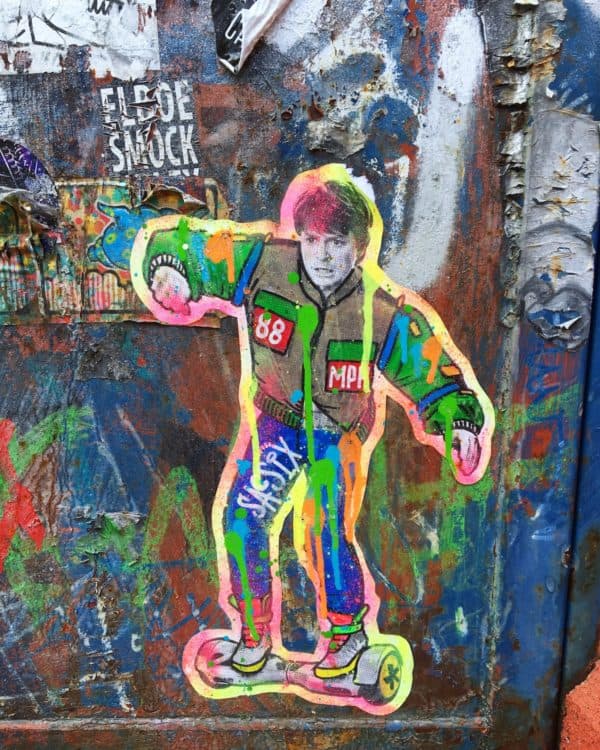

Rewind the clock 35 years ago today and cinemas were opening for the first time to the iconic time-traveling antics of Back to the Future. Looking at Doc and Marty and knowing their contrasting personalities – one an eccentric inventor and one a streetwise kid – you wouldn’t think their partnership would work. But their dynamic makes for spectacular viewing.

Similarly, two parties with very different mindsets in finance have recognized the unique collaboration opportunity at their fingertips. Instead of navigating the complexity of time travel though, it’s the customer experience. Just as Fintechs and challenger banks bring innovation and digital-first experiences to the table, traditional community banks and credit unions come with their own unique set of skills, including the wealth of experience and knowledge of their local customer bases.

Only a few years ago, discussion in the banking industry was fixated on how Fintechs would engulf incumbents. Today, we see the opposite: the beginnings of a budding and unexpected friendship as more Fintechs and traditional community banks partner up to reach new heights of success that could really bring banking into the future.

Embracing the creativity of modern banking

Fintechs are the inventors of this unlikely duo – our Doc. Fintechs embrace the modernest of technology, employing digital-first tools and techniques which have seen them rapidly improve efficiencies across the board. They have the cutting edge tools to get the job done, much like the famed DeLorean.

By offering more modern, often cloud-based systems, they are able to deliver real-time software updates, faster processing, quicker transactions and reduced human error. Crucially, they are also matching consumer expectations of on-demand, mobile-ready banking services as more customers look to take control of their own finances via open banking and digital interfaces. This is particularly important in the age of Covid-19, with in-person visits difficult, if not impossible, for many.

In resemblance of Doc’s independent and bold attitude, most Fintechs have end-to-end ownership of their own frameworks and digital roadmaps. Meanwhile, traditional community banks and credit unions are often lumbered with legacy technology. Due to their smaller size and lower budgets, most can’t afford to build new software from scratch in-house. Fintechs offer them access to customizable, third-party software and, when chosen and integrated correctly, the right Fintech partner can help traditional community banks and credit unions become more competitive and scale-up.

There’s no doubt that Fintechs can provide banks with the technology they would not otherwise have access to. However, it’s not all about being inventive and embracing technology. Like Fintechs, Doc was flawed in that he lacked a connection to the real world around him and, despite his youth, Marty was the more grounded of the pair. Traditional banks make their own contribution by rendering these Fintech offerings more accessible thanks to their wide-reaching, loyal customer bases.

Keeping finance accessible

Although traditional community banks have historically proven themselves more conventional, which can make innovation slower for them, the skills they bring to the table are still of enormous importance. Their on-the-ground, person-to-person values and historic expertise as incumbents in the world of banking have kept customers by their side for not just years but decades, even generations.

While digital banks offer important technological capabilities, traditional banks have practical skills that Fintechs haven’t quite mastered. In the same way that Marty brings practical skills like guitar and skateboarding to the table, banks can facilitate physical tasks like processing a cashier’s check. In this way, digital banks are sometimes seen as inaccessible for individuals with lower levels of technological literacy. Research is also showing that it is not only baby boomers visiting banks, with many young people stating that they have no problem going to a branch and interacting in-person. Therefore, traditional brick-and-mortar banks still have a role to play in providing financial access to certain demographics and offering certain key services, ultimately providing a personal touch that digital-only banks may struggle to achieve.

Additionally, traditional banks often have the upper hand when it comes to regulation. Not only do they already have regulatory approval, but they have the structures and knowledge to know how to approach compliance. They have the superior knowledge of the regulatory landscape and their Fintech counterparts should leverage this expertise.

As the banking sector digitalizes, it is also important not to lose the personal knowledge of customers held by traditional community banks and credit unions. Traditional banks have an advantage in that they have the historical data of their clients to tailor services to them. Personal attention to customers is of the utmost importance in building up trust, and knowing your customer is extremely valuable. A person-to-person approach can often see complex problems solved more efficiently, with less of the frustration that could be caused by dealing with things like chatbots with automated generic responses. The importance of personable customer service and the Marty-like qualities of loyalty and approachability is a lesson community banks can teach digital banks trying to achieve more frictionless experience.

A forward thinking partnership

It’s understandable to see why traditional banks have their reservations. They are proud institutions, but this can lead to taking unnecessary risks reminiscent of Marty’s reactions when accused of being “chicken.” Banks need to embrace where things are heading and establish collaborative, mutually-beneficial relationships with Fintechs.

As with our time-traveling companions, it is the very difference between Fintechs and traditional community banks that make them so symbiotic. Their opposing skill sets complement each other perfectly. The combination of digital-first technology and people-first customer service can help both community banks and Fintechs cater to the evolving requirements of their customers. As both sides share tools and expertise, they can work in tandem to embrace their next forward-thinking adventure.

Vincent Bezemar is Head of Strategy – North America, Backbase. Bezemer joined Backbase in 2014 and leads the Backbase North American strategy execution and corresponding sales initiatives. Focusing on building exceptional teams, instilling operational excellence, and building industry alliances & partnerships. Stanford and MIT trained, his unique combination of industry knowledge, technical understanding and European flair resulted in a career building partnership with Fortune 1000 companies like American Express, Central1, Wells Fargo, USAA, Navy Federal, Royal Bank of Canada and many, many others. Prior to Backbase, Bezemer led global field operations for the world’s leading Customer Experience solution.