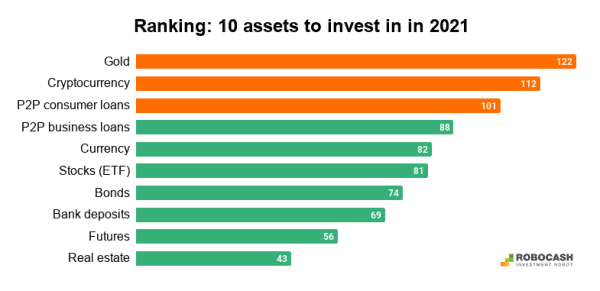

Robo.cash, a peer-to-peer lending marketplace, says the top asset classes for investing in 2021 are gold, crypto followed by peer to peer loans.

Robo.cash says that researchers analyzed 10 popular assets and ranked them in 7 different criteria. All assets were given a score of 1 to 10, and it was then multiplied by a coefficient of 1, 2, or 3 depending on the importance of the criterion. Other criteria included liquidity, pandemic resistance (weighting coefficient 2), entry threshold, and complexity of the tool.

Gold scored 122, crypto 112 and P2P consumer loans scored 101 in their research. Robo.cash states:

“The top 3 assets on the list may look surprising, as young assets like P2P consumer loans and cryptocurrencies scored higher than more conventional ones, such as stocks or bonds. The explanation is simple: these assets generated higher returns during 2020, and they are more likely to deliver a better risk-reward ratio in 2021. Stock markets are very sensitive to changes in political and economical spheres, e.g. at the beginning of the pandemic, they reported their biggest one-week drop since the 2007-08 financial crisis. The market became extremely volatile over the following week, with fluctuations of 3% or more in the daily session. Crypto is less dependent on the situation in the world, whereas risks at P2P lending can be minimised by investing in reliable lenders and platforms.”