Tink, a Sweden-based fintech that provides APIs to create next-generation banking services, announced on Thursday it has acquired Instantor, a European provider of credit decision solutions based on open banking technology. Tink reported that the acquisition is part of its strategy to continue to invest in intelligent data-services based on open banking.

“Instantor’s market leading products for credit decision solutions will now be made available to all Tink customers on top of Tink’s open banking connectivity.”

Tink also revealed that Instantor supports more than 5 million credit decisions annually and had an annual revenue of €4 million in 2019. Speaking about the acquisition, Daniel Kjellén, Co-Founder and CEO of Tink, added:

“What Instantor has achieved to date in Europe is impressive. It has deftly proven to be a leading European provider of credit decision solutions based on open banking technology. We are thrilled to be able to offer Instantor’s market leading credit scoring products to all of our customers and now look forward to continuing to invest in product development in that domain.”

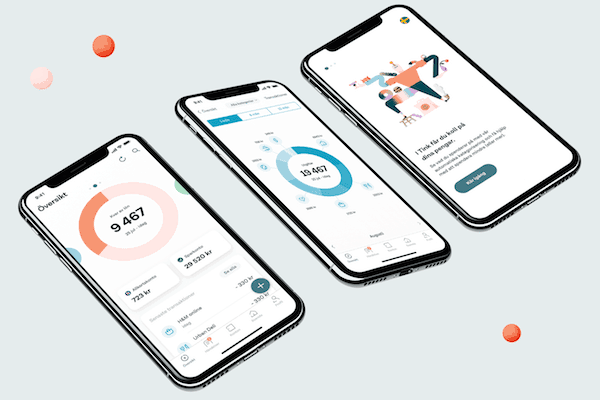

Tink is on a mission to make banking “better” by creating technology to improve customer experience and bring more financial clarity.

“Today, we are an FSA-regulated partner to big banks, fintech unicorns and even small startups. Our 150 employees serve 9 European markets out of two offices. And our API offers one access point to financial data from across Europe – as well as the ability to offer insights and actionable advice – whether it’s through our full-service enterprise offering or our self-service platform for developers.”