Coinfield, a smaller crypto exchange operating out of Estonia, is working with Solegenic to “connect traditional financial markets with crypto assets,” according to a release.

Coinfield, a smaller crypto exchange operating out of Estonia, is working with Solegenic to “connect traditional financial markets with crypto assets,” according to a release.

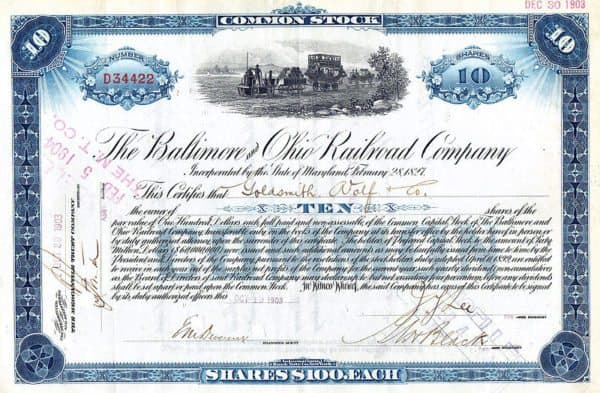

Sologenics, an entity that is affiliated with Coinfield, says it facilitates users with investing, trading, and on-demand tokenization of over 40,000 traditional assets such as stocks, ETFs, and commodities. Users apparently will be able to tokenize assets from a list of well-known securities exchanges.

Bob Ras, the co-creator of Sologenic who is also the CEO of Coinfield, made the following statement:

“What makes Sologenic a game changer is “On-demand Tokenization,” where traders have access to a wide range of securities offered by the top global stock exchanges. Traders can tokenize any assets in real-time and then trade them against cryptocurrencies or other tokenized assets. I believe it’s time for the traditional financial markets to be disrupted and take advantage of existing blockchain technology.”

The Sologenic says it generates stablecoins backed 1:1 with real-world assets on the XRP ledger. Each stablecoin represents the ownership of real-world assets. Once tokenized, the asset issued on the blockchain is denominated with the suffix of “ƨ,” for example, a tokenized asset of TSLA stock is represented as TSLAƨ.

The company also said additional products are in the pipeline including the ability to spend digital assets instantly worldwide.