical option for any of the issuers.

7. This analysis focuses on the applicable securities regulations enforced by the SEC. These regulations have by themselves proven an insurmountable hurdle to the majority of proposed token issuances. However, clearing this hurdle only leads to more hurdles in the form of other federal regulations and state regulations, not to mention foreign regulations for those selling to global investors.

|

Token Type |

Examples |

Security |

Can Be Used to Sell Tokenized Equity |

Sales to Non-Accredited Investors |

SEC Pre-Approval Required |

| RAT

(Reg A+ Token) |

● Blockstack

● Props Project (or YouNow Inc.) |

√ |

√ |

√ (in some circumstances sale to non-accredited investors may be limited) |

√ |

| NST

(Non-Speculative Token) |

● Pocketful of Quarters |

√ |

Although not required, uncertainty strongly suggest consulting with SEC | ||

| RDT

(Reg D Token) |

TZROP (but see discussion below) |

√ |

√ |

||

| DCT

(Decentralized Token) |

● Bitcoin

● Ether (although maybe not at launch) |

√ |

Although not required, uncertainty strongly suggest consulting with SEC |

Discussion

RATs – As part of the JOBS Act, Regulation A+ was promulgated to promote crowdfunding. There are two tiers that allow annual fundraising of $20 million and $50 million. Issuers need to file a registration statement (form A-1) that is a slimmed-down version of the form used for a conventional IPO (form S-1). To allow for maximum future trading opportunities, the issuer will have to continue semi-annual reporting. Most trading will be on exchanges, making these tokens impractical for utility uses. The SEC has to approve the form A-1 for two issuers. While this process normally takes 3-4 months, the first Reg A+ token approved took almost a year and cost $1.8 million in legal and accounting fees – a figure that is at least 6-7 times the cost of a “conventional” Reg A+ offering.

NST – This is the “Holy Grail” of tokens. A token that can be sold to anyone and is not considered a security. In theory, these can be issued without SEC approval, but do so at your own peril. The SEC recently issued a No-Action Letter with respect to the Pocketful of Quarters (“PoQ”) token. A No-Action Letter is issued by the SEC in response to a request and in the letter, the SEC indicates that subject to compliance with conditions described in the response, the SEC will not take enforcement action against the conduct described in the letter. Formally, it is precedent only for the entity sending the letter, but it gives a detailed view of the SEC’s thinking. I call these tokens Non-Speculative Tokens because the 9 conditions laid out in the PoQ No-Action Letter make it clear that the SEC has a laser-like focus on ensuring that the tokens will be completely unappealing to speculators. The conditions in the letter accomplish these goals by imposing strict limits on the token supply and pricing, the token’s use, transferability and convertibility into fiat. The net result is tokens that are somewhat more flexible versions of frequent flyer miles. Even with all the caveats, it took over a year of discussion with the SEC to get issuance of this letter.

NST – This is the “Holy Grail” of tokens. A token that can be sold to anyone and is not considered a security. In theory, these can be issued without SEC approval, but do so at your own peril. The SEC recently issued a No-Action Letter with respect to the Pocketful of Quarters (“PoQ”) token. A No-Action Letter is issued by the SEC in response to a request and in the letter, the SEC indicates that subject to compliance with conditions described in the response, the SEC will not take enforcement action against the conduct described in the letter. Formally, it is precedent only for the entity sending the letter, but it gives a detailed view of the SEC’s thinking. I call these tokens Non-Speculative Tokens because the 9 conditions laid out in the PoQ No-Action Letter make it clear that the SEC has a laser-like focus on ensuring that the tokens will be completely unappealing to speculators. The conditions in the letter accomplish these goals by imposing strict limits on the token supply and pricing, the token’s use, transferability and convertibility into fiat. The net result is tokens that are somewhat more flexible versions of frequent flyer miles. Even with all the caveats, it took over a year of discussion with the SEC to get issuance of this letter.

