Nada, a U.S.-based real estate technology startup, recently announced its seed capital round to accelerate its growth and product development. The company has raised nearly $400,000 in funding through its funding round on Republic.

Nada set a minimum hurdle of $25,000 – a number it has easily topped. The company’s max raise is for $1.07 million.

Investors will receive a “Crowd SAFE” that enables investors to receive equity at a future date at a 20% discount and a valuation cap of $12 million.

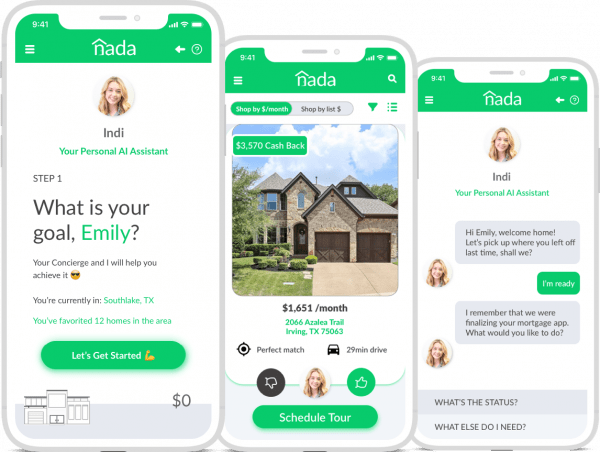

Founded in 2018, Nada describes itself as a vertically-integrated real estate services company that makes homeownership simple, rewarding, and accessible.

“Most homeowners (nearly 90%) who sell their home using a real estate agent pay 6% of the home price as a commission fee – with 3% going to the sellers agent and 3% on the buyers agent. On a $400,000 home that’s a $24,000 commission fee split between the two agents. At nada, we recognize how outrageous this commission fee is. So when buyers choose nada as their agent, we collect our 3% then refund up to $2,000 to the buyer. This is possible because of our team support structure and use of automation to streamline the home buying process- reducing our costs and your outrageous real estate fees.”

Nada further observed that as a new brand in an established market, it was able to generate more than 3,000 client sign-ups through our digital marketing efforts.

“With over 75% of our realty clients relying on Nada to secure mortgage financing and title services, we validated the market need for a vertically integrated solution while generating over $250k in revenue.”

Speaking about the investment round, John Green CEO of Nada, stated:

“This seed round has moved fast–with the 4 commitments from private investors, the record-breaking revenue, and the amazing support from all of you on our public offering, we are now considering closing the round sooner than originally planned. As we continue to discuss and explore strategies we will issue updates and if any material change is made to our Republic offering you will receive formal notice.”

The securities offering is scheduled to close in December.

Have a crowdfunding offering you'd like to share? Submit an offering for consideration using our Submit a Tip form and we may share it on our site!