NowRX, a great business for the current COVID-19 infused world, raised $20 Million in Series B funding via securities listed on SeedInvest. The $20 million securities offering is the largest raise ever for SeedInvest, according to a note from NowRX. The securities are being issued under Reg A+, a securities exemption that requires extensive documentation that must be qualified by the SEC but allows an issuer to raise more capital (from both accredited and non-accredited investors).

The actual offering page shows total amount raised of $17,973,393, a bit short of $20 million but this may be due to pending investments that are still going through the confirmation process – something that can take a couple of weeks. The page also indicates that 8549 investors participated in the offering of preferred equity in the company that had a pre-money valuation of $65 million – meaning an investor expects shares to be worth north of $85 million at some point in the future.

As has been previously reported, NowRX is a prescription/pharmacy order and delivery service. Social distancing friendly and all online – vital during the Coronavirus health crisis. NowRX is targeting same-day delivery of prescriptions/meds to the entire US at some point in the not so distant future.

Pharmacy services are said to be provided from “low cost, highly automated micro-fulfillment centers,” utilizing robots to dispense the meds. NowRX has drivers to deliver the products with free, same-day delivery.

NowRX recently shared that it is booking over $ 1 million in revenue per month, via 4 different locations (soon to be 5), operating in 2 markets (San Francisco Bay area and Orange County). Arizona is next on the list with three locations in the works.

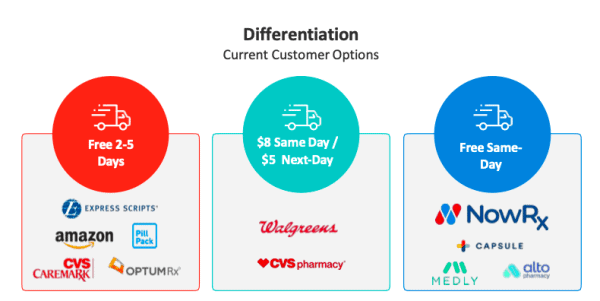

The concept is a bit of a no-brainer as the Amazon of meds. One of the biggest risks, obviously, is competition from established pharmacies of the world (like CVS/Walgreens) or Amazon decides to aggressively push into prescription drug delivery. There are several smaller firms attempting to do the same, according to the offering page.

Of course, the ultimate goal for the company, as well as investors, is to IPO/Merge/Acquisition at a higher price than the company stands today.

NowRX explains that retail pharmacy is a $400 billion industry that “relies on expensive real estate to drive foot traffic and depends on outdated, legacy software systems to manage prescriptions.”

NowRx says it is on track to achieve profitability. SeedInvest CEO and co-founder Ryan Feit said that investors were quick to grasp the advantages of NowRx even before the COVID-19 pandemic because so many have the first-hand experience with the hassle of getting prescriptions filled.

“Investors understand the problem NowRx is solving,” Feit said.

Have a crowdfunding offering you'd like to share? Submit an offering for consideration using our Submit a Tip form and we may share it on our site!