Embedded Finance Fintech Cross River and Trustly to Enhance Instant Payments with FedNow Service

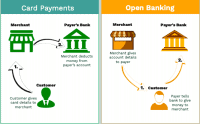

Trustly, a global enabler of Open Banking Payments, and Cross River Bank, a technology infrastructure provider that offers embedded financial solutions, are expanding their collaboration in instant payments with the addition of the FedNow Service. The development delivers the anticipated expansion of “an instant payment… Read More

Read more in: Fintech, Global | Tagged cross river bank, instant payments, open banking, trustly