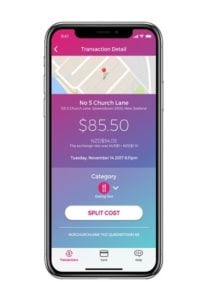

Kong, a cloud connectivity company, announced on Tuesday Australia’s Xinja Bank has deployed Kong Enterprise to power its mobile banking platform. Kong reported that with its service connectivity platform, Xinja may more effectively connect, secure, and manage all of its API and services.

“As a 100-percent digital bank designed for mobile, Xinja is bringing a new kind of bank to customers and revolutionizing the entire banking experience. This includes not just providing traditional banking products but also integrating with other valuable products through open APIs to deliver a financial ecosystem to their customers.”

Speaking about the partnership with Kong, Rohan Sharp, Co-Founder and Head of Architecture at Xinja Bank, stated:

“Our lending origination partner needed us to expose our APIs in a way that was secure and compliant with OIDC standards,” said “This was easy with Kong; not only could we comply with industry standards, but we could protect our APIs and internal landscape quickly and with low risk – while minimizing impacts on Xinja’s existing infrastructure.”

Augusto Marietti, CEO and co-founder of Kong, went on to add”

“In today’s new digital reality, companies must embrace digital innovation, or they will be left behind. By taking a fully digital approach and building its technology on cloud-native, microservices-driven architecture – all powered by Kong – Xinja is well-positioned to truly revolutionize the banking industry.”

Founded in 2017, Xinja describes itself as an independent, 100% digital neobank for Australians that is esigned for mobile and made for people.

“We believe it’s time Australians had access to a banking experience built around their needs and in their interests.”