Beam, a mobile banking app, will be banned from offering such services and must give full refunds to users. The announcement was made as part of a settlement with the Federal Trade Commission (FTC). As part of the settlement, Beam neither admits nor denies any allegations included in the FTC complaint.

Beam, a mobile banking app, will be banned from offering such services and must give full refunds to users. The announcement was made as part of a settlement with the Federal Trade Commission (FTC). As part of the settlement, Beam neither admits nor denies any allegations included in the FTC complaint.

In late 2020, it was revealed that Beam was the target of an FTC legal action where the agency alleged that Beam Financial Inc. and its founder and CEO Yinan Du, (AKA Aaron Du), promised users of their mobile banking app that they could make transfers out of their accounts and would receive their requested funds within three to five business days. Apparently, some users waited weeks or even months to receive their money despite repeated complaints to Beam. The FTC claimed that others said they never received their money.

The FTC claims that Beam also failed to give users the high-interest rates the company promised. Beam is said to have repeatedly claimed that users would receive at least 0.2 percent or 1.0 percent, but many new users received a much lower interest rate of 0.04 percent and stopped earning any interest after requesting that Beam return their funds, according to the complaint.

As part of the settlement, Beam is banned from operating a mobile banking app or any other product or service that can be used to deposit, store, or withdraw funds. It also is prohibited from misrepresenting the interest rates, restrictions, and other aspects of any financial product or service.

In addition, full refunds, including interest, must be provided to all of Beam’s customers, and Beam must periodically update the FTC on its refund efforts, including identifying any consumer complaints. It also is prohibited from benefitting from any personal information collected from customers.

The Commission vote approving the stipulated final order was 3-1, with Commissioner Rohit Chopra voting no. The FTC filed the proposed order in the U.S. District Court for the Northern District of California.

Daniel Kaufman, Acting Director of the FTC’s Bureau of Consumer Protection, stated:

“People taking a financial hit from the pandemic may need 24/7 access to their savings, which is exactly what Beam Financial promised and didn’t deliver. The message here is simple for mobile banking apps and similar services: Don’t lie about your customers’ ability to get their money when they need it.”

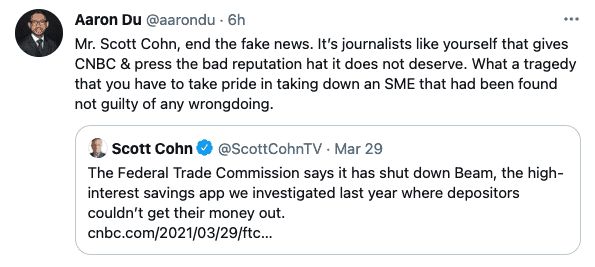

Du recently criticized CNBC’s coverage of the news stating they have not been found guilty of any wrongdoing.