Credit Sesame, a personalized credit service and financial wellness company, is morphing into a bank. And why not?

Credit Sesame, a personalized credit service and financial wellness company, is morphing into a bank. And why not?

While traditional banks struggle to pay for the real estate they own, Fintechs are providing a more diverse portfolio of financial services minus the need to queue up for a teller.

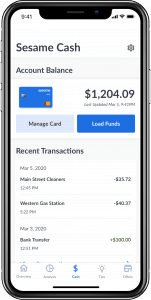

Today, Credit Sesame has announced; “Sesame Cash” – a bank account that is part of its new digital banking service. Credit Sesame will be partnering with Community Federal Savings Bank, Member FDIC, to provide the bank account services.

The new bank account service comes with a Sesame Cash debit card, provided by Mastercard.

Credit Sesame states that the majority of its customers live paycheck to paycheck and rely solely on their available cash and credit to live and make daily spending decisions and thus are a segment of the population at risk to financial duress. Credit Sesame seeks to assist this underbanked population.

Credit Sesame reports that about 500,000 new members join its platform each month. The Fintech expects many of these members will become digital banking customers.

Adrian Nazari, Credit Sesame Founder and CEO, explains that by leveraging AI they have been able to help millions of customers but there remains a disconnect between advice and services.

Adrian Nazari, Credit Sesame Founder and CEO, explains that by leveraging AI they have been able to help millions of customers but there remains a disconnect between advice and services.

“With Sesame Cash, we are now bridging that gap and unlocking a whole new set of benefits and capabilities in a new product category. This underscores our mission and commitment to innovation and financial inclusion, and the importance we place in working with partners who share the same ethos.”

Credit Sesame’s new digital banking service is said to analyze consumers’ finances and their repayment ability against their credit to provide them with personalized recommendations.

Credit Sesame’s digital bank account offers; a no-fee debit card with Mastercard Zero Liability protection, no overdraft fees, no minimum balance, no monthly service fees, free access to more than 55,000 ATMs, the option for early payday, real-time transaction notifications, the ability to freeze or unfreeze the debit card, and virtual card integration with most major mobile wallets.

The digital bank also provides “credit-centric features” that include:

- Free, Daily Credit Score Refreshes: Customers will have access to daily score updates to help them stay on top of their credit.

- Credit Improvement Cash Rewards: A cash incentive program that will reward consumers with up to $100 per month as they improve their credit scores

- $1 Million Credit & Identity Protection: A free credit and identity theft protection, which includes live access to identity restoration specialists.

Credit Sesame said it will be rolling out additional featuresin the coming months, including:

- A smart bill pay service that optimizes and manages consumers’ cash to improve their credit, lower interest payments on their credit balances, and pay down debt faster

- Auto-savings roundup of transactions to the nearest dollar to help consumers pay down their debt or save to reach financial goals

- Additional rewards programs for everyday purchases

Smart budgeting tools and more

Credit Sesame has been operationally profitable since 2016.