Tink, a Sweden-based fintech that provides APIs to create next-generation banking services, announced on Friday it secured €85 million through its latest investment round, which was co-led by Eurozea Growth and Dawn Capital with participation from PayPal Ventures, HMI Capital, Heartcore, ABN AMRO Ventures, Poste Italiane and BNP Paribas’ venture arm, Opera Tech Ventures. The latest investment comes less than a year after Tink raised €90 million.

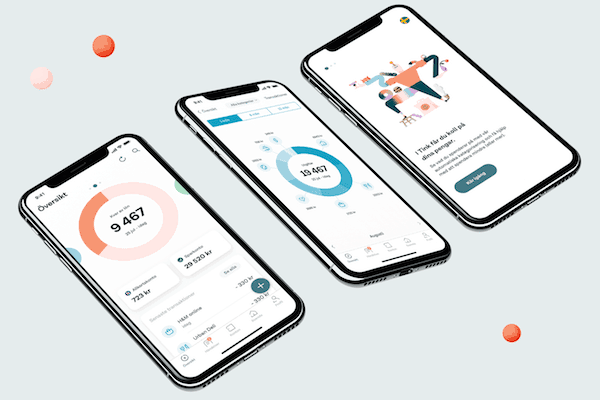

As previously reported, Tink is on a mission to make banking “better” by creating technology to improve customer experience and bring more financial clarity.

“Today, we are an FSA-regulated partner to big banks, fintech unicorns and even small startups. Our 150 employees serve 9 European markets out of two offices. And our API offers one access point to financial data from across Europe – as well as the ability to offer insights and actionable advice – whether it’s through our full-service enterprise offering or our self-service platform for developers.”

Speaking about the company’s growth and development, Daniel Kjellén, Co-Founder and CEO of Tink, stated:

“Despite the difficulties of 2020, it was a year of great growth for Tink. We significantly built out our bank connections across Europe, increasing coverage from 2,500 to 3,400 banks, and now serve more than 300 world-leading financial institutions. We also doubled the fintech users on our platform to 8,000 and increased employees from 250 to 365, in 13 offices across Europe.”

Tink also reported that during 2020 it made three major acquisitions, as part of its strategy to invest in intelligent data-services based on open banking. Tink acquired Swedish credit decisioning firm Instantor, giving Tink increased capability in credit risk products built on top of its open banking connectivity, Spanish account aggregation provider Eurobits, significantly increasing Tink’s bank connectivity in Europe, and the aggregation platform of UK open banking pioneer, OpenWrks, which will bring UK business account data to Tink’s customers.