The global COVID-19 crisis has forced many businesses to either shut down or make significant changes to their business models. Individuals and companies are increasingly using digital platforms and services to conduct transactions or complete routine tasks that they normally carried out at physical locations.

The global COVID-19 crisis has forced many businesses to either shut down or make significant changes to their business models. Individuals and companies are increasingly using digital platforms and services to conduct transactions or complete routine tasks that they normally carried out at physical locations.

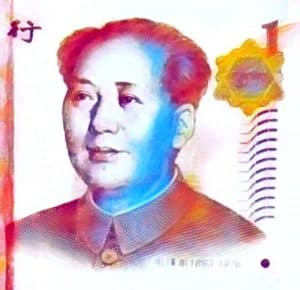

It seems that now would be an ideal time to introduce alternative payment methods, including digital currencies. The development of China’s national virtual currency payment system, the Digital Currency Electronic Payment (DCEP), has been making steady progress

There’s reportedly been a significant increase in the number of large firms that have joined the virtual yuan project. Companies are helping the developers of the digital yuan with testing and implementing the new payments system.

As reported, Meituan Dianping, which is China’s largest wholesale and delivery platform for local products, has also agreed to help the People’s Bank of China (PBoC) with testing and implementing the digital renminbi. The DCEP platform has nearly 450 million potential customers and around 6 million firms that are ready to use it to sell their products.

DiDi Chuxing, which is often referred to as the Chinese Uber and has 550 million clients, has also joined the digital renminbi project along with leading video streaming service provider Bilibili, which claims over 170 million users.

Simon Li, founding partner at Chain Capital, has confirmed that DiDi will be accepting payments made with China’s central bank digital currency (CBDC).

The PBoC reportedly began selecting the first merchants for testing the DCEP in April 2020. The bank had asked giant retailers and merchants such as Starbucks and McDonald’s to test its new payments system.

DiDi, Bilibili and Meituan Dianping may have been chosen to take part in the testing because billions of dollars worth of transactions are processed through their platforms – which makes them ideal for large volume testing and could also be suitable for adopting the production-ready version of the digital yuan.

DiDi, Bilibili and Meituan Dianping have more than 1 billion customers (in total). Their services are also available in Australia and several South American nations.

It remains unclear just how long the testing period of the virtual renminbi will last, and when the production-ready version of the CBDC will be launched.

As reported, the DCEP testing is being carried out in the Chinese cities of Shenzhen, Suzhou, Chengdu and Xiong’an.

Four Chinese state-managed banks, along with Huawei and telecommunications companies China Telecom, China Mobile and China Unicom have all joined the DCEP testing program. The Agricultural Bank of China has also been taking part in these tests.

China might be leading the way when it comes to developing a CBDC, however, it’s certainly not alone as many other countries like Japan and Sweden (among many others) are exploring or considering launching a virtual currency.

The Bank of Japan revealed on July 20, 2020 that it has appointed a new team to closely examine CBDCs, which may become very useful at a time when the demand for cashless and contactless payments has increased worldwide due to COVID-19.

The BOJ said that its team would follow up on the bank’s previous efforts which involve the development of its own CBDC. The group will conduct relevant research and continue the country’s collaboration with other nations on a potential virtual currency.

The new team will be working within the BOJ’s payment and settlement systems department.