Banks in Venezuela are reportedly issuing debit cards for US dollar-denominated accounts, according to a report from Reuters which cited sources familiar with the matter.

Banks in Venezuela are reportedly issuing debit cards for US dollar-denominated accounts, according to a report from Reuters which cited sources familiar with the matter.

There’s now a group of Venezuelan banking institutions that have been providing debit cards to customers who maintain accounts in “hard currency” like the US dollar and other more stable currencies. Meanwhile, Venezuela’s Bolivar has become practically worthless due to record levels of hyperinflation caused by rampant corruption among other issues like the crippling US-led sanctions.

The decision to issue these types of debit cards has been “quietly” backed by the nation’s authorities who may want to extend the use of US dollars in everyday transactions, the sources claim.

It’s worth noting that in the nearby South American country of El Salvador, the official currency is the Salvadoran Colon but as of 2001, the Law of Monetary Integration allows the circulation of the US dollar in the nation with a set exchange rate of 8.75 colones. Although the colon is still technically legal tender, it’s no longer in circulation and is rarely used. These developments indicate that many fiat currencies are beginning to collapse due to problems in the traditional monetary system. In other regions like Africa, the Zimbabwe dollar has also become pretty much worthless.

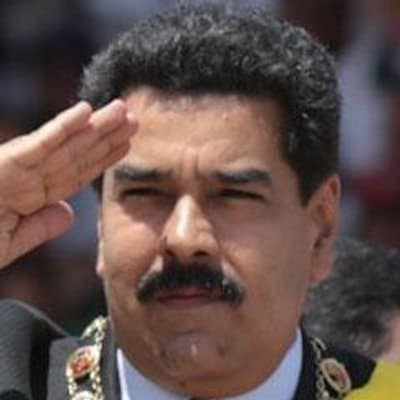

As reported by Reuters, banks have for more than a year been maintaining cash dollars for corporate customers as part of an “economic liberalization” under socialist President Nicolas Maduro. For the past 15 years, US dollar transactions had been monitored and kept under strict government oversight.

Venezuelan State officials have now privately instructed local banks to start allowing customers with USD accounts to use that money to perform transactions denominated in the Bolivar currency, the sources revealed.

The decision has been taken in an attempt to improve liquidity and reduce or eliminate barriers to commerce in an economy suffering from hyperinflation and various shortages. However, the sources pointed out that Maduro’s administration isn’t really going to prepare a complete dollarization.

But four mid-sized private banking institutions in Venezuela have begun providing the cards, the sources confirmed. State-managed Banco del Tesoro is also advertising a USD-based credit card on its official website.

A Venezuelan finance professional remarked:

“The bolivar little by little will turn into a currency for transactions, while savings will be in dollars.”

When customers make purchases with these debit cards, the associated US dollars will be provided to the nation’s reserve bank, which will then auction the hard currency as part of its foreign exchange platform, which is often short of dollars, the sources claim.

Venezuela’s reserve bank, information ministry, and banking industry regulator Sudeban have not officially commented (in detail) on the matter/

But in a recent speech to parliament, Maduro had stated that the country would be transitioning to a completely digital economy and that merchants will be able to use their debit cards for USD accounts.

Banks in Venezuela have only been providing US dollar accounts to a few clients, which may be due to the fact that local entities are not supposed to take funds associated with officials or business people who have been sanctioned by the US for being linked in some way to the Maduro administration.

This should be good news for Venezuelan consumers and merchants, who have been depending on various workarounds like makeshift vouchers and customer IOUs in order to carry out US dollar-based transactions in a country where it’s hard to obtain American currency.

P2P Bitcoin exchange LocalBitcoins recently reported that Venezuela (among a few other countries) is now among its main markets with the most BTC trading activity.

As covered in November 2020, the global Fintech Circle partnered with the Bolivarian Republic of Venezuela and Airtm to provide aid to the nation’s residents with the USDC stablecoin.