RDT – As discussed above, Reg D is an exemption to the registration requirements of the Securities Act. In particular, most coin offerings rely on Section 506(c) which requires sales only to accredited investors. Reg D offerings do not require SEC approval, issuers merely have to file a one-page form after the offering. Other than reviewing the form for completion, the SEC does no review of the offering. Numerous issuers attempted to mislead the public by claiming that the filing of the form constituted approval. That said, it is possible to undertake a token issuance that complies with Reg D. The issue, as highlighted in the STO discussion above, is that the token remains a security and subject to applicable restrictions on trading that are likely inconsistent with many/most business models.

DCT – These are “there are no there, there tokens.” The concept of decentralized tokens was first laid out by William Hinman, Director of the SEC’s Division of Corporation Finance, in a June 2018 speech to a Yahoo Conference (“Digital Asset Transactions: When Howey Met Gary (Plastic)”). The concept was defined in greater detail by the SEC in its “Framework for ‘Investment Contract’ Analysis of Digital Assets” issued in April of 2019. The decentralization analysis focuses on the absence or presence of on  or more “Active Participants” who provide “essential managerial efforts that affect the success of the enterprise, and investors reasonably expect to derive profit from those efforts, then this prong of the test is met.”

or more “Active Participants” who provide “essential managerial efforts that affect the success of the enterprise, and investors reasonably expect to derive profit from those efforts, then this prong of the test is met.”

Bitcoin is considered to be “decentralized” and therefore is not treated as a security. In his 2018 statement, Director Hinman indicates that Ether had become decentralized but provides a strong suggestion that it was not at the time it was issued and, therefore would have been a security. Both Hinman’s statement and the SEC Framework allow for the possibility that a token launched as a security could become a non-security if it became “decentralized.” This is a possible solution to the secondary trading restrictions encountered by RDT’s – they could become DCT’s once “decentralization” has been attained. While the SEC has provided factors to be considered in the decentralization analysis, the guidelines are far from clear and no issuer seeking to launch a DCT or a RDT that would convert into a DCT should do so without in-depth consulting with the SEC.

Back to the Cat Food

If nothing else, the SEC has made it clear that token issuances and their subsequent trading will be the subject of rigorous regulatory scrutiny. Billions of dollars were raised in non-compliant ICO’s. The upside of the lack of regulatory compliance was a frenzy in which issuers and their advisors could make all sorts of outlandish claims.

If nothing else, the SEC has made it clear that token issuances and their subsequent trading will be the subject of rigorous regulatory scrutiny. Billions of dollars were raised in non-compliant ICO’s. The upside of the lack of regulatory compliance was a frenzy in which issuers and their advisors could make all sorts of outlandish claims.

The compliant token models I have described above are much less “sexy.” However, while future SEC guidelines will likely provide more details, the fundamental guard rails are unlikely to change.

Given the current political environment in Washington, legislative action that would dramatically change the rules is unlikely to be passed any time soon. So these are the token types that can actually go to market and with the regulatory uncertainty significantly reduced, it is time to find out if the cats will eat them.

Dror Futter is a partner in the Rimon, PC law firm. Dror’s practice focuses on representing startup companies in their financing and merger and acquisition transactions and their intellectual property, IT and internet agreements. He also advises companies with respect to Initial Coin Offerings and other blockchain legal issues. Dror was the co-founding chair of the PLI VC Law program and hosted their first blockchain legal program. He is a frequent speaker and writer on blockchain legal topics. He is a member of the model forms drafting group of the National Venture Capital Association, the legal advisory board of the Angel Capital Association and the legal working groups of the Wall Street Blockchain Alliance and the Digital Chamber of Commerce. Dror can be reached at dror.futter@rimonlaw.com

Dror Futter is a partner in the Rimon, PC law firm. Dror’s practice focuses on representing startup companies in their financing and merger and acquisition transactions and their intellectual property, IT and internet agreements. He also advises companies with respect to Initial Coin Offerings and other blockchain legal issues. Dror was the co-founding chair of the PLI VC Law program and hosted their first blockchain legal program. He is a frequent speaker and writer on blockchain legal topics. He is a member of the model forms drafting group of the National Venture Capital Association, the legal advisory board of the Angel Capital Association and the legal working groups of the Wall Street Blockchain Alliance and the Digital Chamber of Commerce. Dror can be reached at dror.futter@rimonlaw.com